Rate hike fears, IMF talks keep bourse in red

Benchmark KSE-100 index drops by 411 points to close at 40,708

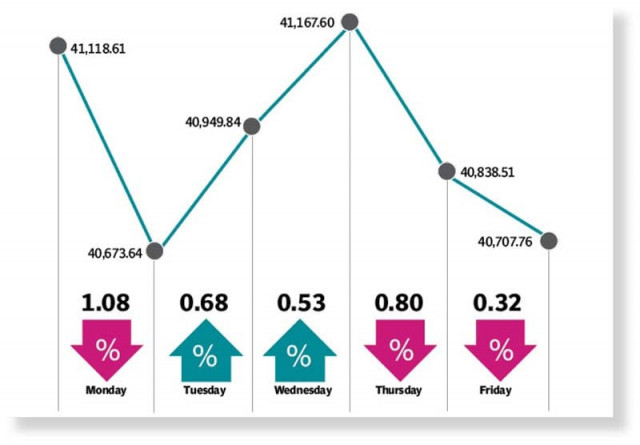

Pakistan Stock Exchange (PSX) ended another week in the red after experiencing roller-coaster trading as policy rate hike fears coupled with concerns over the fate of International Monetary Fund (IMF) loan programme dented investor interest.

The week began on a negative note, fuelled by expectations of increase in central bank’s policy rate. Political uncertainty and delay in a staff-level agreement with the IMF also triggered bearish trading.

However, market sentiment flipped and pushed the KSE-100 index towards north in a bull-run. It came amid investor confidence on expectations of successful talks between Pakistan and the IMF for the release of next loan tranche.

The momentum accelerated on Wednesday after the approval of $700 million for Pakistan by China Development Bank, which helped the index surpass the 41,000-point mark. A host of encouraging corporate results also boosted market sentiment. However, the two-day winning streak came to an end on Thursday following increase in treasury bills’ (T-bills) yields by 200 basis points, which sparked fears of another interest rate hike and dragged the index below 41,000.

Selling pressure prevailed on the last trading session of the rollover week as pessimistic investors pulled the index further down in the absence of clarity about the IMF agreement. The benchmark KSE-100 index dropped by 411 points, or 1% week-on-week, and settled at 40,708.

JS Global analyst Wasil Zaman, in his report, noted that the KSE-100 remained in the negative territory, down 1% week-on-week, over expected monetary tightening coupled with rising political temperature as elections in K-P and Punjab hung in the balance. The government, on the other hand, inched closer to reaching an agreement with the IMF with the approval of mini-budget in the National Assembly, he said.

“Cement sector stood out as a top performer (+3.1% week-on-week) while exploration and production (-5.9%), auto (-4.8%) and banking (-2.5%) sectors were the underperformers.” Pakistani rupee continued its positive trend, further gaining 1.1% week-on-week. Current account deficit for January 2023 shrank by 17% month-on-month to $242 million, driven by lower imports. Forex reserves showed some stability and increased to $3.2 billion.

In the T-bills auction, the government raised Rs258 billion against bids of Rs347 billion with cut-off yield for three-month bills reaching 19.95%, the JS analyst added.

Arif Habib Limited, in its report, said that the market started on a positive note as parliament passed the Finance Bill, aimed at changing certain laws relating to taxes and duties in order to generate an additional Rs170 billion.

Additionally, the current account posted a $3.8 billion deficit for Jul-Jan FY23 compared to $11.5 billion in the same period of last year, depicting a decline of $7.7 billion. However, market condition started to deteriorate towards the end of the week as money market yields rose significantly, indicating an imminent rate hike, it said.

Furthermore, SBP’s reserves showed an increase of $66 million to $3.25 billion and the rupee appreciated by Rs2.81, or 1.07% week-on-week, against the US dollar, closing the week at 259.99/USD.

In terms of sectors, positive contribution to the market came from miscellaneous (100 points), power generation and distribution (89 points) and cement (71 points).

Negative contribution came from oil and gas exploration companies (-269 points), commercial banks (-171 points), oil and gas marketing companies (-71 points), fertiliser (-60 points) and chemical (-35 points).

In terms of individual stocks, positive contributors were Pakistan Services (109 points), Hub Power (90 points), Systems Limited (71 points), United Bank (61 points) and Maple Leaf Cement (34 points).

Negative contributors were Pakistan Petroleum (151 points), Habib Bank (143 points), Oil and Gas Development Company (118 points), TRG Pakistan (40 points) and PSO (38 points).

Foreigners’ buying continued as they bought stocks worth $0.75 million as compared to net buying of $1.6 million last week, the AHL report added.

Published in The Express Tribune, February 26th, 2023.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ