On aggregate basis, banks lent money to customers at 13.40 per cent in May this year compared to 14.09 per cent in the corresponding month last year. In comparison, depositors of banks got return of 6.05 per cent on their savings against 6.62 per cent in May last year.

In April this year, the banking spread was 7.39 per cent as banks advanced money at 13.42 per cent and offered profit on deposits at 6.03 per cent.

Foreign banks charged the highest interest rate of 14.36 per cent in May compared to 15.33 per cent in May 2009. However, they gave the best return on deposits of 6.63 per cent compared to government, private and specialised banks. In May last year, foreign banks offered return of 7.18 per cent.

The lowest interest rate was charged by specialised banks in the month under review. They extended loans at 9.13 per cent compared to 9.11 per cent in May 2009. But these banks gave the lowest return on deposits at 4.66 per cent compared to 6.15 per cent last year.

Specialised banks are those which provide loans, assistance and advice to clients in a specified area like agriculture, industry etcetera.

In the five months (January-May) of 2010, the banking spread has actually risen from 7.25 per cent in January to 7.35 per cent in May. In January, the lending rate was 13.35 per cent while the deposit rate was 6.10 per cent. In May, the lending rate stood at 13.40 per cent and deposit rate at 6.05 per cent.

The low deposit rates offered by banks are a source of discouragement for savers, who then search for other profitable avenues to invest their money in. These areas are gold, stock market, government savings certificates and foreign currencies.

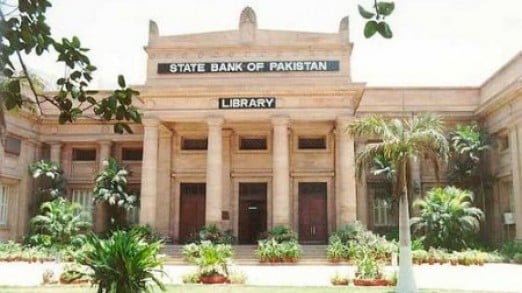

Former State Bank governor Shamshad Akhtar during her tenure before 2009 had time and again stressed the need of increasing the deposit rates in order to lure investors towards savings. Pakistan has a low percentage of savings.

Besides, a substantial cut in the lending rate encourages the private sector to borrow for expanding its operations, which eventually props up the country’s economy.

However, the State Bank has kept its policy rate, which serves as a benchmark for bank lending, unchanged at a high level of 12.5 per cent in a bid to curb inflationary pressures.

Published in The Express Tribune, June 26th, 2010.

1719319701-0/BeFunky-collage-(10)1719319701-0-165x106.webp)

1730379446-0/WhatsApp-Image-2024-10-31-at-17-56-13-(1)1730379446-0-270x192.webp)

1735025557-0/Untitled-(96)1735025557-0-270x192.webp)

COMMENTS (1)

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ