Weekly review: Political tensions keep bourse under pressure

Government’s tussle with army and judiciary keeps investors on the sidelines.

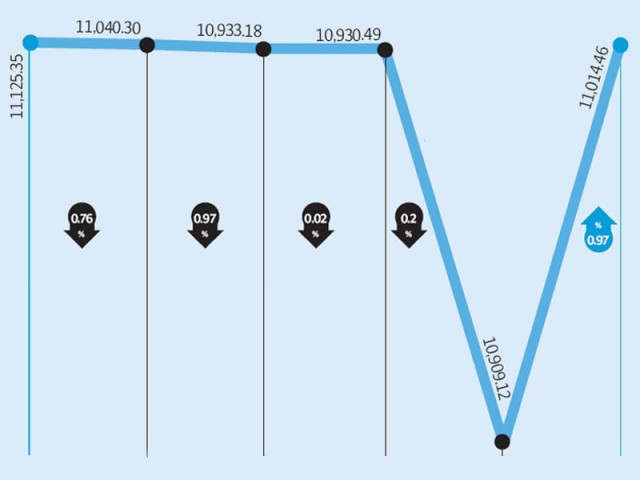

Political news dominated proceedings at the country’s bourses as the future of the government came under question during the week. Investors remained cautious as the benchmark KSE-100 index closed the week down by 1% or 111 points at 11014.46 point level.

The government found itself embattled on multiple fronts as its tussle with the country’s army and judiciary reached fever pitch during the week. The start of the week saw the prime minister take jibes at the army, which resulted in a sharp rebuttal from the army, leading to news that a coup was imminent.

To make matters worse, later in the week, the prime minister dismissed the defence secretary which created further friction with the army. In response, the chief of army staff appointed a new head of the 111 Brigade, the unit infamous for securing Islamabad at times of a military coup.

With so much drama ensuing, investors took a backseat and stayed away from investing as was reflected in the abysmal trading volumes. Average daily volumes stood at 28 million shares, down 33% over the previous week.

The index witnessed declines in three of the first four trading sessions of the week, declining by almost 2% and falling below the 11,000 point psychological barrier, before witnessing a recovery rally on the last trading session of the week, to close barely above it.

Macroeconomic data also posted a bleak picture, as the country’s trade deficit widening to $11.5 billion for the first six months of the current fiscal year, up 38.5% over the previous year. The country’s exports climbed only 3.9% in the period under review to $11.2 billion. However, remittances showed promise as they rose 19.5% and stood at $6.3 billion during the period.

Sector-wise news saw the inauguration of the Kunnar-Pasakhi Gas Pipeline project, which provided a boost to the energy and power sector. The fertiliser sector saw prices increases by both Fauji Fertilizer Company (FFC) and Fauji Fertilizer Bin Qasim (FFBL), which resulted in both shares outperforming the market.

The flow of foreign funds finally turned positive as foreigners purchased $0.2million worth of equity during the week. The KSE’s market capitalisation declined by 0.9% and stood at Rs2.86 trillion.

What to expect?

Developments in the political landscape will be the key determinant for the market in the coming week.

Monday, January 9

Investors decided to remain away from the bourse resulting in a gloomy session with not much activity. Activity seemed lost as investors remained cautious and sidelined on heightened political noise. The government and army seemed to be headed for yet another round of confrontation.

Tuesday, January 10

The stock market closed below the 11,000-point mark, levels last seen in November 2010, over speculations regarding NRO case. The Supreme Court warned the President and Prime Minister of disqualification for defying implementation of the NRO verdict.

Wednesday, January 11

The stock market closed flat as local investors chose to remain sidelined due to the Supreme Court’s interim order given a day earlier. With investors staying away, trade volumes fell to paltry level of 23 million shares compared with Tuesday’s tally of 44 million shares.

Thursday, January 12

Stocks fell to a four-month low in thin trade amid investors being cautious following growing tensions between the government and army.

Friday, January 13

After six consecutive days of decline, the stock market shrugged off all political news and welcomed news that the government is considering different options to revive the dwindling stock market activity.

Published in The Express Tribune, January 15th, 2012.

1733130350-0/Untitled-design-(76)1733130350-0-208x130.webp)

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ