Remittances hit all-time high

Amount to $2.8 billion in March as inflows surge ahead of Eid

The inflow of workers’ remittances soared beyond market expectations and hit an all-time high at $2.8 billion in March, extending much-needed support to foreign exchange reserves and the rupee value against the US dollar.

“These are the highest-ever monthly workers’ remittances,” Pakistan’s central bank announced on Thursday.

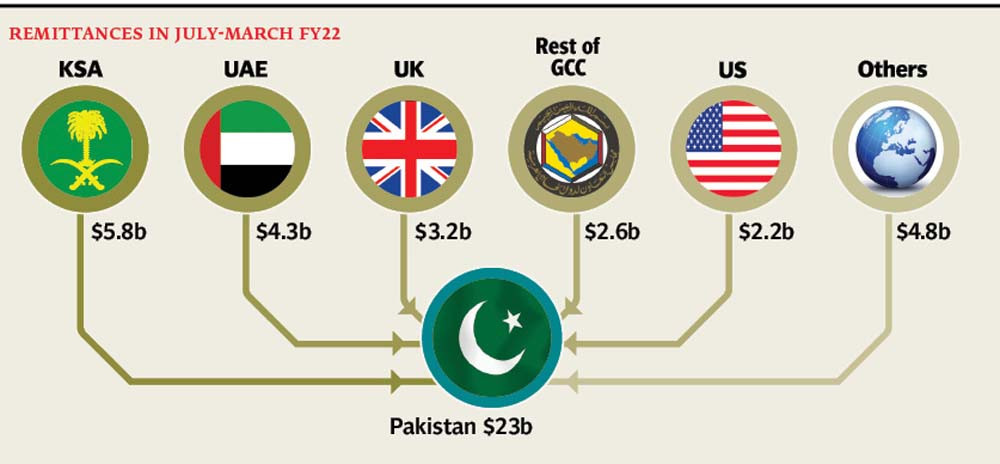

Cumulatively, the remittances rose to $23 billion in the first nine months (July-March) of current fiscal year 2021-22, up 7.1% over the same period of previous year, it added.

Historical trends suggest that overseas Pakistani always send record high remittances during the month of Ramazan and before Eid holidays every year, according to experts.

“The flow of remittances amounting to $2.8 billion into the country in March was higher than market expectations,” Pak-Kuwait Investment Company Head of Research Samiullah Tariq said while talking to The Express Tribune.

Earlier, the market was expecting the remittances to remain in the range of $2.5-2.6 billion in March considering that international travel was gaining momentum following the disruption caused by the Covid-19 pandemic. Many people prefer to carry funds while visiting their home country instead of sending them through banking channels.

With the latest inflow of $2.8 billion, the workers’ remittances have continued the unprecedented trend of staying above $2 billion over the last 22 months (since June 2020), the State Bank of Pakistan (SBP) said.

In terms of growth, the remittances increased 28.3% in March 2022 compared to the previous month of February and were up 3.2% compared to March 2021.

Remittances during the month under review were mainly sourced from Saudi Arabia ($678 million), the United Arab Emirates ($515 million), the United Kingdom ($401 million) and the United States ($300 million), the central bank said.

The breakdown of data, however, suggested that the remittances slowed down from Saudi Arabia and the United Arab Emirates (UAE) where a majority of the non-resident Pakistanis (NRPs) is living. Nearly, 9 million expatriates reside in the two nations.

On the contrary, the inflows increased notably from United States (US), United Kingdom (UK), European Union and other countries in the month of March compared to the same month of the previous year.

Country-wise breakup

Remittances from Saudi Arabia decreased 2% to $678 million in March 2022 compared to $694 million in the same month of the last year. The inflows from UAE dropped 13% to $515 million during the month compared to $591 million in the corresponding month.

Read February remittances reach $2.2b

On the other hand, they surged 19% from EU to $280 million compared to $236 million. Inflows rose 15% from US and amounted to $300 million in March 2022 compared to $262 million in same month of 2021.

From UK, the country received $401 million last month which was 7% higher than $376 million in March 2021.

The flow of remittances from the remaining countries rose 13% to $636 million in March 2022 compared to $564 million in March 2021.

The remittances from Gulf countries slowed down apparently due to loss of jobs in that region during the initial outbreak of Covid-19.

“The drop in international crude oil prices to a record low level, which turned negative at one point during peak Covid times, badly hit the economies of oil producing and exporting countries like Saudi Arabia and UAE,” Tariq recalled. “This motivated the respective economies to cut jobs.”

On the flip side, Western countries opted to pay unemployment benefits during the pandemic and managed to retain majority workforce, he said.

Secondly, a notable portion of non-resident Pakistanis (NRPs) travelling to their home country carried funds along with them instead sending them through banking channels.

More importantly, the “global illegal hundi-hawala (reference) operators” may have reassembled with restoration of international travelling as well and they offer a better currency exchange price to remittance receivers than banks.

Tariq noted the growth in inflow of remittance has slowed down to single digit at 7% cumulatively in the first nine months of the current fiscal year 2021-22 compared to 26% in the full previous fiscal year 2020-21.

Also read Remittances hit record high at $18b

“The trend of inflows suggests Pakistan that has achieved growth. The resumption of international travelling remains a big reason behind slowdown in the inflows in recent months,” he said.

“The remittances are estimated to be recorded in between $30-31 billion in the current full fiscal year 22.”

Published in The Express Tribune, April 15th, 2022.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ