The Pakistan Stock Exchange (PSX) witnessed lacklustre trading throughout the outgoing week and remained under pressure owing to an uncertain economic and political scenario coupled with the lack of positive triggers with many investors remaining on the sidelines.

The week started off on a bearish note as jittery investors opted to stay away from market proceedings as a delay in the ninth review of International Monetary Fund’s (IMF) loan programme dented investor interest.

A range-bound session was witnessed on Tuesday over the prevailing pessimism in the wake of uncertainty about talks with the IMF and macroeconomic concerns.

However, the market sentiment flipped following Finance Minister Ishaq Dar’s remarks that dismissed rumours about the IMF programme review.

Dar said his team was in talks with the global lender, which rejuvenated investor confidence and helped the benchmark KSE-100 index to notch up gains.

However, the positive trend could not be sustained and another lacklustre session was witnessed on Thursday owing to a poor macroeconomic outlook and the uncertain political situation.

The index further shed some points on the last trading day of the week as market players refrained from taking fresh positions in the absence of positive triggers.

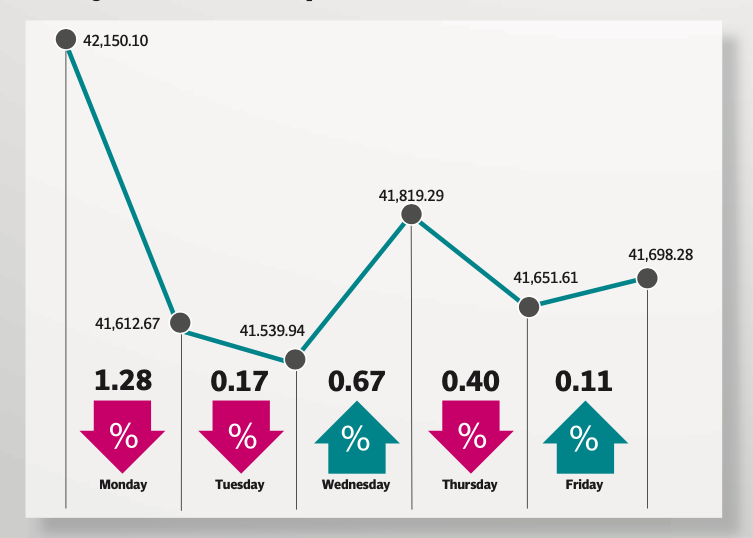

The KSE-100 index closed the week down by 452 points, or 1.1%, at 41,698 compared to the previous week.

“KSE-100 opened the week on a pessimistic note owing to political uncertainty and delay in talks with the IMF,” said JS Global analyst Muhammad Waqas Ghani.

The market witnessed a partial recovery during the middle of the week and closed at 41,698 points, limiting losses to 1.1% week-on-week.

On the domestic front, political noise remained high following PTI chairman’s announcement that they would dissolve the provincial assemblies in Punjab and Khyber-Pakhtunkhwa.

On the economic front, however, the finance ministry reiterated that the IMF programme was on track and negotiations for the ninth review were at an advanced stage.

Despite the receipt of $500 million from the AIIB, the forex reserves held by the State Bank dipped to a four-year low at $6.7 billion due to debt repayment during the week ended December 2, 2022.

Now, the country has planned to seek a $4.2 billion additional package from Saudi Arabia, which will comprise deposits of $3 billion and an oil-on-deferred-payment facility of $1.2 billion to create breathing space.

Foreign currency inflows through the Roshan Digital Account (RDA) in November 2022 came in at $141 million, a 24-month low, the JS analyst added.

Arif Habib Limited, in its report, said that in the outgoing week, market players remained jittery, even though Pakistan repaid a $1 billion international bond on time and Saudi Arabia extended its $3 billion deposit with the SBP.

“The market remained under pressure mainly due to uncertainty over the IMF programme and political noise,” it said.

However, it turned positive midweek as Russia agreed to sell oil to Pakistan at a discounted price, but the momentum could not be sustained.

In terms of sectors, positive contribution to the market came from miscellaneous (131 points) and automobile parts and accessories (3 points).

Negative contribution came from cement (109 points), power generation and distribution (61 points), pharmaceuticals (60 points), technology and communication (57 points) and automobile assemblers (45 points).

Foreigners’ selling continued during the week, which came in at $6.3 million compared to net selling of $6.6 million last week, the AHL report added.

1730464111-0/raygun-(1)1730464111-0-165x106.webp)

1730967569-0/BeFunky-collage-(28)1730967569-0-165x106.webp)

1730967164-0/trump-(21)1730967164-0-165x106.webp)

1730963708-0/Express-Tribune-Web-(27)1730963708-0-270x192.webp)

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ