Pakistani currency depreciated Rs0.11 and hit over three-month low at Rs278.62 against the US dollar in the inter-bank market on Monday in the wake of a surge in demand for the foreign currency in the domestic market.

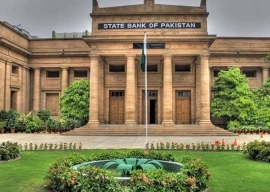

According to the State Bank of Pakistan’s (SBP) data, the rupee had closed at Rs278.51 against the greenback on Friday. Exchange Companies Association of Pakistan (ECAP), however, reported an uptick of Rs0.05 in the rupee value, which settled at Rs280.32/$ in the open market compared to Rs280.37/$ on Friday.

The latest drop in the inter-bank currency market came after the central bank unexpectedly reported a current account deficit of $270 million for May 2024 against high expectations for a surplus in line with the trend seen over the past few months.

The return of current account deficit after remaining in surplus for three consecutive months came in the backdrop of the central bank’s decision to let foreign companies send higher profits and dividends to their headquarters abroad to clear the backlog.

It indicated that the demand for US dollars spiked owing to the increasing outflow in the shape of profits and dividends.

On the other hand, inflows of dollars remained robust with the remittances sent home by overseas Pakistanis jumping to an all-time high of $3.24 billion in May 2024. Remittances soared ahead of Eidul Azha in mid-June as expatriate Pakistanis sent home more money to their relatives ahead of the festival. Post-Eid, workers’ remittances may register a seasonal decline.

Financial experts said the demand for US dollars may stay stable since the central bank reported that it had cleared almost the entire backlog for repatriation of profits and dividends by the multinational companies (MNCs) running their businesses in Pakistan.

The rupee-dollar parity is expected to remain stable in the outgoing month of June despite likely fluctuation in demand and supply of the greenback.

The rupee is projected to lose some ground from July onwards with likely growth in demand for the greenback to cover a gradual increase in imports following the easing of restrictions.

The government has worked out the rupee-dollar parity at an average of Rs295/$ for the next fiscal year 2024-25 beginning July 1.

1730706072-0/Copy-of-Untitled-(2)1730706072-0-270x192.webp)

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ