K-P surpasses revenue collection target

Authority registers 31% growth in tax collection

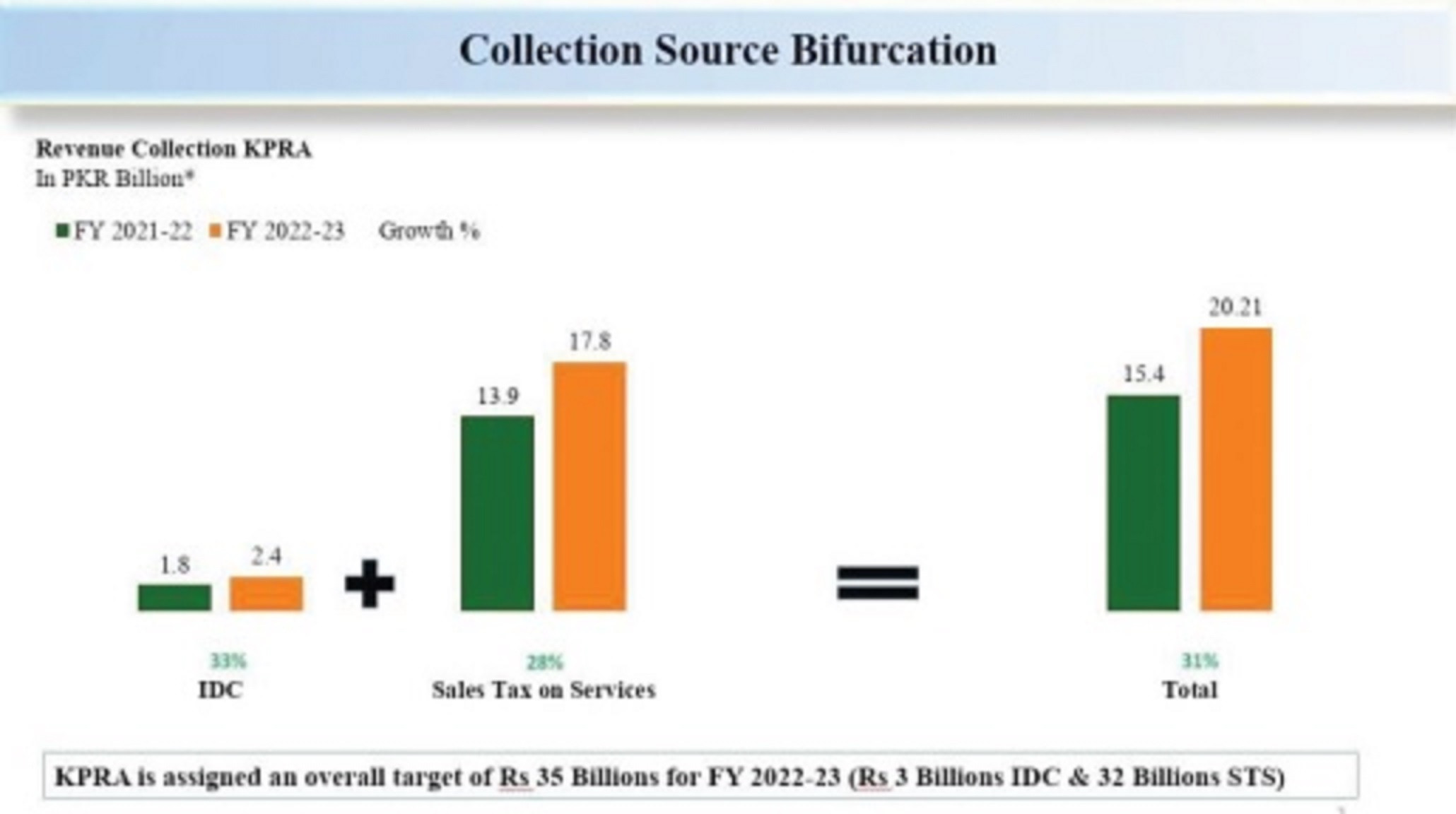

The Khyber Pakhtunkhwa Revenue Authority (KPRA) has reported 31 per cent growth in revenue collection in the first eight months of the financial year 2022-23 compared to the same period last year.

According to details shared by the KPRA media wing, the KPRA has collected Rs20.21 billion in taxes until February in the current financial year. Last year, KPRA collected Rs15.4 billion in the same period which shows 31 per cent growth rate in the current fiscal year. KPRA is responsible for collecting and administering sales tax on services and infrastructure development cess (IDC) in the province.

This year KPRA has managed to collect Rs17.8 billion from sales tax on services and Rs2.4 billion from IDC. At a progress review meeting, the Director General KPRA Raja Fazal Khaliq appreciated the efforts of the KPRA team for their performance and directed them to increase their efforts to not only achieve their targets but to surpass them with good margins.

“The efforts of KPRA teams are indeed commendable and the figures show that we have achieved encouraging growth as compared to the last financial year and with these efforts we will be able to surpass the set targets comfortably,” he said. The director general was given a detailed presentation on the performance of all regions and progress in court cases.

The meeting was informed that the government has assigned KPRA a target of Rs35 billion for the year 2022-23 out of which Rs20.21 billion has been collected in the first eight months and they are optimistic about achieving the target as the collection increases in the second half of the financial year. The figure also does not include the amount of the input tax adjustments which is yet to come from the Federal Board of Revenue (FBR) and the KPRA is expecting to get around Rs3 billion in the input tax adjustment from the FBR in the current fiscal year.

The DG KPRA stressed on operationalizing the e-hearing system in the Collectorate of Appeals and Appellate Tribunal to facilitate the taxpayers. The DG also stressed on increasing interaction with the taxpayers and general public to improve their awareness and directed the headquarters and regional offices to regularly conduct training workshops on monthly basis for taxpayers’ education.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ