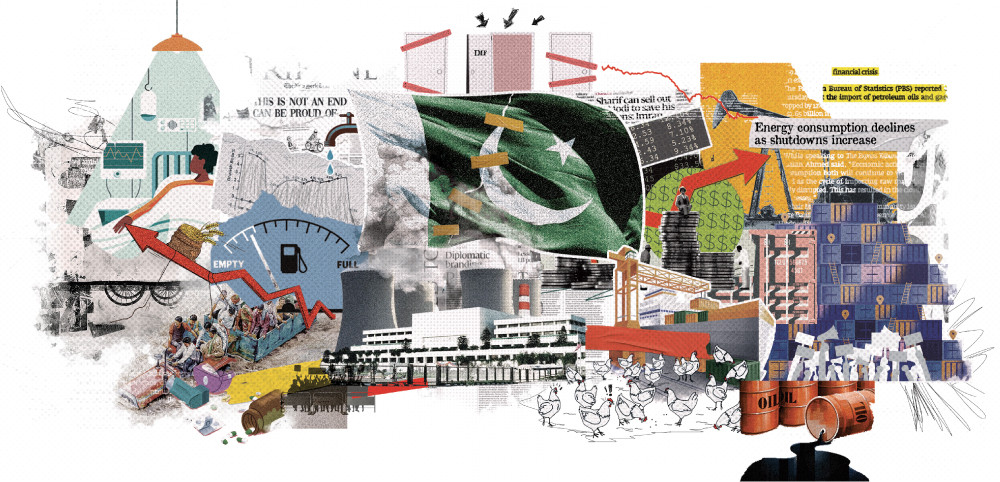

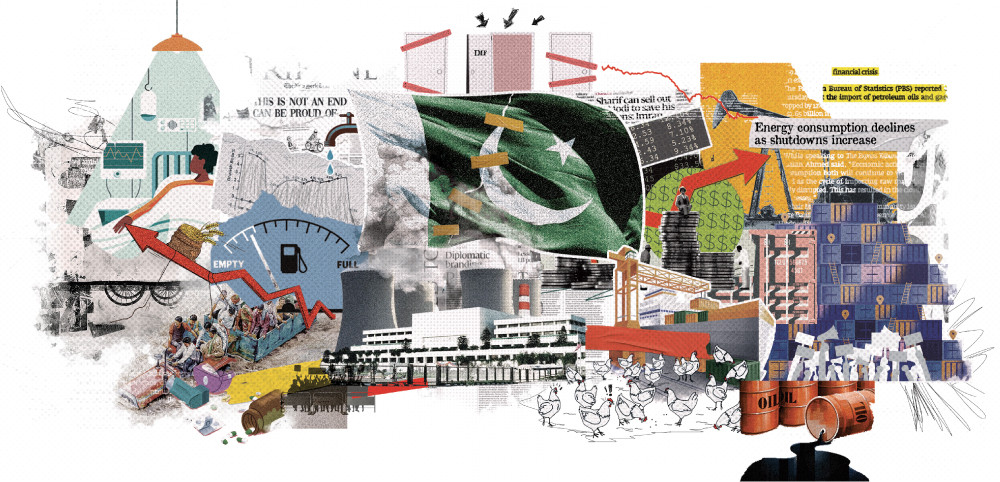

Will Pakistan oscillate between despair and hope this year?

Key fundamental steps taken at the dawn of 2024 will make the difference

As 2023 draws to a close, it has left behind a mix of despair and hope. The economy had teetered on the brink of default but was then propped up with life support. The future of 242 million people now hinges on the anticipation of a return to political and economic stability at the dawn of 2024.

The first half of 2023 witnessed escalating economic and political uncertainty, eroding trust among the people and investors in the ability of the two incumbent governments to navigate the crises. The unprecedented nature of the economic crisis gave rise to a transformed government structure. Some institutions relinquished power, while others gained authority, depending on their ability to broker power deals.

The redefined and restructured federal government is now seen as a ray of hope to lift the country out of the economic crisis and set it on a path of sustainable and irreversible economic growth. With three million more people slipping below the poverty line in fiscal year 2023, according to the World Bank’s $3.6 per day income threshold, the nation is now pinning its hopes on a new democratic setup to alleviate their economic woes.

The lower-middle-income poverty rate in 2023 is estimated at 39.4%, or 97 million people at the $3.65 per day income threshold, only slightly below the poverty rate of 40% in 2018. This sets the stage for the new political dispensation, with one yardstick for evaluating the next government’s performance being its ability to lift people out of poverty, especially from the estimated 97 million affected.

design: mohsin alam

design: mohsin alam

Internal political conflicts and rivalries within a single political party disrupted negotiations with the International Monetary Fund (IMF) and created a vacuum that was exploited by another arm of the state to extend its boundaries.

By mid-2023, Pakistan’s economic stability hinged on the outcomes of talks with the IMF. The global lender, the last resort, became an estranged bedfellow due to mishandling of negotiations by the finance ministry. Inter-party rivalry risked the first peace-time sovereign default due to massive external debt obligations.

Read Pakistan’s undocumented economy

At one point, Pakistan's official foreign exchange reserves had dwindled to $3 billion, insufficient to finance even three weeks of the country’s import bill. Concurrently, inflation peaked at Pakistan’s highest-ever single-month level of 38%, amid heightened political conflict and an unprecedented crackdown compromising civic rights.

The country averted default after its chief executive intervened, giving personal guarantees to the IMF for future fiscal and economic responsibility. However, for the second time in four years, Pakistan’s economy contracted by 0.3%, driven by steep import restrictions to make room for debt repayments. The remainder of 2023 was a struggle to balance the budget and keep the country afloat.

The 23rd year of the century unleashed unprecedented economic hardships on the majority, with the costs of electricity, heating, cooking, education, and daily affairs soaring, resulting in diminished purchasing power.

The country’s de-jure and de-facto rulers could not offer solace to the majority, who suffered under record inflation. Official briefings revealed how people were burdened by financing the electricity and gas bills of others, robbing them of their hard-earned money.

The country’s top energy sector manager, the Secretary Power, candidly admitted this year that the electricity consumers paid Rs575 billion for picking the cost of subsidies for other consumers. The poor consumers were also overcharged by Rs100 billion to hide poor performance of the power distribution companies.

Will the new government fix this wrongdoing? It is unlikely largely because of lack of fiscal space in the budget to provide subsidies and also because these people do not have a voice to defend themselves.

Pakistan’s addiction to programme loans fuelled high budget deficits, neglecting essential reforms for economic productivity and perpetuating reliance on foreign debts to fund a lavish lifestyle. These short-term loans contributed to increasing external financing requirements to an unsustainable level of around $25 billion annually for the next three years. The trend now has moved towards credit over aid.

As developing countries faced balance of payment crises over the last two decades, they sought support through loans under specific programmes like the IMF’s structural adjustment programmes. 2024 may not differ from 2023 in terms of yawning external and domestic financing needs, but greater clarity on the source of financing is expected with a new long-term IMF umbrella.

However, the IMF will impose conditions making it challenging to ease the financial troubles of the majority. Even bilateral creditors like China, Saudi Arabia, and the United Arab Emirates will not rollover their combined $12 billion lending without an effective IMF umbrella.

Pakistan must break the habit of accepting condition-free foreign commercial loans and conditional budget support loans to finance a lavish lifestyle. Expenses on public administration and defence remained high, despite the potential to curtail them. Public finances allocated minimal amounts to health, housing, education, transport, and development of agricultural and physical infrastructure.

Will Pakistan oscillate between despair and hope for another year? The situation might not differ from the outgoing year, but the key fundamental steps the new government takes at the dawn of 2024 will make the difference.

The focus of 2024 should be on increasing economic productivity by ending favourable policies for unproductive sectors like real-estate and the stock market. Stable currency, monetary policies, taxation policies, and an end to export biases are crucial steps to boost productivity. Record interest rates have impeded economic activity, with manufacturing at a standstill and electricity consumption at one of the lowest levels.

Foreign direct investment should be used as a short-term tool, as dependence on foreign investment leads to higher outflows. An unconventional approach is needed, and early public debt restructuring, including domestic banks being ready for a haircut, is imperative.

No specific forum can be a permanent alternative to attract foreign investment to a stable set of economic policies and a judicious system of dispute resolution.

The crossroads at which Pakistan finds itself today demands an unconventional approach. The Ministry of Finance should initiate early public debt restructuring, extending beyond external debt to include preparedness for a haircut by domestic banks.

Interest payments, estimated at Rs8.6 trillion for this fiscal year, equal 91% of the Federal Board of Revenue’s tax collection target. Restructuring, reduction in non-productive expenditures, a smaller civil and military footprint, and taxing untapped sectors are essential for averting default.

Tax exemptions for privileged bodies and individuals must end, signalling equity to the people. The nation needs a stable political government to transform the fate of those affected by political battles between civilian and military institutions.

Published in The Express Tribune, December 26th, 2023.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ