Tensions with US spur Chinese buying of chipmaking stocks

Chinese chipmakers' shares jumped by the most in two years this week

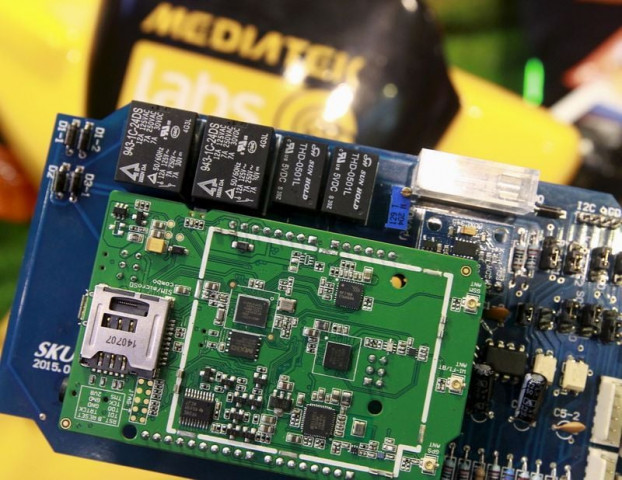

Chinese chipmakers' shares jumped by the most in two years this week as House of Representatives Speaker Nancy Pelosi's visit to Taiwan heightened tensions with the U.S., driving patriotic bets on a sector Beijing sees as key to its rivalry with Washington.

The surge in interest in chipmaking stocks, which had lost more than a third of their value over the past year on valuation concerns, came after the U.S. Senate last week passed the "Chips and Science" Act to better compete with China.

China's semiconductor index rose 6.8% on Friday to a four-month high, bringing the week's gains to 14.2%, the best weekly performance since mid-2020.

Although the U.S. Chip Act would further restrict the use of advanced U.S. technologies in China, while prodding more semiconductor investment in the U.S, some investors interpret it as good news for local Chinese players.

"Domestic chipmakers will have huge opportunities to replace imported products," said Niu Chunbao, director of investment at private fund house Wanji Asset, adding local players could see explosive growth.

This view was echoed by Guorong Securities, which said in a note that the U.S. Chip Act will "stimulate the development of China's semiconductor industry".

Shares in Shenzhen China Micro Semicon Co Ltd soared 82% on their first day of trading in Shanghai, in contrast with weaker recent stock market debuts.

Chinese chipmaking giant Semiconductor Manufacturing International Corp (SMIC) jumped 7.1% in Hong Kong and 4.4% in Shanghai . The SSE STAR Chip Index surged 8.3%.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ