Is Pakistan on its way to becoming the next Sri Lanka?

Businesses are bearing the brunt of the foreign exchange shortage

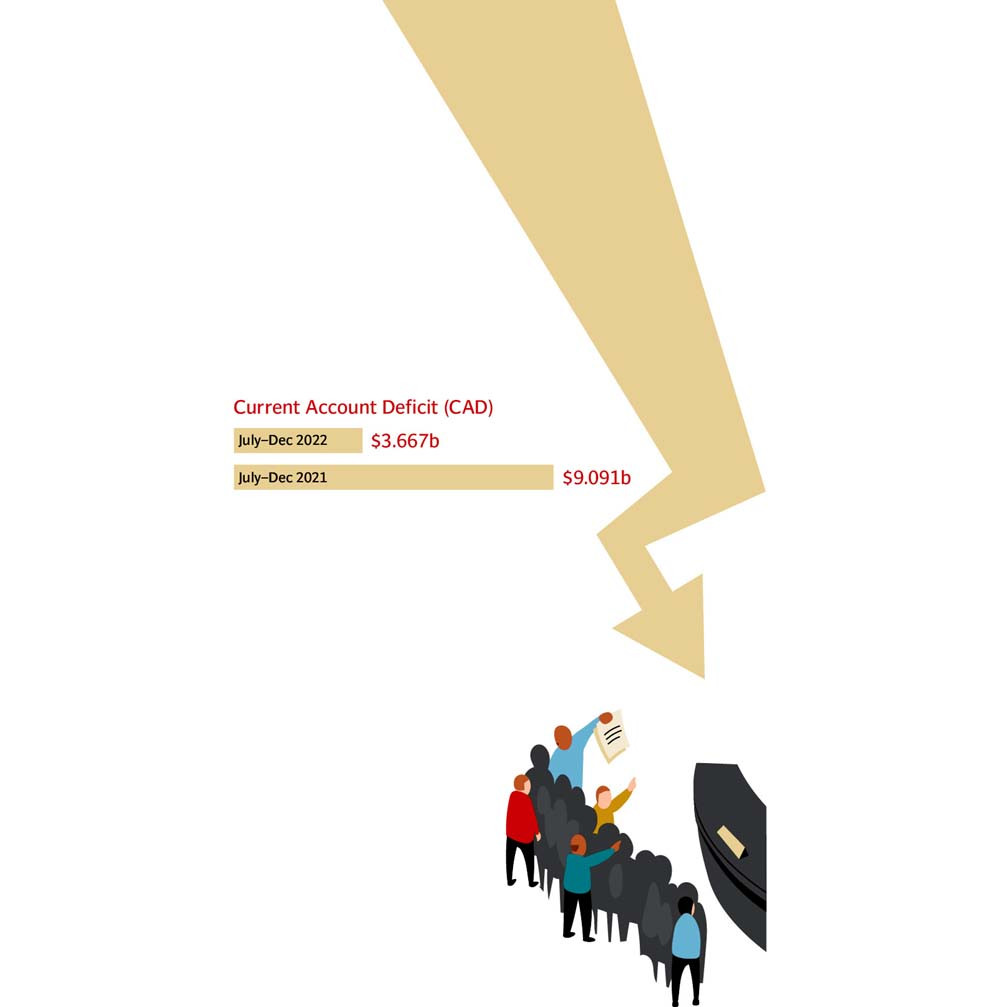

A bank branch located at a busy business centre in Karachi is seen to be extremely crowded; a large number of customers are standing inside and outside – worry and anxiety clearly visible on the faces of the customers as well as the staff.

The customers sitting in front of the branch manager were looking at him with questionable eyes. The branch manager, on the other hand, looked frazzled – trying desperately to contact the bank’s treasury department on his mobile phone.

Of course, these are not uncommon situations, nor is such a large number of customers flocking to perform day-to-day bank-related operations.

In fact, this was an Islamic bank branch located in Karachi’s Timber Market, in which the members of the relevant traders’ association had staged a protest inside the branch due to the non-approval of import documents – with customers protesting inside and outside the bank.

This was the situation on Monday in most bank branches located in every major business area, from Tower to Superhighway. This time, however, the customers seemed to be wondering when they would finally get their foreign exchange payments cleared for their respective import consignments.

The reality is that the crisis of foreign exchange shortage, caused by external debt repayments, is becoming more and more serious by the day – and the business community is bearing the brunt.

In recent meetings with State Bank Governor Jameel Ahmad, the members of the FPCCI and Karachi Chamber openly expressed their anxiety and business difficulties.

The SBP governor and Finance Minister Ishaq Dar, however, failed to provide these business leaders with a road map that ensured the resolution of this economic crisis.

Banking expert Faisal Mamsa was of the opinion that banks were not at fault in this situation, but as things have continued to get worse, the people and businessmen were expressing their frustration.

He said the situation was that like in Sri Lanka, where life came to a standstill when petrol was rationed, load-shedding became a norm and medicine were scarce. The people of Sri Lanka came out on the streets and asked the politicians who was responsible for this situation.

“Of course, the people of Pakistan also have the right to ask the rulers and politicians who is responsible for this situation,” he added.

Mamsa maintained that LC payments cannot be made until dollars were arranged. There were chances of inflows; “Although, we have assurances from the United Arab Emirates (UAE), a formal agreement has yet to be made.”

“Maybe there will be some inflows this week. Financial support from the United States (US) is also expected but the situation will not change until the 9th review of the International Monetary Fund (IMF) is complete and Pakistan receives the funds,” he said, adding that even though there is an emergency in Pakistan, the international organisations will only release funds under their own systems, which might take time.

The expert said that the delay in taking a decision had come from the government. If the decision to accept the IMF terms had been taken two months ago, the situation would have been prevented from becoming so bad.

“In fact, the government delayed the decision due to the political ramifications of the tough economic decisions. Now, the entire country has to bear the crisis,” he added.

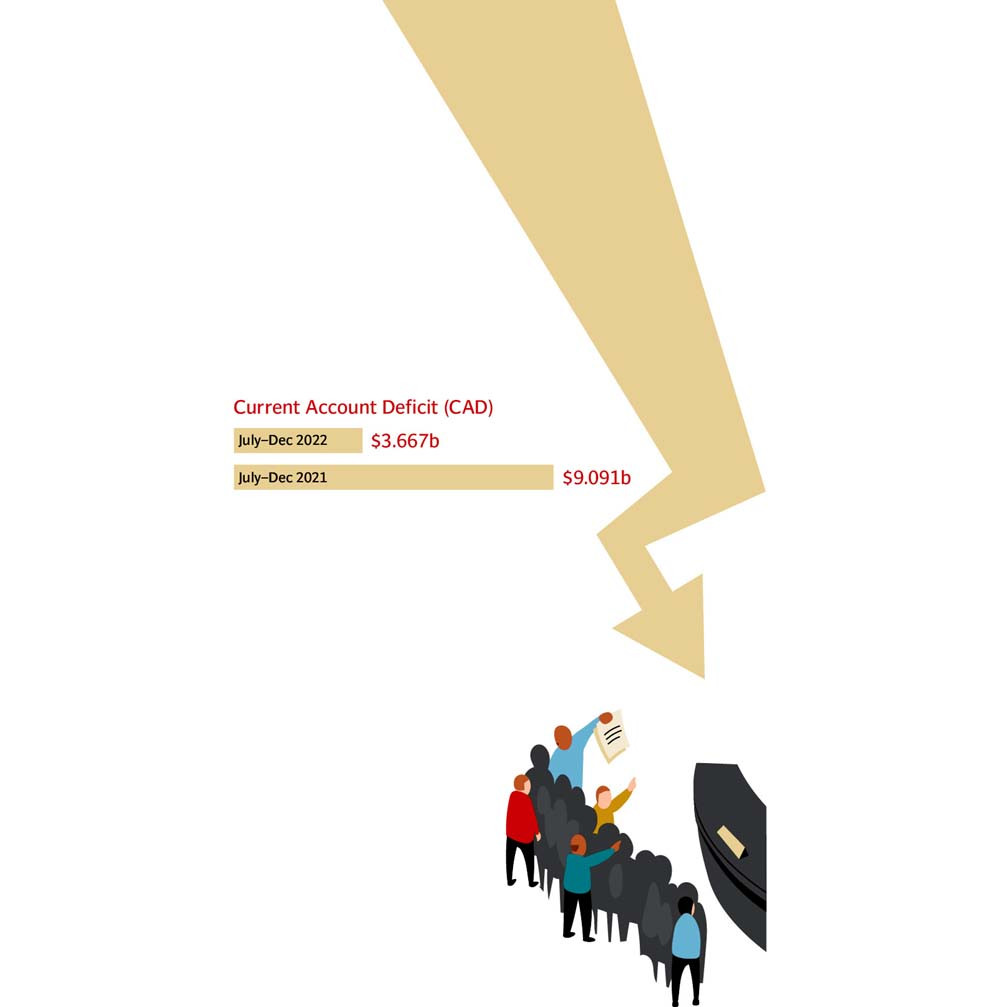

To deal with the shortage of foreign exchange, the government tried to improve the balance of payments by restricting imports. This strategy was quite successful, and the current account deficit during July–December 2022 was limited to $3.667 billion – it had reached $9.091 billion in the same period of the previous financial year.

Although the condition of acquiring prior approval from the SBP for external payments had been relaxed, and the import of basic goods and equipment for key sectors had been included in the priority list, there were still some sectors where the suspension of payments had further increased economic concerns.

According to the importers, there were currently 5,700 containers at the Karachi ports that could not be cleared due to non-clearance of payments – much more than the number of imports that were due to arrive at the port or had been settled.

In this situation, there is an additional risk that the goods being exported from Pakistan may also be halted due to a delay in freight payments to shipping companies.

Pointing out this danger, the Pakistan Shipping Agents Association appealed to the relevant ministries, including the Ministry of Finance and SBP, to pay the requisite freight charges to the foreign shipping companies.

Shipping sector expert Captain Rashid Abro said, “Pakistan’s economic crisis is affecting the shipping sector along with other industries. Due to the war between Russia and Ukraine, shipping companies stopped going to Russian ports, which had already made it difficult for Pakistan to deliver its exports to Europe.”

Abro emphasised that funds should be obtained from international financial institutions and friendly countries as soon as possible to run the stalled wheel of the economy and bring political stability at the internal level.

Sources in the power sector said that despite the removal of the condition of prior LC approval from the SBP for key sectors, foreign exchange is not being allowed for equipment imported for the power sector.

Topline Securities Analyst Mohammad Sohail commented on the situation saying, “Once the IMF review is complete and the friendly country inflows arrive, the situation may improve slightly, especially if the rupee reaches a real level.”

He believed that once the inflows arrive, the restrictions are also expected to gradually decrease.

“If the government fulfils the IMF conditions, the situation will start improving from the end of February. With the government being totally dependent on external resources to deal with the economic situation, one thing was clear: the economic team of the government is failing to restore the confidence of the business community,” said Sohail.

For any nation to come out of difficult situations, it is important that they believe in economic improvement policies to prevent social chaos from spreading, he said.

Published in The Express Tribune, January 26th, 2023.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ