Dar puts on brave face despite lurking default

Pakistan needs significant additional financing for successful completion of the ninth review bailout package: IMF

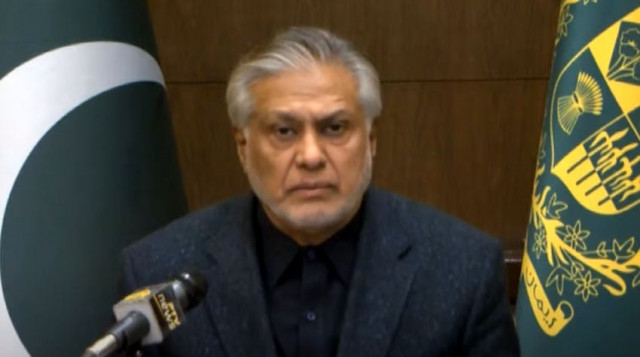

Finance Minister Ishaq Dar on Thursday put on brave face, expressing optimism that Pakistan would not default on its external repayments as the government struggled to resolve an acute balance of payments crisis in the absence of a deal with the International Monetary Fund.

The statement came as the IMF said in a scheduled press conference in New York that Pakistan needs significant additional financing for a successful completion of the long-stalled ninth review bailout package.

A staff-level accord to release a $1.1 billion tranche out of a $6.5 billion IMF package has been delayed since November, with nearly 100 days gone since the last staff level mission to Pakistan. That is the longest such gap since at least 2008.

“Pakistan has fulfilled all the IMF conditions [for the revival of its loan programme]. It took steps to meet those conditions. The government has ensured its external repayments till December,” Dar said while speaking at a session on the country’s economic challenges during an event titled ‘Islamabad Security Dialogue-2023’.

Commenting on a global credit rating agency’s report on Pakistan might defaulting on its external repayments, the minister said if the IMF sought more time to reach a staff-level agreement with the country, it could proceed ahead with it.

He added that Pakistan had arranged funds to pay off its external repayments to the tune of $3.2 billion in May and June on time. Dar maintained that global institutions should not speak about Pakistan defaulting.

He continued that the friendly countries would soon fulfill their pledges to finance Pakistan.

Commenting on the state of financing in Pakistan, Julie Kozack, IMF spokeswoman, said that financing already committed by Pakistan's external partners was welcomed.

The United Arab Emirates, Saudi Arabia and China came to Pakistan's assistance in March and April with pledges that would cover some of the funding deficit.

On Thursday, the State Bank of Pakistan reserves fell $74 million to $4.38 billion, barely a month's worth of imports.

"Our team is very heavily engaged of course with the Pakistani authorities, because Pakistan indeed faces a very challenging situation," said Kozack. She added that the large South Asian economy was facing stagflation and had also been battered by a series of shocks including severe floods.

Pakistan has committed not to implement a cross-subsidy programme, an IMF spokesperson told Bloomberg News. The government also will not introduce new tax exemptions and will "durably allow" a market-based exchange rate for the rupee currency, the IMF told Bloomberg on Thursday.

In March, Prime Minister Shehbaz Sharif proposed charging affluent consumers more for fuel, with the money raised used to subsidize prices for the poor who have been hit hard by inflation.

Also read: AJK PM discusses finances with Dar

The proposed scheme was seen as one of the reasons for the delay in implementing the IMF bailout. The cash-strapped country of 220 million people now faces a fresh set of challenges in the form of political turmoil.

The rupee fell 2.91% against the greenback on Thursday to close at a new low of Rs298.93.

"The debt to risk cost is very high. It's very difficult to see how the country manages to service its debt over the next few years," said Diliana Deltcheva, Head of Emerging Market Debt at Candriam. Risk premiums were more likely to rise than fall, she said.

"We do expect as a team that there are a few countries that may not make it over the near to medium term. Pakistan is on that list next to Egypt and Kenya. We think they might require some sort of debt restructure," said Deltcheva.

Bloomberg stated that there was around $2.6 billion left to disburse from the $6.7 billion programme that was scheduled to expire at the end of June.

In an interview with Bloomberg TV earlier, Minister for Petroleum Musadik Malik said the IMF had hesitations about the fuel subsidy plan, which would have raised prices “for wealthier motorists to finance subsidies for lower-income customers”.

The IMF funds are needed for the government to avoid a default on its external debt. The situation has worsened as the rupee lost a third of its value over the last year, contributing to record inflation while sending interest rates to an all-time high.

Pakistan also needs to confirm other funding that it expects to receive before the programme resumes, which is necessary to help the country increase its foreign exchange which stands “at a critically low level of $4.5 billion and covers just about one month of imports”.

Earlier, Moody’s Investors Service warned that Pakistan could default without an IMF bailout as the country faced uncertain financing options beyond June.

"With protesters on the streets, the IMF will be even more wary about restarting the loan deal," said Gareth Leather, senior economist for Emerging Asia at Capital Economics.

JPMorgan analyst Milo Gunasinghe said little relief from political uncertainty was in sight while the IMF programme remained stalled.

"The latest developments likely dampen any prospect of a political breakthrough across both sides," Milo added.

(With input from agencies)

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ