Weekly review: Bourse posts highest gain in more than two years

Index rocketed on expectations of capital gains tax relaxation and other positive news.

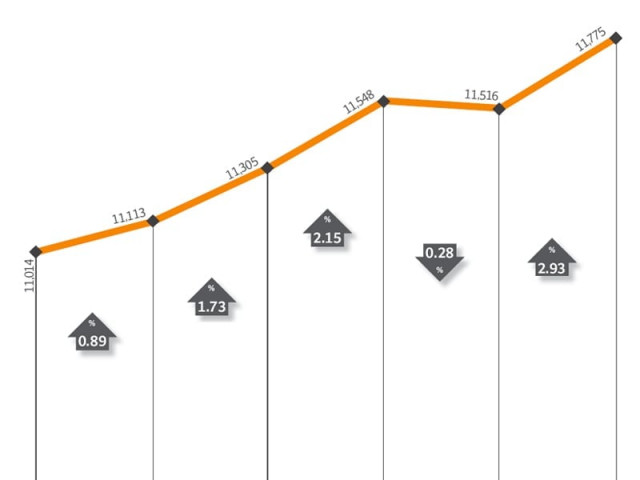

Positive news flows overwhelmed all negative sentiments at the stock market during the week as the benchmark KSE-100 index shot up by 6.9% or 760 points, the highest weekly gain since April 2009.

The index, which had witnessed continuous declines in recent weeks due to the ongoing political situation, managed to break the trend as a flurry of triggers provided investors with much needed incentive to participate in the market.

The week kicked off on a positive note as political tensions fizzled out after Prime Minister Yousaf Raza Gilani appeared before the Supreme Court, where the hearing was adjourned till February 1. The index climbed 0.9% on Monday.

However, things picked up steam the following day as news emerged that regulatory relaxations pertaining to the much-ridiculed Capital Gains Tax (CGT) were on the cards. The Securities and Exchange Commission Pakistan recommended to revise CGT regulations related to audit with possibly no question on source of funds invested in equities till 2014.

In the following days, it also emerged that Finance Minister Abdul Hafeez Sheikh would visit the bourse on Saturday, and possibly announce the new collection framework to investors. The news spread like wildfire and resulted in a bull-run, which culminated with a 5.7% gain in the last four sessions of the week.

Investors showed their whole-hearted support for the development by participating heavily and average daily volumes more than tripled to 87 million shares traded per day. Although the average number wasn’t high, the volumes on Friday of a 178 million shares showed a promising sign of things to come.

During the week, the government also announced that it would try to resolve the circular debt issue, and will issue Rs150 billion worth of Term Finance Certificates for the same. According to report by JS Global Capital, banks have agreed to subscribe to the issuance of these TFCs which will provide a short-term relief to the energy sector.

However, foreigners again turned net sellers during the week and offloaded $3.7 million worth of equity after being net buyers of $0.2 million in the previous week. The KSE’s market capitalisation jumped 6.6% and managed to cross the Rs3 trillion mark during the week.

What to expect?

The finance minister’s visit to the bourse on Saturday will be an important one and if the CGT relaxations do materialise, then the market’s momentum can be expected to flow into the coming week, according to KASB Securities.

Investors will also focus on the earnings season, which will officially kick off during the coming week.

Monday, January 16

The stock market managed to close in the positive territory on the first trading session of the week with the help of late foreign buying.

Tuesday, January 17

Investors brushed aside political tensions and accumulated stocks with the corporate result season around the corner. Engro hit its upper circuit over rumours that substantial gas will be diverted to its new plant from the new gas find at Kunnar-Pasakhi field.

Wednesday, January 18

Investors swarmed at the stock market as trading activity surged to levels not seen in the past 16 weeks. Investors brushed aside politics and finally some good sense backed by fundamentals took charge as local and foreigners were active value hunters.

Thursday, January 19

After rising more than 500 points in the last few sessions, investors opted to book profits and cash in while stocks are at healthy levels. Investors booked profits in blue chip stocks after a five-day bull run.

Friday, January 20

The stock market showed off what its got to offer by posting an impressive rally to close at a two-month high amid heavy activity, a day before the finance minister’s visit. Investors are hopeful that Finance Minister’s visit will result in a positive outcome regarding the Capital Gains Tax issue.

Published in The Express Tribune, January 22nd, 2012.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ