Positive momentum continues at PSX

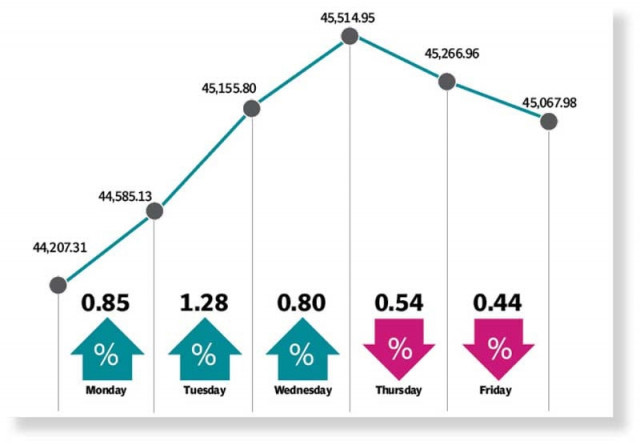

KSE-100 index rises 861 points, or 1.95%, settling at 45,067.98

The Pakistan Stock Exchange (PSX) maintained its positive momentum in the outgoing week as the KSE-100 index surged over 850 points, propelled by the Fitch ratings upgrade, improved external liquidity and foreign inflows.

Following the International Monetary Fund (IMF)’s loan approval, Fitch upgraded Pakistan’s foreign currency issuer default rating from “CCC-” to “CCC”, fuelling a rally at the PSX, which rose more than 300 points on Monday.

The positive trend continued on Tuesday after the receipt of a $2 billion loan from Saudi Arabia for one year as part of a plan to raise funds under a condition set by the IMF for the new package.

Bulls maintained their grip on Wednesday as well with the winning streak continuing for the third consecutive day ahead of the IMF’s board meeting for approval of a $3 billion standby arrangement.

Unfortunately, the momentum could not be sustained next day when the index retreated over profit-taking, which pulled the index down despite the approval of the $3 billion loan. The downtrend continued on Friday where bears kept their control, dragging the index down by nearly 200 points over reports of a 14.47% decline in the output of large-scale manufacturing industries (LSMI) in May 2023, rising government’s bond yields and a surge in industrial power tariff.

The benchmark KSE-100 index, however, managed to stay in the green, gaining 861 points, or 1.95%, compared to the previous week. It settled at 45,067.98.

JS Global analyst Muhammad Waqas Ghani highlighted that investor optimism remained strong following an agreement with the IMF. Sector-wise, chemical firms (13% week-on-week), engineering companies (6%) and refineries (5.6%) outperformed during the week.

On the economic front, the IMF’s executive board approved a $3 billion, nine-month standby arrangement for Pakistan and the first tranche ($1.2 billion) was disbursed immediately. The board emphasised the need for key measures including FY24 budget implementation, market-based exchange rate, monetary tightening, and energy sector reforms.

The IMF’s first tranche alongside deposits of $2 billion and $1 billion made by Saudi Arabia and the UAE respectively were the key positive triggers for the bourse.

Moreover, Fitch upgraded Pakistan’s foreign currency issuer default rating from “CCC-“ to “CCC” due to improved external liquidity and funding conditions following the IMF agreement.

As per Pakistan Bureau of Statistics data, 11MFY23 LSM posted a negative growth of 9.9% year-on-year as energy constraints and curbs on the import of raw material were the key impediments to the industries.

Meanwhile, the treasury bills’ yields increased up to 1% at Wednesday’s auction in line with market projections. After several months, there was a notable increase in participation in one-year papers, which surpassed the auction target by 11.8%.

Topline Securities, in its report, said that the KSE-100 index gained 1.95% week-on-week, where attractive valuations and the resumption of IMF programme along with support from friendly countries continued to garner investor interest.

“However, some profit-taking was observed by the end of the week as the index lost some steam with two consecutive negative sessions.”

Other major numbers released during the week were remittances clocking in at $2.2 billion for June 2023, car sales including non-Pama members rising 10% month-on-month in June and the LSMI expanding 5.9% MoM and falling 9.9% YoY in May 2023.

Healthy investor participation was observed at the exchange as average traded volumes and value stood at 440 million shares and Rs12.4 billion respectively.

Published in The Express Tribune, July 16th, 2023.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ