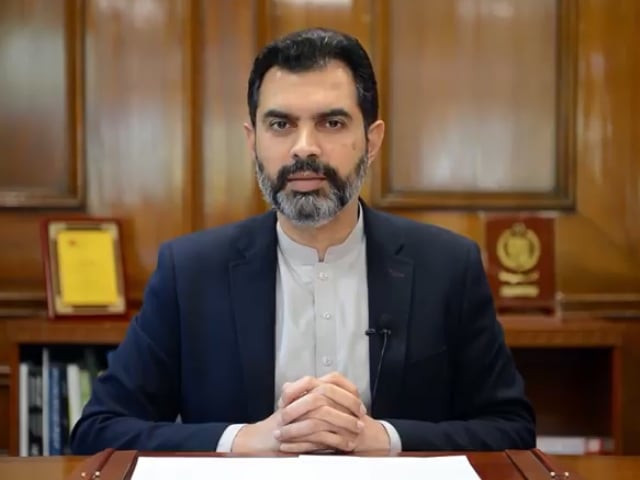

Baqir stresses expanding scope of housing finance

Laments lack of focus on mortgage financing by banks in past

The State Bank of Pakistan’s (SBP) Mera Pakistan Mera Ghar (MPMG) scheme aims to provide affordable housing solutions to lower and middle income groups of the country, said State Bank of Pakistan Governor Dr Reza Baqir.

Speaking during an awareness session held in Faisalabad to enhance the outreach of the scheme on Saturday, he acknowledged the efforts of commercial banks in turning Mera Pakistan Mera Ghar project into a success story.

Citing figures, he added that commercial banks had approved Rs157 billion under the MPMG so far and disbursed Rs56 billion to the applicants.

“In the past, mortgage financing was largely ignored by the banks,” he lamented.

Sharing his views on the encouraging response MPMG, he stated that the progress made so far was commendable. He further hoped that every Pakistani family would be given an opportunity to own a house through the scheme.

“If the banks continue functioning with the same zeal, they can achieve this formidable task,” he said.

Promising full support of the banks and SBP for promotion of MPMG, Baqir urged the business community of Faisalabad, including the members of chamber of commerce and business groups, to encourage those employees to avail financing under this scheme who do not own a house.

Baqir further advised the banks to arrange focused awareness drives at the premises of major firms in Faisalabad and other cities and offer the MPMG financing facility to their employees.

He also advised banks to reduce the application processing time and mobilise higher amount of resources for promotion of housing solutions especially to the lower segment of the economy.

It is pertinent to mention that banks have taken several initiatives to promote MPMG program including allocation of 50% of their branches to facilitate financing under the scheme and preparation of income assessment model to support applicants with informal incomes.

They also established a joint call center to address queries and concerns of potential customers.

The banks also introduced e-tracking systems for applicants to track the progress of their requests and simplified loan application forms as well as relevant documentary requirements. They have also conducted extensive social, print and electronic media campaigns to promote awareness about the scheme.

In 2020, SBP took several measures to support the provision of financing for housing and construction sector.

Published in The Express Tribune, March 20th, 2022.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ