The highs and lows of trading at PSX in 2022

Benchmark KSE-100 index lost 9.4% in rupee value, compared to pre-opening level at 44,596 points on January 1, 2022

Stock prices jumped up at the Pakistan Stock Exchange (PSX) on Friday, the last working day of 2022, due to optimism over the resumption of the IMF loan programme that remains crucial towards fixing the faltering domestic economy.

Otherwise, however, 2022 was a horrible year for traders who lost almost 10% of their total investment in rupee value and almost 30% in US dollar value during the year.

PSX, however, did not bleed alone. Most of the regional and international stock markets lost their balance amid a likely recession in the US and Europe. The closure of the national bourse on a positive note on the last working day is a silver-lining among the dark clouds of an economy otherwise facing turbulence in its recent past.

Speaking to the Express Tribune, Pak-Kuwait Investment Company Head of Research, Samiullah Tariq said, “PSX carries high potential to offer a return of 18-20% to 47,000- 48,000 points in 2023, subject to the return of stability in the economy in general and particularly in foreign exchange reserves and rupee-dollar parity.” Another seasoned expert anticipated the market rising to somewhere between 49,000-51,000 points next year from the last closing on Friday.

PSX’s benchmark KSE-100 Index rose by 1.69% (or 673.09 points) to 40,420.45 points on Friday. Although the fluctuating market saw this level a couple of times during the year, in actuality the level was last seen in November, 2020.

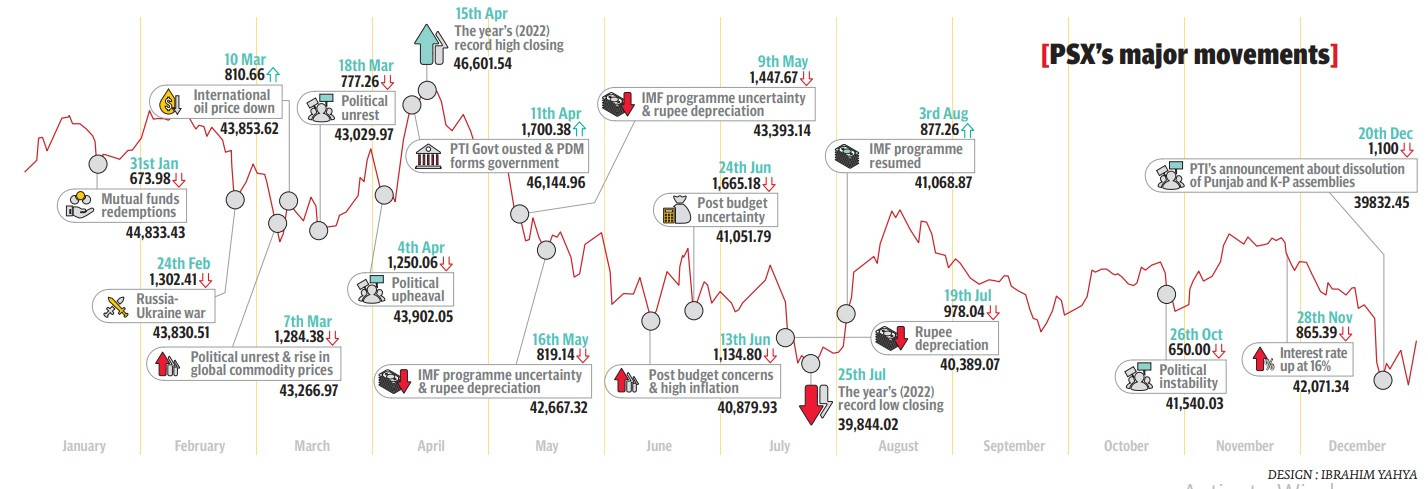

This means that 2022 eroded the gains achieved over the past two years at the market. The benchmark index lost 9.4% in rupee value to date compared to the pre-opening level of the year at 44,596 points on January 1, 2022. The market received a battering in wake of the pandemic aftershocks, Russia-Ukraine war, exorbitant global commodity prices and a 49-year high inflation reading in the country.

In addition, political upheaval, the suspension of the IMF loan programme twice during the year, a freefall in foreign exchange reserves and the rupee-dollar exchange rate, a significant surge in the central bank’s key policy rate, an increase in petroleum product prices, high taxation and post-budget concerns kept pulling the market back through the year.

These developments wiped out 15% of the market capitalisation (total share value) of Rs6.50 trillion in the year. This eroded 34% in US dollar value, due to rupee depreciation, to $29 billion at present, as compared to $43 billion at the start of the year. Foreigners sold stocks worth net $127 million in 2022, as compared to net $433 million in 2021, making it the sixth straight year of foreigners exiting the local bourse.

“Foreigners’ holdings have reduced to a meagre total of $300-400 million at PSX at present,” said seasoned broker, Arif Habib earlier this week. Foreigners’ holdings stood at four to five-times compared to the current one in 2017, it was learnt. Arif Habib Limited (AHL) Head of Research, Tahir Abbas said in a detailed commentary that “While global investors sided with caution, market participants of the domestic bourse also took account of the political impasse in Pakistan, which began well before the ex-premier Imran Khan was removed by a vote of no confidence.”

“Moreover, a spectrum of economic issues triggered by another external account crisis and an ongoing bout of high CPI (inflation), which despite multiple policy rate hikes during the year, overshadowed any positive news,” he explained. “Some temporary spikes were seen particularly when the landmark agreement of Reko Diq was reached and when Pakistan made an exit from the Financial Action Task Force (FATF) Grey List in October, 2022 after a four-year stint,” Abbas noted.

With the stock market undergoing profound uncertainty, investors chose to remain on the sidelines. Accordingly, the average traded volume for the year settled at 229 million shares per day, down by a mammoth 52%, while the average trade value shrunk drastically by 67% to $34 million a day in 2022. The top negative index contributing sectors remained banks, cement, pharma, steel and food producers.

In contrast, key gainers consisted of fertiliser followed by power, technology and communication and chemical companies. A total of three equity IPO (new companies listed at PSX) transactions were witnessed in 2022, compared to eight in 2021. The total transactions include two main board listings, including Pakistan’s First Developmental REITs project namely Globe REIT Residency and Adamjee Life Assurance Company Limited.

Meanwhile, one gem board listing of Supernet was also executed this year. All these companies listed on the PSX managed to raise Rs1.3 billion in 2022, as compared to Rs19.9 billion in 2021. Tariq commented that “The future outlook depends on the resumption of the IMF programme in 2023. The government has shown willingness to implement all the tough commitments made with the global lender to get the next tranche worth $1.2 billion approved sometime in February.” “This could prove to be the dawn of a new journey towards stabilising the economy and giving confidence to investors to stage a comeback to PSX,” he noted.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ