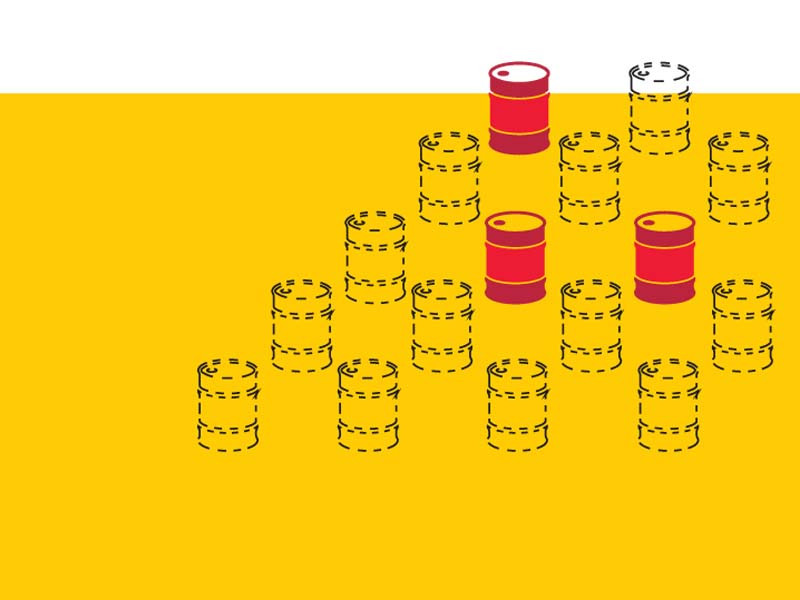

Pakistan’s energy landscape appears bleak in the coming years as the country has consumed 79.8% of the total oil reserves and 66.6% of the gas reserves.

According to a report submitted by the Petroleum Division to the Auditor General of Pakistan (AGP), out of the oil reserves of 1,234 million barrels, Pakistan has consumed 985 million barrels, which constitutes 79.8% of the total. Now, around 249 million barrels of reserves are left.

The Petroleum Division said that Balochistan had recoverable oil reserves of 1.84 million barrels, of which 0.24 million barrels had been utilised, leaving 1.60 million barrels. Khyber-Pakhtunkhwa (K-P) had recoverable reserves of 264.83 million barrels and out of these 170.59 million barrels has been consumed. Now, only 94.24 million barrels are left.

Punjab had original recoverable reserves of 457.43 million barrels, of which 383.20 million barrels have been consumed while 74.23 million barrels are yet to be utilised.

Sindh had estimated recoverable reserves of 509.58 million barrels and out of these the province has consumed 430.60 million barrels while 78.98 million barrels are left.

Pakistan’s oil production stood at 27 million barrels in financial year 2020-21 compared to the target of 30 million barrels, showing 90% achievement of the goal.

In comparison to oil, Pakistan has been a major gas producer to meet the domestic needs. The country had been self-sufficient in the past but due to the launch of gas supply schemes on political considerations, it has become an importer of liquefied natural gas (LNG) since 2015. According to the Petroleum Division’s report, Pakistan has so far consumed 66.6% of the total gas reserves, leaving 33.4% of the reserves untouched.

Exploration and production (E&P) companies have not been able to ramp up gas production since 2000 and have also failed to make major discoveries.

Pakistan had over 63 trillion cubic feet (tcf) of natural gas reserves, out of which around 42 tcf has been consumed. According to the Planning Commission, gas production stood at 1.27 tcf per year against the target of 1.43 tcf.

Province-wise data showed that Balochistan had total recoverable reserves of 20.637 tcf, of which 15.182 tcf had been consumed, leaving a balance of 5.455 tcf (26%).

K-P had total recoverable reserves of 2.932 tcf and out of these 1.746 tcf has been consumed while 1.186 tcf (40%) is left.

Punjab had total recoverable reserves of 3.977 tcf. Out of these, 2.379 tcf has been utilised, leaving a balance of 1.598 tcf (40%).

Sindh has 35.5% of the recoverable reserves left. It had total reserves of 35.765 tcf, of which 23.053 tcf has been consumed while 12.712 tcf is yet to be utilised.

Natural gas forms one of the major components of Pakistan’s energy mix with 33% domestically produced gas, 10% LNG and 1% liquefied petroleum gas (LPG).

An annual increase of 5% in natural gas demand has been eating into the limited domestic reserves for the past many years.

AGP remarked that based on the Petroleum Division’s report a rapid depletion of the existing reserves with no substantial new discoveries since 2001 was one of the main reasons for the widening gap in demand and supply of natural gas in the country.

Domestic production is calculated at 1.263 tcf per annum against demand for about 1.770 tcf, which shows a deficit of 0.507 tcf.

To make up for the shortfall, 0.382 tcf (8.1 million tons) of LNG is imported. Over time, the share of LNG in natural gas supply has risen to 29%.

At present, a net shortfall of 0.125 tcf is dealt with through the curtailment of gas supply, or load management, to different sectors of the economy.

AGP also pointed out several issues in the Ministry of Energy. It said that the E&P sector was regulated by more than one regulator. Director General Petroleum Concessions deals with the E&P sector by formulating and implementing the petroleum policies, E&P rules and petroleum concession agreements (PCAs).

Absence of an independent upstream regulator has resulted in inordinate delay in the extension of leases, award/ cancellation of E&P blocks and allocation of oil and gas to buyers.

Similarly, ineffective monitoring of production and sale, partial/ non-implementation of petroleum policies, PCAs, rules/ guidelines and field development plans of E&P companies can be cited as reasons for the non-allocation of crude oil and gas to refineries and Sui companies respectively and non-finalisation of gas sale and purchase agreements.

The E&P sector is confronted with multiple challenges which include slow exploration and production of hydrocarbons. Adverse security conditions in the exploration areas cause extra cost, damage to assets and disruption to E&P activities. Variable E&P costs of low and depleting reserves could not be rationalised over the years.

Unconventional sources of energy such as shale gas/ oil and tight gas/ oil have not been tapped due to extraordinarily high costs and unavailability of service providers/ technologies.

Multiple projects of E&P companies were either delayed or could not achieve the set production targets. In some cases, production was stopped due to the unsynchronised installation of storage facilities. Furthermore, unnecessary/ unjustified procurements caused blockade of funds, which ultimately led to wasteful expenses.

Published in The Express Tribune, December 13th, 2022.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

1732266251-0/Josh-Brolin-(1)1732266251-0-165x106.webp)

1732266343-0/BeFunky-collage-(82)1732266343-0-165x106.webp)

COMMENTS (4)

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ