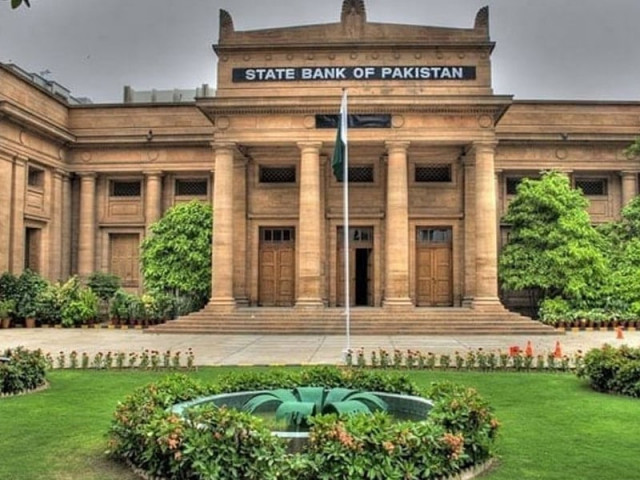

Senate panel approves amendments to SBP Act amid opposition

Requires banks to lend 60% of local deposits despite opposition from SBP, finance ministry

A Senate committee on Wednesday approved amendments to the State Bank of Pakistan (SBP) Act, requiring commercial banks to lend in Khyber-Pakhtunkhwa (K-P) and Balochistan equal to 60% of the deposits being raised from the two underdeveloped provinces.

The amendment was proposed after it was revealed that cumulative lending in these provinces amounted to just 1.33% of the total bank lending, even below the 2.5% charity rate. While banks were raising funds from these provinces, loans were being disbursed primarily in Punjab and Sindh. The Senate Standing Committee on Finance and Revenue approved the amendments proposed by Pakistan Tehreek-e-Insaf (PTI) Senator Mohsin Aziz. However, the SBP and the Ministry of Finance opposed the amendment, raising concerns about its passage through the Senate and National Assembly.

In a separate matter, the committee's proposal to grant the Senate chairman the authority to increase Senators' salaries did not go through after Secretary Finance Imdad Ullah Bosal requested more time to respond.

The committee meeting, chaired by Pakistan Peoples' Party (PPP) Senator Saleem Mandviwalla, approved the SBP (Amendment) Bill, 2024 by majority vote, with Senator Anusha Rehman abstaining.

Senator Mohsin Aziz noted that only 0.98% of total bank lending was directed to companies in K-P, while Balochistan received just 0.35%. He lamented that the combined lending in both provinces was less than the 2.5% charity rate.

According to the amendment, banks would be obligated to lend at least 60% of the deposits they raise from these two provinces.

SBP Governor Jameel Ahmad opposed the bill, stating that only the federal government, with the central bank's consent, could amend the SBP Act. He also pointed out that the central bank cannot direct commercial banks to lend a specific amount, as lending is dependent on demand.

Aziz expressed concern over the negligible lending, stating that this had led to persistent deprivation and slow industrialisation in the provinces. "When deprivations grow, Bangladesh takes birth," warned the senator.

The committee also discussed amending the Members of Parliament Salaries and Allowances Act of 1974. It proposed transferring the authority to determine senators' perks and privileges from the federal government to the Senate. The secretary finance requested more time to respond, although these powers have already been granted to the National Assembly.

Additional Finance Secretary Saad Fazal Abbasi stated that it was Parliament's prerogative to adopt such changes as it sees fit. The committee directed the Ministry of Finance to respond within three days.

The committee also received a briefing from the SBP governor on the Islamic banking system. The briefing revealed that Islamic banks were making undue profits by charging higher rates on loans while offering low returns to depositors.

SBP Executive Director of Islamic Banking disclosed that the average loan rate for Islamic banks last year was 21.1%, compared to 14.1%, resulting in a profit margin of 7%. By comparison, conventional banks offered loans at an average rate of 22.2% and paid 18.8% interest to depositors, a margin of only 3.4%.

Senator Anusha Rehman of the Pakistan Muslim League-Nawaz (PML-N) criticised Islamic banking practices, stating, "There is nothing Islamic about these practices. Are these banks not just doing normal banking under the name of Islamic banking?" The SBP governor did not have a satisfactory answer.

Governor Jameel Ahmad defended the low deposit rates of Islamic banks, citing difficulties in operations. He explained that unlike conventional banks, which can lend extensively to the federal government, Islamic banks have fewer opportunities, as the government has already taken Rs4.7 trillion in loans.

The SBP has proposed a shift from the current asset-based lending model to an asset-light model, but Islamic scholars have expressed reservations, said Ahmad.

Committee Chairman Senator Saleem Mandviwalla requested a comparative report on SBP regulations for Islamic and conventional banking. He also noted that the mention of Hiba (gift) was missing from the Musharakah contract. He expressed concern that Islamic banking might be yielding higher profits, leading to its promotion. The committee urged the SBP to establish a mechanism that aligns Islamic banking with Shariah principles.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ