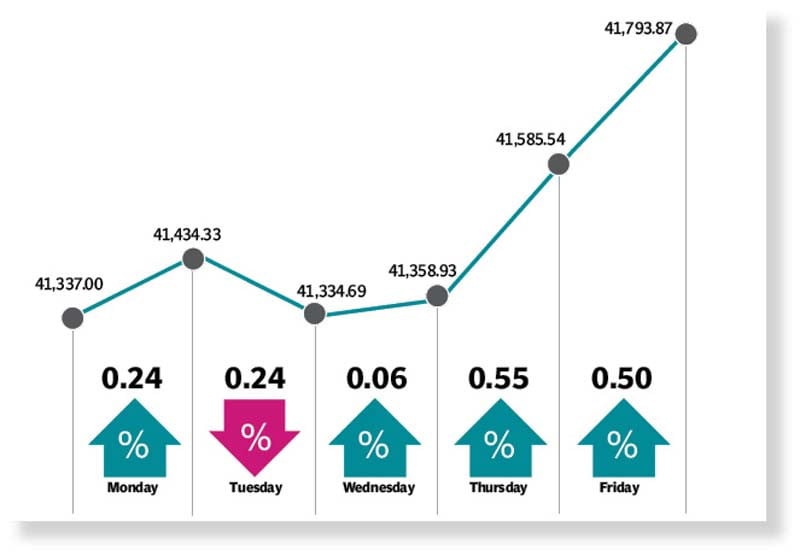

Investors’ reflected confidence as the Pakistan Stock Exchange (PSX) extended gains with bulls taking charge after dominating trading at the bourse during the current week, lifting the KSE-100 index in wake of optimism about the progress in talks with the International Monetary Fund (IMF).

The week commenced on a flat note with slight gains as investors remained optimistic about reaching a Staff Level Agreement (SLA) with IMF following the rollover of a $1.3b loan by the Industrial and Commercial Bank of China (ICBC).

The market was jittery on Tuesday despite the rupee’s recovery as economic and political uncertainty played on investors’ mind and the KSE-100 index shed a few points to end on a flat note.

Investors remained under pressure on Wednesday as the fate of the IMF SLA hung in the air, restricting them from taking any fresh position. Bulls returned to the bourse as buying activity accelerated over the finance minister’s assurances about an agreement with the IMF in the next few days, rising over 200 points.

Bulls dominated the last session cheering the slight rupee appreciation by 0.02% against the US dollar in the interbank market. The KSE-100 index closed the week positive and settled at 41,794, up 457 points, or 1.1%. JS Global analyst Wasil Zaman, in his report, noted that the KSE-100 saw a steady week closing at 41,794 points, up 1.1% week-on-week (WoW) as the government nears SLA with the IMF.

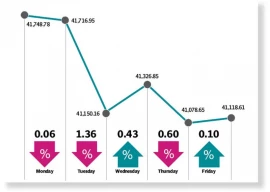

Sector-wise, cements remained key outperformers whereas banks, E&P and food sectors underperformed in the market, he said. Foreigners turned net sellers with the highest share of selling coming from Banks, Zaman added.

On the news front, the SBP reserves continued to rise slowly as combined inflows of $1.2 billion have come from China over the past two weeks. Reserves with the SBP now stand at $4.3 billion, up by $487 million WoW.

Acknowledging the unsustainability of administrative controls on imports, the SBP chief mentioned plans to relax controls once IMF SLA is reached. Additionally, sales tax on luxury goods for multiple categories was increased to 25%.

In the auction for MTBs, the government raised Rs1.6 trillion against a target of Rs1.8 trillion with return on short term papers up to 21% post rate hike.

Data for cement dispatches came in showing stability month-on-month (MoM) in February at four million tonnes, dispatches for 8MFY23 however, remained in the negative territory, down 17% year-on-year (YoY) at 29.8 million tonnes. The textile sector, on the other hand, dipped 9% MoM to $1.2 billion in February, whereas sales for 8MFY23 now stand at $11.2 billion, down 11% YoY, the JS analyst said.

Arif Habib Limited, in its report, said that gross inflows in the Roshan Digital Accounts (RDAs) witnessed growth of 14% MoM (climbing by $125 million) during February. With this, the overall cumulative gross RDA inflows reached $5.8 billion. The rupee, however, depreciated against the US dollar by Rs2.85, or 1% WoW, closing the week at 280.77/$.

Meanwhile, remittances witnessed a decline of 9% YoY to $2 billion in February.

In addition to this, the textile exports in February plummeted by 28% YoY, or 9% MoM, said the AHL report.

Albeit, the market closed at 41,794 points, gaining 457 points (up by 1.1%) WoW. In terms of sectors, positive contribution came from cement (200 points), technology (93 points), power (92 points), banks (89 points), and engineering (37 points).

Negative contribution came from miscellaneous (161 points), insurance (14 points), and chemical (11 points). In terms of individual stocks, positive contributors were Hub Power Company (89 points), Habib Bank (72 points), Lucky Cement (50 points), Systems Limited (48 points) and Pakistan Petroleum (36 points).

Negative contributors were Pakistan Services (164 points), Pakistan Oilfields (29 points), Engro Corporation (25 points), United Bank (14 points), and National Bank of Pakistan (14 points).

Published in The Express Tribune, March 12th, 2023.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

1731637727-0/Bear--(1)1731637727-0-165x106.webp)

1731619853-0/ice-cream-(1)1731619853-0-165x106.webp)

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ