Pakistan Stock Exchange (PSX) on Friday witnessed a lacklustre trading session as investors refrained from taking fresh positions and the KSE-100 index closed below the 41,000-point mark with marginal losses. Investors kept a low profile and remained under pressure owing to multiple developments. Jittery players mainly stayed on sidelines in the first half on concerns over political noise and chances of an end to the International Monetary Fund (IMF) loan programme.

Investors opted for a waitand-watch approach following board meetings of different companies with strong expectations about the imposition of a tax on company reserves in the budget for FY24. The second session commenced with a decline as falling forex reserves and rupee depreciation dented market confidence and the index reached an intra-day low of 40,783.79 points.

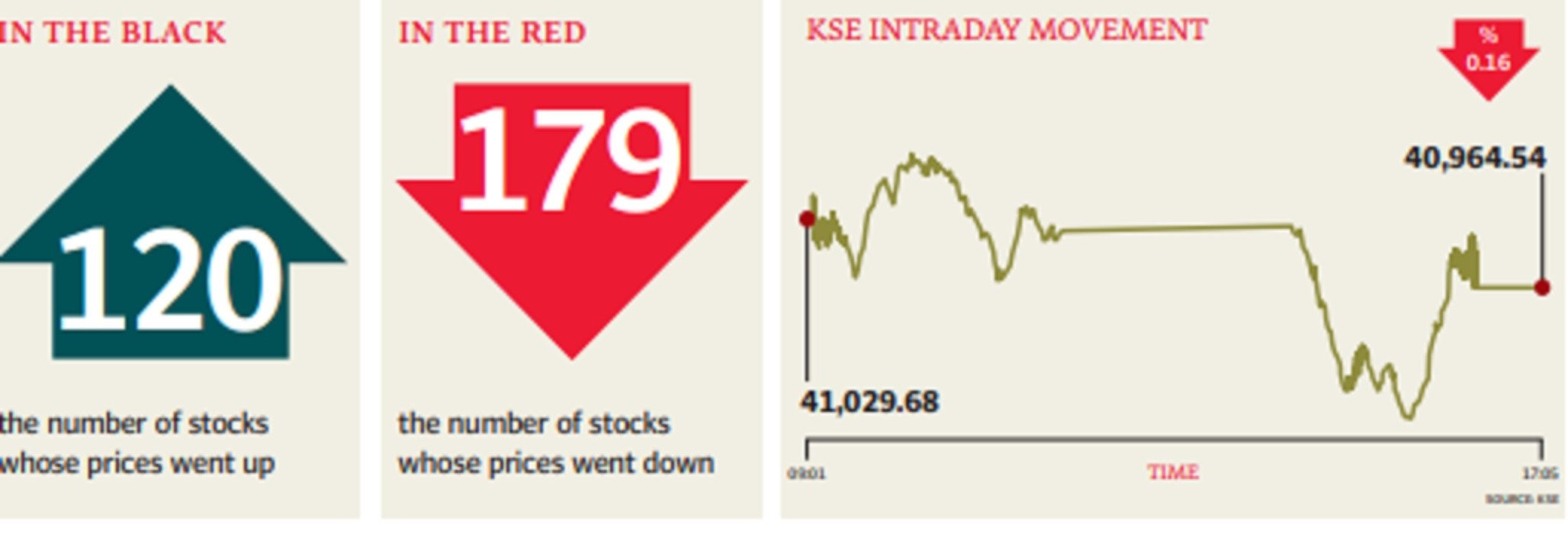

However, it bounced back in the final hour on cherry-picking of stocks that had dropped to attractive valuations. Despite that, the index closed with thin losses, where it could not be able to maintain the 41,000 mark. “Pressure remained at the PSX over falling FX reserves, rupee instability and concerns over end to the IMF programme,” said Arif Habib Commodities CEO Ahsan Mehanti. “Mid-session support remained in the cement sector on likely PSDP allocation of Rs1 trillion in the federal budget.” At close, the benchmark KSE-100 index registered a decrease of 65.14 points, or 0.16%, and settled at 40,964.54 Topline Securities said that a range-bound session was observed where the market touched an intra-day high of 119 points and intra-day low of -65 points.

“A number of companies announced board meetings other than financial results; it is expected they will approve an increase in authorised capital for the purpose of bonus issues on expectation that a tax may be imposed on company reserves in the upcoming budget announcement,” it said. Lucky Cement, Engro Corporation, Maple Leaf Cement, Colgate-Palmolive (Pakistan) and Pakistan Oilfields were among the major contributors as they cumulatively added 163 points to the index. On the flip side, Systems L i m i t e d , P a k i s t a n Petroleum, TRG Pakistan, Oil and Gas Development Company and Pakistan State Oil lost ground, erasing 146 points from the index, Topline added. Arif Habib Limited (AHL), in its report, said that the PSX opened with lacklustre trading as investor participation remained low due to the ongoing political turmoil. However, as the session resumed after break, investor activity rose substantially when bears dominated the KSE-100 index, pulling it down by 245.88 points in intra-day trading, it said.

“During the final trading hour, however, investors chose to add value to their portfolios by cherrypicking stocks.” Volumes climbed considerably due to the end of rollover week with the cement sector in the limelight, AHL added. JS Global analyst Sara Saeed said that the KSE-100 index remained volatile as the roll-over week’s momentum continued. “Investors are recommended to book profits in the cement sector and avail of the ongoing downside as an opportunity to build fresh positions in value stocks,” the analyst said. Overall trading volumes increased to 168.5 million shares compared with Thursday’s tally of 125.3 million.

The value of shares traded during the day was Rs6.8 billion. Shares of 329 companies were traded. At close, 120 stocks closed higher, 179 declined and 30 remained unchanged. WorldCall Telecom was the volume leader with trading in 10.3 million shares, remaining unchanged at Rs1.10. It was followed by Maple Leaf Cement with 9.8 million shares, gaining Rs1.35 to close at Rs27.84 and National Bank with 6.7 million shares, losing Rs0.3 to close at Rs20.31. Foreign investors were net sellers of Rs334.9 million worth of shares, according to the NCCPL.

1725354252-0/Untitled-design-(5)1725354252-0-405x300.webp)

1732099866-0/adele-(3)1732099866-0-165x106.webp)

1732084432-0/Untitled-design-(63)1732084432-0-270x192.webp)

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ