Stocks dive on political turmoil

No-confidence motion, jump in global energy prices drive bearish trading

The Pakistan Stock Exchange endured a roller coaster trading week marked by bearish activity owing to political instability in the country coupled with spike in global commodity prices.

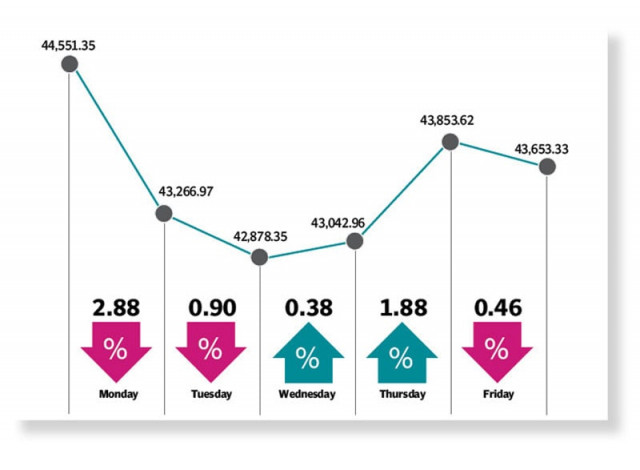

Owing to the volatility on the global and domestic front, the KSE-100 index slid 898 points or 2.02% in the outgoing week to end at 43,653 point level.

“The decline can be attributed to an increase in political noise, as the opposition submitted a no-confidence motion against the prime minister in the National Assembly amid volatility in international commodity prices on the backdrop of Russia-Ukraine conflict,” a report from Topline Securities stated.

The week commenced with a dip and the KSE-100 index nosedived over 1,600 points in the first two days as the no-confidence motion, lodged by the opposition parties against Prime Minister Imran Khan, shattered the sentiments of the market participants.

Furthermore, a surge in global crude oil prices to 14-year high at almost $130 per barrel motivated investors to safeguard their positions.

The anticipation of increase in interest rate by the State Bank of Pakistan further restrained traders from making fresh buying.

The central bank’s move of maintaining the policy rate at the current level of 9.75% helped end the bear run at the bourse in the middle of the week and the market recovered some of the losses in a two day bullish streak.

In addition, a rout in international oil prices further facilitated the rally at the stock market.

The market reversed its trend in the final session of the week after subsequent developments on the no-confidence motion took a toll on investors’ minds.

Moreover, a dip in rupee value to an all time low against the US dollar sparked fears of hike in inflation reading and swelling of the current account deficit that kept investors at the bay.

“We expect the market to remain range-bound in the upcoming week,” stated a report from Arif Habib Limited. “With government and opposition seeking allies prior to the no-confidence motion against the prime minister, the market is expected to remain jittery.”

During the week under review, average daily traded volume declined 0.7% week-on-week to 214 million shares, while average daily value traded decreased 11% week-on-week to $38 million.

In terms of sectors, positive contributions came from technology and communication (107 points), automobile parts and accessories (20 points) and chemical (15 points).

On the flipside, sectors which contributed negatively included banks (167 points), oil and gas exploration companies (163 points), power generation and distribution (143 points), cement (113 points), and oil and gas marketing (101 points).

Meanwhile, scrip-wise positive contributors were Systems Limited (148 points), National Foods Limited (23 points) and Thal Limited (20 points).

However, negative contributions came from Hub Power Company (124 points), Lucky Cement (122 points), Pakistan Petroleum Limited (75 points), Oil and Gas Development Company (60 points) and Pakistan State Oil (59pts).

Foreign selling continued this week, clocking-in at $3.13 million as compared to a net sell of $0.97 million the previous week. Major selling was witnessed in banks ($4.4 million) and textiles ($0.4 million).

On the local front, buying was reported by companies ($5.4 million), followed by other organisations ($3.7 million).

Other major news of the week included SBP amending prudential regulations for commercial banking, Engro Powergen Thar citing that recent explosion caused no major damage, six months KIBOR reaching 11.93%, foreign exchange reserves declining by $207 million and UAE sharing plans to acquire Guddu Power Plant.

Published in The Express Tribune, March 13th, 2022.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ