Pakistan Stock Exchange (PSX) rose modestly in the outgoing week on the back of a string of positive developments such as the announcement of general elections’ date and the rupee’s consistent winning streak against the US dollar.

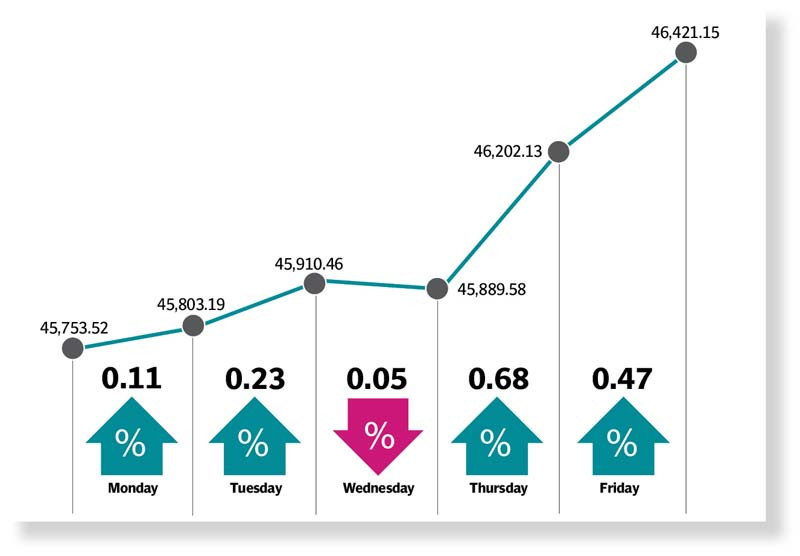

Those factors continued to dominate the mood of investors who, despite jitters on the economic front, looked for building positions in attractive stocks. As a result, the benchmark KSE-100 index closed at 46,421, with an increase of 668 points, or 1.5% week-on-week (WoW).

At the beginning of the week, the bourse remained marginally positive as it gained nearly 50 points owing to support from the swift recovery of the rupee and the central bank’s decision to leave its policy rate unchanged.

The market extended gains on Tuesday, going up by another 107 points as the government’s crackdown on currency smugglers continued in a bid to stabilise the exchange rate.

The very next day, the market lost some ground in directionless trading as the mounting debt and surging power tariff dented investors’ confidence.

On Thursday, the bourse turned around and notched up decent gains of 313 points as the Asian Development Bank forecast that Pakistan’s economy would stabilise after polls and reforms. The Election Commission of Pakistan (ECP)’s announcement that polls would be held in the last week of January 2024 also lent key support to the market. The index extended its rally at the conclusion of the week, driven higher by the rupee’s continuous strengthening and some increase in Pakistan’s foreign currency reserves.

Topline Securities, in its review, attributed the market’s recovery to appreciation of the rupee, ECP’s statement about general elections and partly to a statement of Barrick Gold Corp CEO where he highlighted the newfound interest in developing the $7 billion Reko Diq gold and copper mine in Balochistan.

JS Global analyst Muhammad Waqas Ghani, in his report, wrote that the KSE-100 closed on a positive note, gaining 1.5% WoW.

It began the week on a positive note as investors welcomed the central bank’s decision to maintain policy rate at 22%, alleviating concerns about a potential hike amid increasing inflation, he said.

During the week, the rupee continued to gain ground and closed at 295/$ in the open market, gaining 1.6% WoW. It came as the State Bank undertook measures to enforce regulations against the unauthorised currency dealers.

On the economic front, the large-scale manufacturing sector posted a 1.1% YoY decline in output for July 2023. While the data remained in the red for the 11th consecutive month, the pace of decline slowed down.

In the T-bills’ auction held during the week, the State Bank sold three, six and 12-month treasury bills at lower yields compared to the previous auction, reflecting the market’s expectation of a decrease in inflation in the coming months. Three-month bonds attracted the most interest where yields fell by 1.71%.

Furthermore, the central bank’s forex reserves increased by $56 million at $7.7 billion, the JS analyst added.

Arif Habib Limited (AHL), in its report, stated that market sentiment remained predominantly positive during the outgoing week, bolstered by significant developments on the economic and political fronts.

The ECP announced that general elections would be held in the last week of January 2024, which effectively put to rest the uncertainty in the market.

Pakistani rupee exhibited a consistent appreciation over the course of the week and closed at 291.76 against the dollar, gaining Rs5.1, or 1.7% WoW. This led to an increase in confidence among market participants, reinforcing the positive outlook on the market.

Foreigners’ buying was witnessed during the week, which came in at $0.29 million compared to net selling of $9.67 million last week.

Published in The Express Tribune, September 24th, 2023.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

1722237119-0/unepmployment-(1)1722237119-0-270x192.webp)

1722236723-0/sukuk445-(1)1722236723-0-270x192.webp)

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ