Stocks climb as political clarity emerges

Benchmark KSE-100 index gains 508 points to settle at 41,129

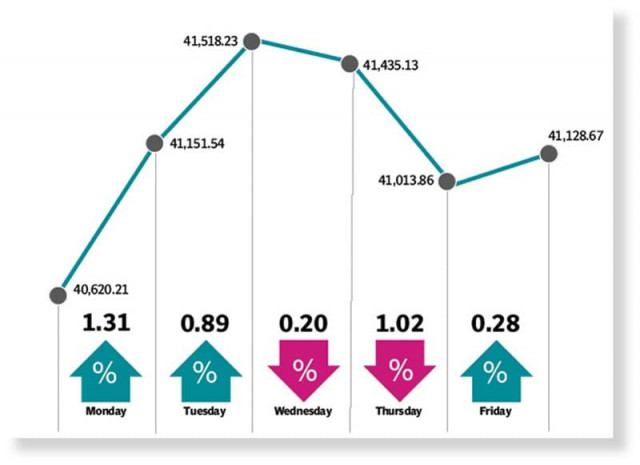

The Pakistan Stock Exchange (PSX) advanced modestly during the outgoing week, driven mainly by a decline in the weekly inflation indicator, change at the helm in the finance ministry and rupee’s continued strengthening against the US dollar.

At the beginning of the week on Monday, the market cherished the positive cues as bulls returned, lifting the benchmark KSE-100 index and snapping the losing streak.

The index recorded sharp gains due to investor optimism about the long-awaited rupee recovery against the US dollar. Market players also expressed satisfaction over the easing inflation and clarity on the political front, helping maintain the positive momentum for two consecutive days.

The return of former finance minister Ishaq Dar, who later took over as the new finance minister, provided further clarity to the bullish spell at the bourse.

However, things took a turn for the worse on Wednesday as the market came under selling pressure due to the rising political noise. Positive sentiment flipped as soon as the audio of informal conversation at the Prime Minister House was leaked.

The market turned bullish on Friday after remaining in the red zone on Thursday owing to political uncertainty and gloomy forecast about the impact of flash floods on the economy. A terror financing case against Habib Bank in the US hammered the banking-sector stocks but the KSE-100 index managed to close the rollover week in the green in anticipation of a positive announcement about petroleum product prices. The week closed at 41,129, up 508 points from the previous week.

“After a positive start to the week, KSE-100 witnessed partial correction towards the end, closing up 508 points (+1.3% week-on-week),” said JS Global analyst Wasil Zaman. Among key performers were refineries (+5.9%) and power companies (+4.4%), while the banking sector (1.3%) stood out as a key under-performer, largely driven by the decline in HBL’s stock price, he said.

HBL’s negative performance was triggered by the news of terror financing allegations against the bank. On the news front, Ishaq Dar took over as the finance minister, followed by positive movement of Pakistani rupee against the US dollar that appreciated 4.7% week-on-week.

On the other hand, State Bank’s forex reserves dropped $341 million week-on-week to $8 billion, which translated into an import cover of less than six weeks, Zaman said. During the week, the ADB announced a flood relief loan of $1.5 billion, which was under process and expected to be received by next month.

On the international front, PM Shehbaz Sharif has planned to visit China where $10 billion will be sought as balance of payments support, the analyst pointed out.

Arif Habib Limited, in its report, said that the week commenced on a positive note as the market went up 531 points on Monday, following the release of Sensitive Price Indicator (SPI) number, which was 8.8% down week-on-week.

Moreover, the market reacted positively to the news of change in the finance ministry. Furthermore, Pakistani rupee appreciated against the greenback, closing at 228.45 (up Rs11, or 4.9%, week-on-week).

On the flip side, the market sentiment became negative towards the end of the week as SBP’s reserves declined 4% week-on-week and reached $8 billion.

In addition to that, the yields on Pakistan’s international bonds maturing in 2022 and 2024 increased by 20-24 percentage points week-on-week, the report said.

Moreover, with HBL coming under international scrutiny, the market sentiment was further dented. Despite that, the index closed at 41,129, gaining 508 points (up 1.25%), it said. In terms of sectors, positive contribution came from power generation and distribution (141 points), cement (107 points), technology and communication (92 points), oil and gas exploration (65 points) and fertiliser (40 points).

Negative contribution came from commercial banks (217 points) and closed-end mutual funds (1 point). Meanwhile, stock-wise positive contributors were Hub Power (139 points), TRG Pakistan (122 points), Pakistan Petroleum (55 points), Lucky Cement (49 points) and Oil and Gas Development Company (40 points).

Negative contribution came from Habib Bank (213 points), Meezan Bank (34 points), Mari Petroleum (32 points), Systems Limited (28 points) and Bank AL Habib (12 points). Foreigners continued to buy stocks during the week, making $0.15 million of purchases compared to net buying of $5.09 million last week.

Average daily volumes came in at 200 million shares (up 20% week-on-week) while average traded value settled at $36 million (up 39% week-on-week).

Published in The Express Tribune, October 2nd, 2022.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ