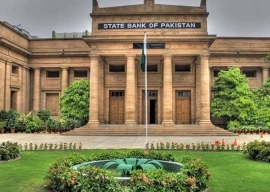

The Pakistani currency continued its upward trajectory for the eighth consecutive working day, gaining 0.37%, or Rs1.11, reaching a fresh one-month high at Rs296.85 against the US dollar in the interbank market on Friday.

This sustained recovery is poised to have a substantial impact on import prices, potentially leading to a reduction in imported inflation, particularly in the energy and food sectors.

The currency’s resurgence comes on the heels of a significant drop in the current account deficit (CAD), which plummeted by 79% to $160 million in August, compared to both July and August 2022. This suggests an increase in the supply of foreign currency in the market relative to demand.

Recent data reveals a robust 14% month-on-month surge in export earnings and a 3% improvement in workers’ remittances. In contrast, imports increased by 2% in August compared to July.

With this latest surge, the currency has cumulatively regained 3.45%, or Rs10.25, over the past eight working days, owing to an ongoing crackdown on currency and gold smugglers and hoarders nationwide.

The All Pakistan Sarafa Gems and Jewellers Association (APSGJA) refrained from issuing daily gold prices for the third consecutive working day on Friday. They announced their intention to resume daily price announcements on Saturday following the release of gold dealers who were apprehended on suspicion of involvement in smuggling and pricing speculation by secret law enforcement agencies.

The association’s President, Haji Haroon Chand Rasheed, indicated that they would release the gold-spot price on a daily basis while discontinuing the release of futures contract prices to prevent speculation.

In the open currency market, the Pakistani currency regained 0.33%, or Rs1, settling at Rs297/$, according to the Exchange Companies Association of Pakistan (ECAP).

The market has now recovered nearly 10.44%, or Rs31, over the past nine working days. Consequently, the gap between exchange rates in the two markets has significantly narrowed, standing at Rs0.15 on the day compared to a substantial 9.33%, or Rs30, observed in the second-to-last week.

The IMF has recommended that the gap may increase or decrease by a maximum of 1.25% on any of five consecutive working days.

Published in The Express Tribune, September 16th, 2023.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

1720097164-0/BeFunky-collage-(9)1720097164-0-165x106.webp)

1730446133-0/BeFunky-collage-(7)1730446133-0-165x106.webp)

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ