K-P proposes Rs157b surplus in Rs2.1tr budget

Opposition parties protest alleged corruption, nepotism

The PTI-led Khyber-Pakhtunkhwa government on Friday presented a Rs2,119 billion surplus budget for fiscal year 2025-26, featuring no new taxes, a 10% salary increase, and a 7% pension hike for government employees.

The budget session, presided over by Speaker Babar Salim Swati, began with the recitation of the Holy Quran.

Khyber-Pakhtunkhwa Chief Minister Ali Ameen Gandapur, opposition leader Dr Ebad Khan, PPP parliamentary leader Ahmed Kundi and leaders of all parties were in attendance.

At the outset of the session, opposition members gathered in front of the speaker's desk, carrying placards and banners bearing slogans against alleged corruption and nepotism in the province.

Earlier, Governor Faisal Karim Kundi declined to immediately summon the budget session, stressing that he would not act under political pressure. He emphasized that while he was legally bound to respond within 14 days, there was no obligation to comply instantly, especially under what he termed undue influence from the chief minister or other quarters.

The chief minister has sent a summary to the governor, requesting to convene the assembly's budget session, but the governor has chosen not to return the summary immediately, leading to a delay in scheduling the session.

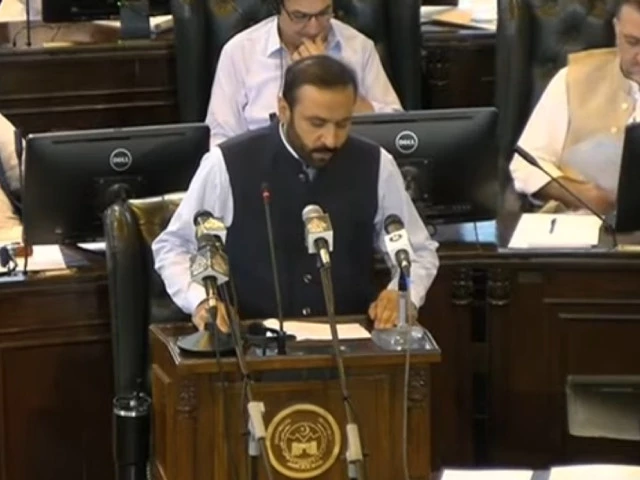

Presenting the annual budget, Finance Minister Aftab Alam announced that estimated expenditures for the fiscal year 2025-26 would total Rs1,962 billion, with a projected surplus of Rs157 billion.

Providing a breakdown, he said the government expects to receive Rs292.340 billion from the federal government for the merged tribal districts. This includes Rs80 billion in current budget grants, Rs39.600 under the Annual Development Program (ADP), Rs50 billion through the Accelerated Implementation Programme (AIP), Rs42.740 billion as inter-provincial share, and Rs17 billion for Temporarily Displaced Persons (TDPs).

The minister added that the province anticipates Rs3.293 billion from the Public Sector Development Programme (PSDP), Rs1,506.92 billion in federal transfers, Rs129 billion from provincial own-source revenues and Rs10.250 billion in other receipts, Rs291.340m from merged district receipts, and Rs177.188m in federal project assistance.

He said Rs137.912 billion would be collected through the one percent share of the divisible pool allocated for the war on terror, Rs57.115 billion as straight transfers under gas and oil royalties, Rs58.151 billion from the windfall levy on oil, Rs34.580 billion as net hydel profit for current year, and Rs71.410 billion as net hydel profit arrears.

The finance minister added that no new taxes have been imposed in the budget. Instead, the tax base has been broadened, with projected tax receipts of Rs83.500 billion and non-tax receipts of Rs45.500 billion for the upcoming fiscal year.

Similarly, the other receipts of Rs10.25 billion would include capital receipts of Rs0.250 billion and Rs10 billion other ways and means and Rs1147.761 billion as federal tax assignment.

The minister said the government has estimated Rs1,255 billion current expenditures for settled areas including Rs288.514 billion for provincial salaries, Rs288.609 billion tehsil salaries, Rs190.297 billion for pension, Rs334.028 billion for non-salary expenses, Rs65.657 billion on Medical Teaching Institutions (MTIs), Rs37.545 billion non-salary expenditure for tehsils, Rs40.350 billion capital expenditure and Rs10 billion under the head of "other ways and means". Similarly, the current expenditure of merged areas is estimated at Rs160 billion, including Rs56.842 billion for provincial salaries, Rs46.865 billion for tehsil salaries, Rs4.670 billion for pension, Rs24.285 billion for non-salary expenses, Rs17 billion for TDPs and Rs10.339b non-salary tehsil expenditure.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ