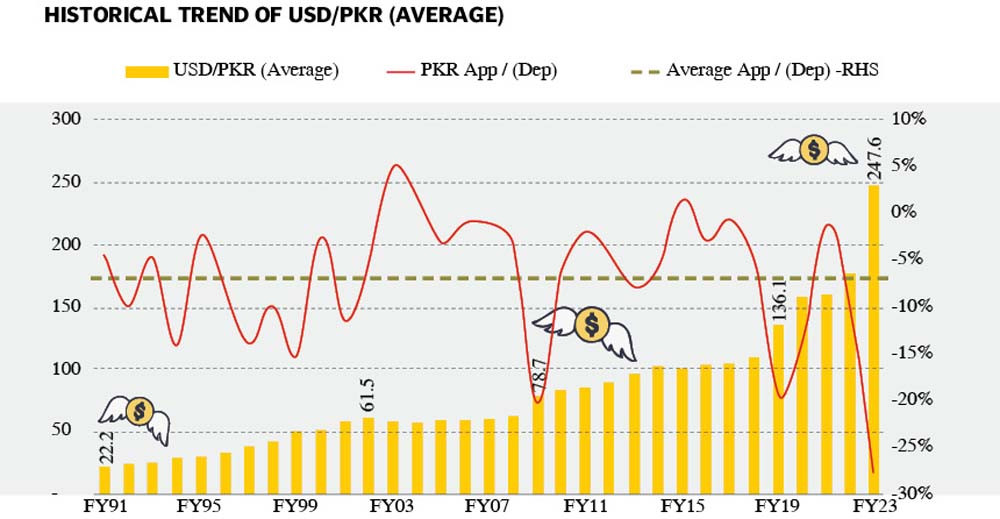

The Pakistani rupee has suffered a significant blow, hitting a historic low of over 28% (or over Rs81) against the US dollar in the outgoing fiscal year of 2023, closing at Rs286 in the interbank market on Tuesday.

Leading financial expert predicts that the domestic currency will continue its downward trend for the third consecutive fiscal year starting July 1, 2023, with a projected further loss of 10-12% to reach Rs320 against the greenback in FY24.

In the previous fiscal year of 2022, the currency had already experienced a 22% drop, falling to Rs204.84/$.

Explaining the reasons behind the highest yearly depreciation of 28% in FY23, Arif Habib Limited, Head of Research, Tahir Abbas said that it was primarily driven by challenges posed by debt repayments, which led to a depletion of foreign exchange reserves and a significant decline in capital inflows from bilateral and multilateral creditors, particularly due to the suspension of the International Monetary Fund (IMF) programme.

The recent rally in the Pakistan Stock Exchange, with a gain of over 1,300 points on Monday, and a partial recovery in the rupee-dollar exchange rate on Tuesday, indicate the possibility of the IMF resuming its stalled loan programme of $6.7 billion before its official expiration on June 30, 2023, as the government has met many of the conditions.

However, while speaking to The Express Tribune, Abbas cautions that the probability of resuming the programme still remains uncertain, stating that “The probability of resumption of the loan programme, however, still remained 50:50 considering the situation still stayed uncertain.” The future of the rupee hangs in the balance. If the programme is resumed by the end of June 2023, it could halt fresh losses and lead to a partial recovery in the short term. This would be followed by capital inflows from multilateral creditors and friendly countries, which would boost foreign exchange reserves, stabilise the rupee, and offer support.

However, in the absence of an IMF programme resumption, the rupee will likely continue to face challenges until the next programme is initiated, expected sometime in December 2023 or January 2024, he said.

The future political and economic moves taken by the new government, expected to come into power after the general elections in the last quarter of 2023, will also significantly influence the rupee-dollar exchange rate.

Pakistan is due to repay a sum of $22 billion in fiscal year 2024, with $13 billion potentially being rolled over. However, the next government will need to pay off $9 billion in debt maturity instalments throughout the year (July 1, 2023, to June 30, 2024).

Furthermore, the resumption of raw material imports and the recovery of economic activities will play a vital role in supporting the rupee against the greenback.

Exchange Companies Association of Pakistan (ECAP) President, Malik Bostan, highlighted that the narrowing gap in the rupee-dollar exchange rate between the interbank and open market to 1.4% or Rs4 on Tuesday has aided in curbing black currency markets.

design: Ibrahim Yahya

“The development will help relocate $1 billion per month supplies from black currency markets to the interbank market,” he said. This meaningful improvement in supplies to the interbank market will be supported by an increase in inflows of workers’ remittances through official channels such as banking channels and authorised exchange companies.

The spread between the two markets narrowed to Rs4 as the exchange rate improved in both sectors. On Tuesday, it increased by 0.25%, or Rs0.72, to Rs285.99/$ in the interbank market and by 0.34%, or Rs1, to Rs290/$ in the open market. Bostan also expressed optimism, stating that the currency has partially gained ground against the dollar in both markets over the past few days following an increase of 20% in workers’ remittances and export earnings. These positive developments have contributed to the decline of the black market.

He hopes that if the supplies continue to improve, the currency will recover to Rs270/$ in the coming weeks and months. Reflecting on the major events that triggered rounds of rupee depreciation during FY23, Abbas mentioned the signing of the staff level agreement (SLA) with the IMF in July 2022 as the first significant depreciation. The rupee faced mounting pressure for the second time in September 2022 amid hopes for the revival of the IMF loan programme. In January and March 2023, the currency experienced substantial depreciation following the government’s decision to shift to a market-based exchange rate after the IMF expressed concerns on both occasions.

The rupee reached an all-time low of Rs299/$ on May 11, 2023, due to political drama and law and order issues.

Published in The Express Tribune, June 28th, 2023.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS (2)

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ