Pakistan’s economy received a shock on Thursday when the central bank reported that the current account deficit (CAD) – the gap between country’s higher foreign expenditures and lower income – widened to a historic high at $2.56 billion in January 2022.

A hefty import bill and drop in the flow of workers’ remittances from overseas Pakistanis were the major factors behind the widening current account deficit.

“No one had expected the deficit to rise to such a high level,” Arif Habib Limited (AHL) Head of Research Tahir Abbas said while talking to The Express Tribune. Financial experts were projecting a deficit of $1.25-1.5 billion for the month, he added.

“The current account deficit rose … largely due to imports in kind that are fully financed,” the State Bank of Pakistan (SBP) said on its official Twitter handle. “Excluding these (imports in kind), the deficit would have been around $1 billion lower in January 2022.”

The imports in kind worth around $1 billion were apparently and mostly the Covid-19 vaccines provided free of charge by the developed countries and petroleum products under ITFC (International Islamic Trade Finance Corporation) arrangements, said Pak-Kuwait Investment Company Head of Research Samiullah Tariq.

Pakistan recorded the new all-time high current account deficit in January 2022 after a gap of 13 years and three months, as the country had last registered a deficit of $2.3 billion in October 2008.

The deficit of $2.56 billion in January 2022 was 12 times higher than the $219 million recorded a year ago in January 2021. On a month-on-month basis, the deficit in January was 37% higher compared to $1.86 billion in December 2021.

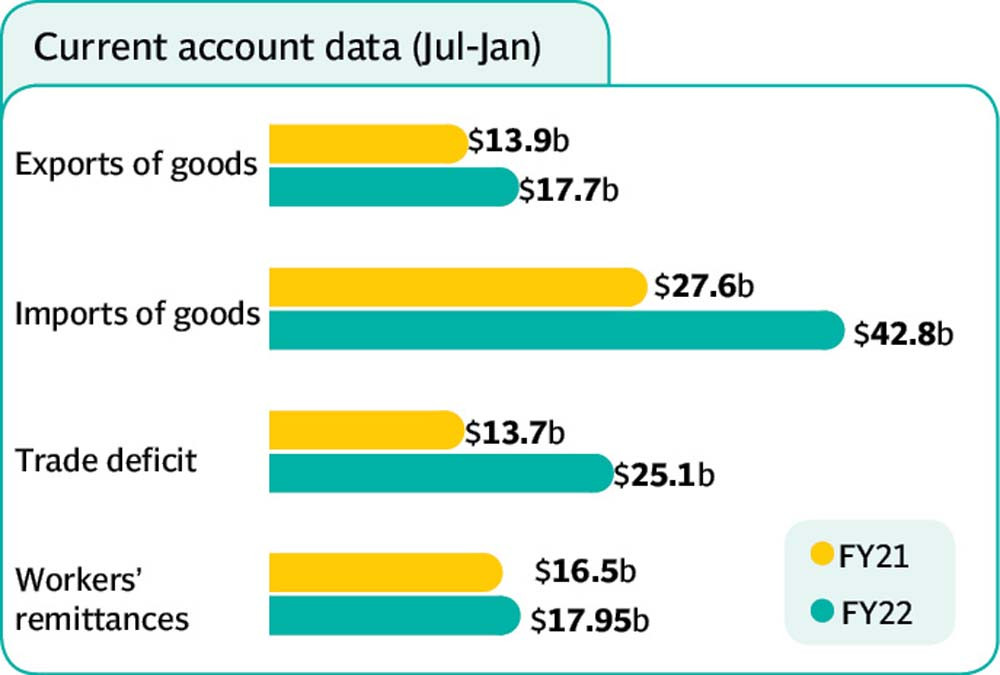

The cumulative current account deficit for the first seven months (July-January) of current fiscal year 2021-22 amounted to $11.58 billion compared to a surplus of $1.03 billion in the same period of previous year, according to the central bank.

The deficit may remain high considering the international petroleum crude benchmark (Brent) hit an eight-year high of over $100 per barrel on Thursday after Russia attacked Ukraine. The oil price was hovering around $70 per barrel about a year ago.

The share of petroleum products in the import bill during the first seven months of the ongoing fiscal year was 25%.

“Higher oil prices pose a threat to the domestic economic activities. The development may slow down economic growth,” he said.

It is very difficult to analyse how the global politics would shape up in the backdrop of Russian military intervention in Ukraine and how the US, European Union, United Nations and Nato would react to the Moscow’s move.

“Oil prices may remain elevated till the global political situation de-escalates,” he said.

“The developments on domestic and global economic fronts suggest that Pakistan’s current account deficit will amount to around $16-17 billion in fiscal year 2021-22.”

Read: Current account gap widens to $9.1b

Earlier, the central bank revised up the current account deficit to 4% of GDP ($14 billion) for FY22. It said late in January 2022 that if oil price would cross over $100 per barrel, it was likely to short-lived and temporary.

Secondly, the government would pass on the increase in international oil price to end-consumers. Therefore, the jump in domestic oil price would encourage people to reduce their petroleum consumption and cut the energy import bill, an official from SBP said the other day.

Tariq, however, anticipated the current account deficit to start reducing in the months to come and estimated the deficit in full fiscal year 2021-22 at around $15 billion (4-4.25% of GDP). “The deficit soared January due to higher imports in December 2021, meaning that imports made in December were documented in January 2022.”

Imports started reducing over the past few months in the wake of the increase in duty on import of luxury goods. Moreover, the large-scale manufacturing sector also exhibited some slowdown in the aftermath of the measures including increase in the benchmark interest rate and rupee depreciation, he said.

Pakistan’s import of goods surged 55% to $42.84 billion in the first seven months of FY22 compared to $27.63 billion in the same period of the last year.

The workers’ remittances grew 9% to $17.95 billion in the period under review compared to $16.46 billion in the corresponding period of the last year.

The export of goods increased 27% to $17.72 billion in the seven month of FY22 compared to $13.92 billion in the same period of the last year.

Published in The Express Tribune, February 25th, 2022.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

1725967717-0/Untitled-design-(3)1725967717-0-165x106.webp)

1725275251-0/Untitled-design-(3)1725275251-0-165x106.webp)

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ