Stocks turn bullish on pre-budget optimism

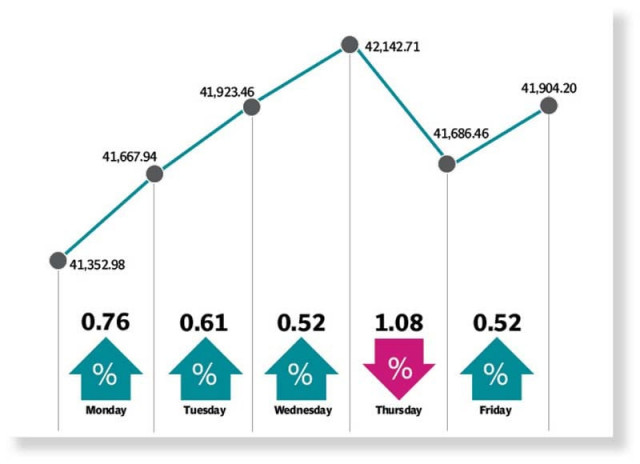

KSE-100 index rises by 551 points and settles at 41,904

Bulls dominated proceedings at the Pakistan Stock Exchange (PSX) during the outgoing week where four out of five trading sessions remained in the green primarily because of positive budget expectations.

However, the KSE-100 index failed to stay above the 42,000-point mark as some investors succumbed to pre-budget jitters. It ended the week with gains of around 550 points. On Monday, the bourse staged a modest rally over optimism about budget reforms, further increase in international oil prices and the rise in local gas tariff.

The following session extendved gains by over 250 points in the wake of investor hopes about successful negotiations with the International Monetary Fund (IMF) for an agreement. The government’s likely move to provide relief from taxes on inter-corporate dividend further boosted investor confidence.

Optimism prevailed in the market on Wednesday as well, triggered by hopes of incentives for the technology and telecommunication companies, which were in the limelight.

Unfortunately, the tables turned on Thursday when investors resorted to panic selling. The index received a battering ahead of the presentation of the federal budget for FY24 as investors resorted to profit-booking and brought the index below the 42,000 mark.

The market regained the lost momentum on Friday due to investors’ interest in selective stocks and positive expectations from the upcoming federal budget. Some investors opted to cherry-pick stocks while building fresh positions.

The benchmark KSE-100 index registered an increase of 551 points, or 1.3% week-on-week (WoW), and settled at 41,904.

JS Global analyst Wasil Zaman, in his report, noted that the KSE-100 gained momentum during the outgoing week till the release of federal budget.

Sector-wise, chemical (up 15% WoW), oil and gas (up 8.9%) and refinery (up 4.2%) outperformed the market while bank (down 1.6%) and tobacco (down 6.1%) under-performed.

Foreigners were net buyers during the week with an investment of $2.1 million. Highest buying was witnessed in the oil and gas sector at $1.1 million.

On the news front, the government unveiled a Rs14.5 trillion budget on Friday with a consolidated budget deficit of 6% of gross domestic product (GDP). GDP growth target was set at 3.5% and inflation target at 21%.

As per market expectations, the State Bank in its upcoming monetary policy meeting on June 12 is expected to keep interest rate unchanged amid high inflation.

State Bank’s forex reserves declined by $179 million and stood at $3.9 billion owing to external debt payments.

The World Bank, in its latest report, further slashed Pakistan’s GDP forecast from 1.6% to 0.4% for FY23, citing the impact of floods, social and political tensions, high inflation and policy uncertainty as key concerns, the JS analyst added.

Topline Securities, in its report, said that the KSE-100 index gained 1.33% WoW, which could be attributed to a pre-budget rally.

Investor interest was observed in following sectors: chemical (up 13% WoW), technology (up 3%), OMCs (up 3%), textile (up 39%) and refineries (up 3%).

Average daily traded volumes and value stood at 217 million shares and Rs6 billion respectively.

During the outgoing week, foreign corporate, broker proprietary books, companies and individuals purchased net equities of $1.61 million, $0.70 million, $0.67 million and $0.43 million respectively as of Thursday’s close.

On the other hand, mutual funds and insurance firms sold net equities of $3.63 million and $0.41 million respectively as of Thursday’s close, Topline added.

Published in The Express Tribune, June 11th, 2023.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

1733130350-0/Untitled-design-(76)1733130350-0-208x130.webp)

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ