In August 2023, the government of Pakistan successfully conducted the auction of sovereign Ijarah sukuk and issued record sukuk worth Rs371 billion (equivalent to over $1.29 billion). It is a historic achievement for Islamic capital markets and once again proved the growing strength of the Islamic finance sector of Pakistan as it marks largest issuance of shariah compliant instrument in a single auction since the inception of the domestic sukuk programme in 2008. The issuance was approved by the Shariah Advisory Committee of the State Bank of Pakistan (SBP) and Meezan Bank acted as the Joint Financial advisor to the issue with Dubai Islamic Bank and Bank Alfalah Islamic.

The shift of the governmental focus towards the issuance of shariah compliant sukuk to replace its interest-based borrowing is a welcome step for the growth of Islamic finance in Pakistan. This strategic shift can contribute positively to the economy and has already generated significant cost savings for the government due to lower costs of sukuk over conventional instruments. Moreover, it fosters financial inclusion, bolsters the Islamic banking sector, and indicate the government’s commitment to adhering to the Federal Shariah Court’s mandate of eliminating interest from the economic landscape.

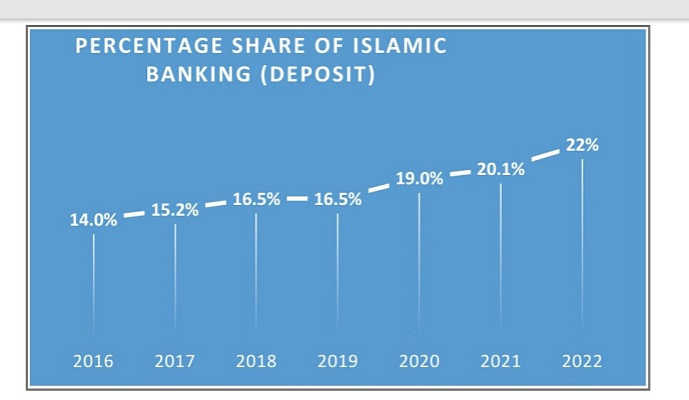

Islamic finance has witnessed remarkable growth in recent years in Pakistan. As per the SBP data by December 2022, Islamic banking market share has reached 26% in terms of financing and 22% of the deposit respectively, with sukuk issuances playing a pivotal role in this expansion and growth. The size of Islamic mutual fund industry has also crossed the benchmark of 40% market share and is poised to reach 50% in next couple of years. Pakistan has recently emerged as an active player in the sukuk market, leveraging these instruments to meet its financing requirements while adhering to Islamic principles.

Sukuk, often referred to as an Islamic alternative to bonds, are financial instruments that comply with Islamic commercial law and offers a Sharia-compliant alternative for generating liquidity, project financing, and government funding needs. Unlike the conventional bonds, a sukuk does not represent an interest-based loan but it is closer to a share in nature and it generally represents ownership of an asset or an investment activity. With the concepts of ownership risk or risk sharing – the sukuk holders are entitled to economic returns in terms of rental income or profits.

The global Sukuk market has experienced significant growth, defying economic challenges and the impact of the Covid-19 pandemic. According to International Islamic Financial Market (IIFM) Sukuk Report 2023, till date 14,228 sukuks have been issued globally with a combine worth of over $1.79 trillion by 36 Muslim majority and non-Muslim countries. The active Muslim countries includes Malaysia, Turkey, Saudi Arabia, Bahrain, UAE, Oman, Indonesia and Pakistan, while several western countries including USA, UK, Japan, Hongkong, Germany, France have also issued sukuk. The global sukuk issuance is led by Malaysia, Indonesia, Saudi Arabia, Turkey and very recently Pakistan has started to register its mark as an emerging player in developing Islamic capital market instruments.

Pakistan made its first entry in the global sukuk market in 2005 with the first sukuk issuance amounting to $600 million. Over the years, Pakistan has successfully issued Ijarah based Sukuk worth $4.6 billion in the global markets creating a foot print for Pakistan and this opportunity can be further explored to raise US dollar fund from international markets targeting ethical and shariah compliant investors in the GCC and western markets. On the domestic front, the domestic Sukuk programme was launched in 2008 and till August 2023, the government has issued Ijarah Sukuk amounting to Rs5.051 trillion.

Benefits of Sukuk for Pakistan

Sukuk has proven to be a cost-effective financing tool for sovereign needs, favoured by Islamic financial institutions due to restrictions on investment in conventional options. Its Sharia-compliant nature appeals to Sharia-compliant institutions and ethical investors. Based on assets and fixed income streams, the Ijarah Sukuk structure offers a less risky investment than equities. Issuing Sukuk reduces reliance on conventional instruments, fostering Sharia-compliant avenues in the domestic Islamic capital market.

The domestic Sukuk market in Pakistan aims to grow, with the government planning to increase its share. The existing Ijarah Sukuk programme targets around Rs1.5 trillion issuances this year. Exploring innovative concepts like retail, asset-light, green, and sustainable Sukuk will further increase Sharia-compliant instruments in the government securities. Focus on Sukuk and its effective marketing to the target investor groups can help expanding the domestic and international investor base as well.

Sukuk’s asset-backed nature can directly contribute to real economic growth. Funding infrastructure projects, such as dams, solar parks, technology parks, railway tracks and hospitals, provide secure financing for essential ventures. It attracts financing for infrastructure development and can be targeted towards retail investors at Pakistan Stock Exchange (PSX), promoting financial inclusion and Islamic capital market development. Initiatives like green and Sustainable Development Goals (SDG) link Sukuk with global sustainability efforts and socially responsible investments. By utilising innovative Sukuk structures, the government can address its national debt in a strategic manner. Sukuk can be employed to convert existing debt into Sharia-compliant instruments, effectively tapping into a new investor base while adhering to Islamic principles.

The impact of Sukuk extends far beyond the confines of the Islamic capital market. Its influence spills over into related industries, such as mutual funds, takaful and banking. By providing a new class of Sharia-compliant assets, Sukuk offerings expand the options available to mutual funds and pension funds to enhancing their ability to tailor portfolios to the preferences of ethically conscious investors. This, in turn, catalyses growth in the mutual fund sector and generates a positive ripple effect throughout the economy by promoting the savings rate.

One noteworthy advantage of Sukuk lies in the alternative it offers for the conversion of public debt from interest-based T-bill and PIBs to Islamic modes in line with the government’s recent decision to convert the economy to Islamic principles as per the Federal Shariat Court’s verdict. Sukuk issuance, if executed efficiently, can also offer a cost-effective path for debt conversion by tapping into large liquidity pools of Islamic financial institutions, local and international investors and can attract the much need investment for the local economy.

The growth of Sukuk issuances in Pakistan has been a game-changer in the realm of Islamic finance. With the government actively participating in the global Sukuk market and leveraging domestic Sukuk programmes, Pakistan has successfully tapped into Sharia-compliant sources of financing while meeting its funding needs. Sukuk offers cost-effective financing, and attracts Sharia-compliant investments. As Pakistan continues to explore new avenues and concepts in the Sukuk market, like tokenisation of Sukuks, green Sukuks, infrastructure development Sukuk and asset-light Sukuks, the potential for further growth and economic development remains significant. Moreover, the strategic deployment of innovative Sukuk structures empowers governments to manage their national debt. Close collaboration and concerted efforts between the Ministry of Finance, the Securities and Exchange Commission of Pakistan (SECP), State Bank of Pakistan (SBP), and financial institutions are imperative to achieve this objective.

Ahmed Ali Siddiqui is the Director at IBA Centre for Excellence in Islamic Finance. Samia Tahir Jawad is the Research Associate at IBA Centre for Excellence in Islamic Finance

Published in The Express Tribune, October 2nd, 2023.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

1730706072-0/Copy-of-Untitled-(2)1730706072-0-270x192.webp)

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ