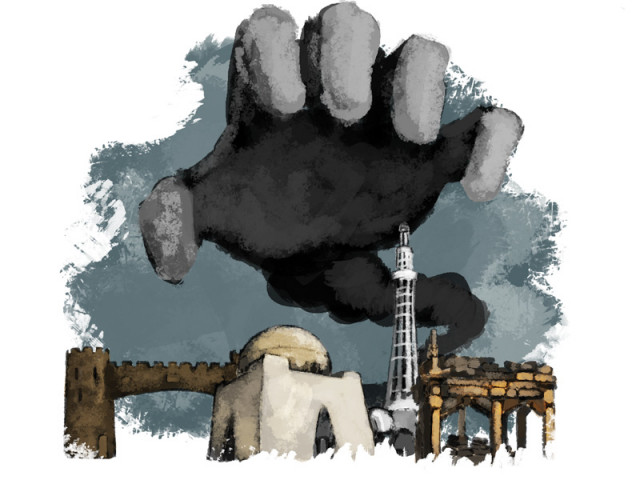

Balancing the budget: Centre forces provinces to run surpluses

Provincial surplus target increased by 24%, despite loud objections raised by Punjab.

Balancing the budget: Centre forces provinces to run surpluses

Having failed to keep its own fiscal house in order, the federal government appears to have decided to inflict pain upon the provinces, raising their targeted budget surpluses by over 24%, for the fiscal year 2012, over the very loud objections of Punjab.

Islamabad appears to be failing at generating as much non-tax revenue as it expected after the delays in the 3G spectrum licence auction and the lack of payments by the United States under the Coalition Support Fund. It has slashed the non-tax revenue target by Rs150 billion, or about 22.7%, to Rs512 billion. In order to make up for at least part of the shortfall, it is asking the provinces to carry larger surpluses, a ‘request’ that has Lahore fuming.

“Our budgets have been allocated for spending, not for generating surpluses,” said Faisal Rasheed, a spokesman for the Punjab finance department. “We told the [federal] finance ministry that it would be difficult to ensure a budget surplus due to an increase in our development expenditures.”

Punjab has vociferously objected to the federal government’s demand at a meeting of the secretaries committee, when the finance secretaries of all four provinces meet with the federal finance secretary. The federal government wants the provinces to save a collective Rs154 billion, 24% higher than the initially budgeted Rs124 billion. Punjab alone is being asked to save Rs80 billion. Sindh is being asked to save Rs38 billion, Khyber-Pakhtunkhwa Rs23 billion and Balochistan about Rs13 billion.

For all their objections, however, the provinces may not have a choice in ‘saving’ the money. While the federal government is legally obliged to pay the provinces their shares of federal tax collection within the fiscal year, it has several tactics up its sleeve. Among the most devious: delaying the disbursements till June 30 – the last day of the fiscal year – making it effectively impossible to spend it within the year and generating an automatic surplus.

One finance ministry official admitted that finance ministry often delays the disbursement of tax revenues to the provinces when it wants them to generate surpluses, but then went on to justify the practise, saying that under the 7th National Finance Commission Award, the provinces now get the lion’s share of the federal tax revenues. This year’s allocation for all provinces combined is Rs1.2 trillion.

The federal finance ministry official claimed that the provinces have generated a combined surplus of Rs63 billion during the first eight months of fiscal year 2012. This figure could not be verified since the finance ministry has yet to release the Fiscal Operations Summary for the first nine months of the fiscal year. However, in the first six months of the year, the provinces had saved only Rs11.8 billion, one-tenth of the original annual target and 7.3% of the revised target. More importantly, Punjab did not generate any surplus at all.

Most provincial governments have struggled to curb their expenses, given the fact that the coming year is expected to be an election year and elected officials want to spend the development budge in their districts. The federal government is running into problems for the same reason. The Rs33 billion annual budget for development projects to be directed by members of the National Assembly and the prime minister was spent within the first eight months of the fiscal year.

Meanwhile, the government’s populist measures have also kept tax revenues low, specifically petroleum taxes as the government fails to pass on the effect of the higher global oil prices to local consumers by cutting taxes. During the first eight months, the government collected Rs35 billion in petroleum taxes, claim finance ministry officials, against an annual target of Rs135 billion.

Published in The Express Tribune, April 21st, 2012.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ