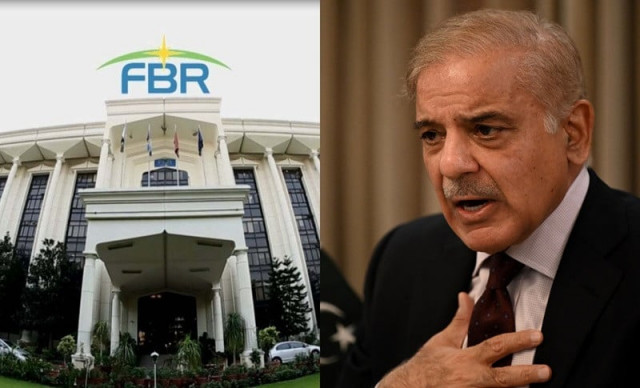

PM Shehbaz orders third-party audit of all FBR projects

Premier praised FBR Transformation Plan; encouraged officials to engage with taxpayers for feedback, recommendation

Prime Minister Shehbaz Sharif has instructed that a third-party audit be conducted on all projects under the Federal Board of Revenue (FBR) to enhance transparency and improve operational efficiency.

This directive was issued during a meeting chaired by the prime minister to review FBR’s operations on Friday.

The premier emphasised that the FBR is the backbone of the country’s economy, and its digitisation is a crucial milestone in the government’s economic reforms.

By improving revenue collection, Pakistan will be able to provide better services to its citizens and improve the social sector.

Additionally, the prime minister stressed the need to further strengthen FBR’s enforcement system, calling it a critical step for the country’s financial stability.

During the meeting, PM Shehbaz praised the FBR Transformation Plan, encouraging officials to engage with taxpayers for feedback and recommendations.

He reiterated the government's commitment to promoting the private sector, describing a strong and thriving private sector as vital for Pakistan's economic future.

The prime minister also urged swift action to combat smuggling, highlighting its detrimental impact on the economy.

The meeting included a detailed briefing on the FBR Transformation Plan, with participation from key federal ministers including Minister for Planning Ahsan Iqbal, Minister for Law and Justice Azam Nazir Tarar, Minister for Economic Affairs Ahsan Iqbal Cheema, and Minister for Finance Muhammad Aurangzeb, alongside other senior officials.

The Federal Board of Revenue (FBR) has reported a significant 71% increase in the number of tax return filers for the fiscal year 2023 (FY23), with an additional 2.2 million people filing, bringing the total to 5.3 million. The deadline for filing income tax returns for FY24 has been set for September 30, 2024.

Previously, FBR reported that in FY23, the FBR collected a total of Rs9.285 trillion ($33.22 billion), slightly surpassing the revised target of Rs9.252 trillion.

Income tax collection alone reached Rs4.512 trillion, exceeding its target by 21.25%. However, the sales tax collection fell short, bringing in Rs3.096 billion, missing the target by 14.16%.

For the first two months of the current fiscal year, the FBR collected Rs1.456 trillion, falling short of its Rs1.554 trillion target by Rs98 billion.

In July, Pakistan reached a Staff-Level Agreement (SLA) with the International Monetary Fund (IMF) for a $7 billion 37-month Extended Fund Facility (EFF), aimed at stabilising the country's economy.

Finance Minister Muhammad Aurungzeb has repeatedly expressed his goal of increasing tax revenue to 15% of the country's GDP by broadening the tax base to include retail, export, and agricultural sectors. The plan involves simplifying both direct and indirect taxation to create a fairer system.

Looking ahead, the government has set an ambitious revenue collection target of Rs12.97 trillion for FY25, a 40% increase over the target for FY24.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ