Bears pull stocks below 43,000 mark

Benchmark KSE-100 index drops 679 points to settle at 42,592

Bears took control of the Pakistan Stock Exchange and dominated trading during the outgoing roll-over week as jittery investors tried to look for positive cues amid growing concerns over the economic and political situation in the country.

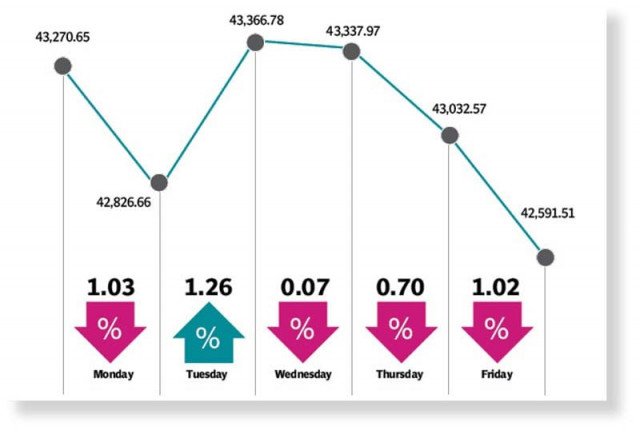

As a result, the benchmark KSE-100 index dropped 679 points, or 1.57%, during the week amid persistent profit-taking and settled at 42,592.

The week kicked off in the backdrop of high political noise as news of possible arrest of PTI chief Imran Khan and multiple cases filed against him including the foreign funding case largely impacted investor sentiment at the bourse.

Moreover, the trading session remained sluggish ahead of the monetary policy announcement, pulling the index below the 43,000-point mark.

However, the investors took fresh positions on Tuesday and lifted the KSE-100 index as in line with market expectation the central bank left its policy rate unchanged. The announcement failed to further excite the investors and the trend reversed on Wednesday with the index closing negative.

Unfortunately, the momentum could not be sustained with the rising political noise coupled with fears of inflation that made the investors more cautious.

The market faltered despite the State Bank reported that the current account deficit had shrunk to $1.2 billion in July as compared to June.

The negative trend continued in the following sessions with investors resorting to profit-taking. The rupee continued to depreciate against the dollar throughout the week, losing 3% of value week-on-week.

Friday marked the third successive trading session that saw the KSE-100 close negative as investor interest remained weak. News flow regarding damage caused by flash floods further dented market confidence. “Increased political noise and devaluation of the rupee against the US dollar (-3% week-on-week) led to profit-taking this week,” said JS Global analyst Faisal Irfan.

The KSE-100 index closed on a negative note at 42,591, losing 679 points week-on-week. Volumes declined 52% with average 250 million shares traded per day during the week. Key underperformers were OMCs (-4%), refineries (-3%) and engineering firms (-3%) while cement makers (0.4%), and fertiliser manufacturers (0.2%) outperformed the benchmark index.

During the week, Brent crude oil prices recovered 5.1% to $100.55 per barrel as fears of a global slowdown subsided.

On the news front, Qatar announced an investment of $3 billion in different sectors of Pakistan whereas Saudi Arabia announced an investment of $1 billion.

Since the start of monsoon in June, roads, bridges and close to half a million homes had been damaged along with a large quantity of the cotton produce, the report added. Arif Habib Limited, in its report, said that the market commenced on a negative note on the back of concerns over new tax measures taken by the government to increase revenue collection.

However, the investor sentiment revived after the SBP kept the policy rate unchanged. Moreover, the momentum further strengthened after Qatar announced plans to invest $3 billion in various commercial and investment sectors, while Saudi Arabia pledged to invest $1 billion, it said.

However, the market turned negative again after the rupee depreciated, closing the week at Rs220.66 (down Rs6 or 2.8% week-on-week). SBP’s reserves fell by $87 million to settle at $7.8 billion.

With the anticipation of re-imposition of sales tax on petroleum products, the nervousness with regard to inflation resurfaced. Hence, the market closed at 42,592 points, shedding 679 points (1.57%) week-on-week. In terms of sectors, positive contribution came from fertiliser (70 points) and cement (28 points). Sectors that contributed negatively included banks (143 points), miscellaneous (138 points), power (101 points), OMCs (80 points) and chemical (59 points).

Meanwhile, stock-wise positive contributors were Lucky Cement (75 points), Systems Limited (35 points), Tariq Glass (26 points), Fauji Fertiliser Company (25 points) and Pakistan Oilfields (19 points).

Foreign selling continued during the week, clocking in at $1.9 million compared to net selling of $2.8 million last week.

Published in The Express Tribune, August 28th, 2022.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ