Rupee becomes worst performing currency

Plunges to all-time low near Rs270 against US dollar as gold clinches new high

The Pakistani rupee has emerged as the worst performing currency in Asia, as it hit a new all-time low of Rs270 against the US dollar in the interbank market on the third consecutive working day of freefall on Monday.

In a bid to revive the stalled International Monetary Fund (IMF) loan programme worth $6.5 billion – due to begin early next month if successful – the government surrendered its control over the exchange rate, allowing market forces to determine the value of the rupee.

Resumption of the IMF programme will allow the country to fetch new foreign debt inflows worth around $3-4 billion within a couple of months, improve the foreign exchange reserves and avert the looming risk of default.

The local currency freshly devalued by 2.61% (or Rs7.03) to a new all-time low at Rs269.63 against the US dollar on Monday compared to Friday’s close at Rs262.60. The currency had hit an intraday low of Rs270.10 during the day.

Cumulatively, the rupee slumped by 14.36% (or Rs38.74) in the three days to date, compared to Wednesday’s close at Rs230.89.

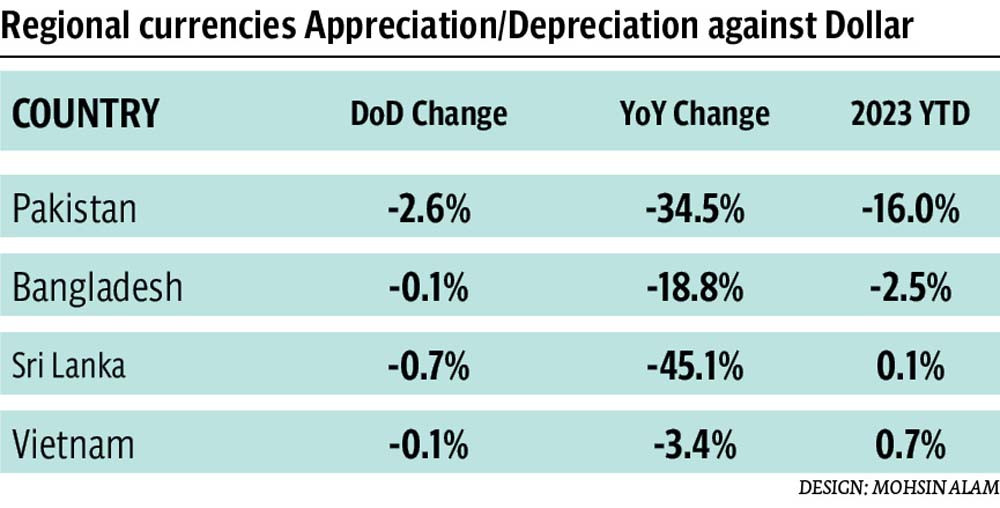

Based on MSCI Asia Emerging and Frontier Markets Index, Topline Securities reported that the Pakistani rupee has emerged as the worst performing currency versus the US dollar in one-day and in the first seven-month (Jul-Jan) of the current fiscal year 2023.

The rupee, however, emerged as the second worst performing currency in a period of one-year after Sri Lanka.

The domestic currency was compared with 11 other Asian currencies on the index including India, Bangladesh, Sri Lanka and Vietnam.

Speaking to the Express Tribune, Topline Securities Director Research Umair Naseer said, “In wake of the latest adjustments in the past three-day (rupee down 14.36%/Rs38.74/$) … the Pakistani rupee has become the worst performing currency on the index.”

The local currency has lost 16% so far in FY23 and 34.5% in one-year (till today) compared to January 30, 2022. Sri Lankan currency dived by 45.1% in one-year period.

With staff level discussions between the two sides set to begin from January 31 to February 29, 2023, Naseer hoped that Pakistan would be able to successfully convince the IMF to revive its programme.

He, however, noted that the government was moving too slow towards implementing its outstanding commitments with the lender. “A further delay in the revival of the programme will lead towards default,” he warned.

If the country is to achieve agreement at the IMF staff level meeting in February, Naseer hoped that the lender’s executive board would then approve and release the loan tranche of around $1.1 billion by March.

So far, however, the government has implemented two commitments including ending its control over the rupee-dollar parity and increasing the price of petroleum products.

Political instability is distracting the government from implementing the loan conditions on priority.

“All the political parties in the country have to agree on a charter of economy that will separate the economy from politics to resolve the current economic crisis. Otherwise, default will come – if not today, then in the months to come,” the analyst cautioned.

KASB Securities Head of Research Yousuf Rahman said the wide gap between demand and supply of the greenback in the system forced importers to pay Rs270 per dollar during the day

While the rupee was expected to “test the level of 270” he warned that, “It might maintain its downward streak. The rupee is, however, expected to stabilise at around Rs265 this week.”

The gap between the demand and supply of the greenback has widened significantly due to the low availability of dollars in the system, explained Rahman.

Gains in gold

Meanwhile, the price of gold price continued to skyrocket against the rupee’s devaluation. The price jumped up by a fresh Rs1,500 per tola (11.66 grams) to Rs210,500 per tola in Pakistan on Monday.

This was the 10th consecutive working day of gains for gold in the country. It has cumulatively surged by 13.60% (or Rs25,200) in 10 days, compared to Rs185,300 on January 19, 2023.

Published in The Express Tribune, January 31st, 2023.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ