Bears rule as PSX dips below 39,000

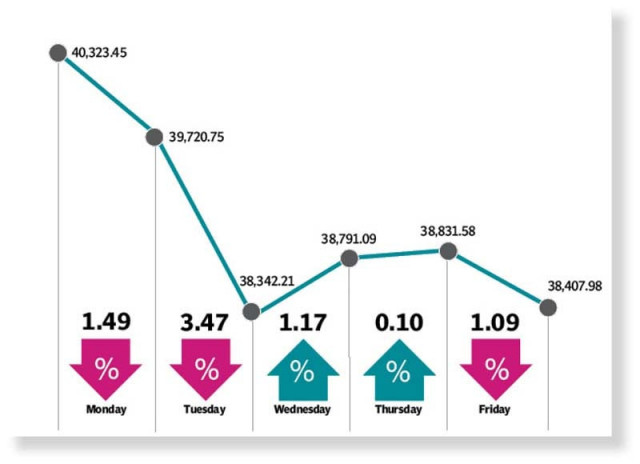

Benchmark KSE-100 index plunges by 1,915 points to settle at 38,408

Bears held their firm grip over Pakistan Stock Exchange (PSX) for most of the outgoing week as investor sentiment remained fragile amid growing concerns over the economic and political situation in the country.

The week kicked off in the backdrop of a high political noise as the KSE-100 index dropped over 600 points in the first trading session, falling below the 40,000-point mark. The negative momentum continued on Tuesday and the market faced a “bloodbath” as the Election Commission de-notified 34 MNAs of Pakistan Tehreek-e-Insaf (PTI) following the acceptance of their resignations by National Assembly Speaker Raja Pervaiz Ashraf.

The rising political temperature ahead of general elections dented investor confidence, pushing the index down by 1,379 points. However, bulls returned to the bourse, snapping a three-day losing streak on Wednesday as they cheered the positive remarks by State Bank of Pakistan (SBP) Governor Jameel Ahmad, who said that Pakistan’s forex reserves would start rising from next week. The index remained in the green on Thursday as well with slight gains owing to the likely announcement of a mini-budget. However, the investors came under pressure ahead of the monetary policy announcement, despite crunch talks on the stalled International Monetary Fund (IMF) loan programme, which pulled the index down by over 400 points on Friday.

The benchmark KSE-100 index closed the week down by 1,915 points, or 4.8%, at 38,408 compared to the previous week.

“The stock market continued to move on its downward track as political and economic uncertainty persisted and closed the week in the negative territory at 38,408, down 4.8% week-on-week (WoW),” said JS Global analyst Muhammad Waqas Ghani.

“Investor participation depicted a noticeable decline of 22% WoW.”

In the first two trading sessions, the index lost a total of 1,980 points. Some recovery was witnessed after news flow that suggested government’s willingness to go for necessary reforms to get the IMF programme back on track, he added.

Increase in revenue collection, rationalisation of gas and electricity tariffs and a flexible exchange rate regime were among the essential policy measures discussed by the cabinet during the week.

On the political front, temperature remained high as the NA speaker accepted the pending resignations of PTI MNAs soon after the party started contemplating its return to the NA. On the other hand, K-P governor signed a summary sent by the chief minister, advising him to dissolve the provincial assembly.

On the economic front, the current account deficit for Dec 2022 came in at $400 million, down 78% YoY due to 34% lower imports as the government and regulator’s administrative controls stayed in place, the JS analyst added.

Arif Habib Limited said that the week kicked off on a negative note due to political chaos in the country, with the Punjab Assembly being dissolved over the weekend and the dissolution of K-P Assembly on the cards.

On the economic front, remittances dropped 19% YoY in December 2022 compared to the same period of previous year. However, one positive development was a slight jump in the SBP’s reserves, which were up $258 million WoW, reaching $4.6 billion. Moreover, Pakistani rupee depreciated by Rs1.52, or 0.66% WoW, against the US dollar, closing the week at 229.67.

In terms of sectors, positive contribution to the stock market came from Real Estate Investment Trust (0.6 point). Negative contribution came from commercial banks (356.5 points), cement (287.7 points), oil and gas exploration companies (224.9 points), fertiliser (166.5 points) and technology (163.9 points).

In terms of individual stocks, positive contribution came from EFU General Insurance (3.2 points), Fauji Fertiliser (1.4 points), Dolmen City REIT (0.6 point) and Colgate-Palmolive (Pakistan) (0.2 point). Negative contributors were Lucky Cement (133.3 points), Engro Corporation (103.9 points), Pakistan State Oil (92.3 points), Mari Petroleum (80 points) and Bank AL Habib (77.9 points).

Foreigners’ buying continued who bought stocks worth $4.9 million compared to net buying of $1.2 million last week.

Published in The Express Tribune, January 22nd, 2023.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ