Current account gap widens to $9.1b

Deficit stems from jump in global oil prices, though import volumes shrink

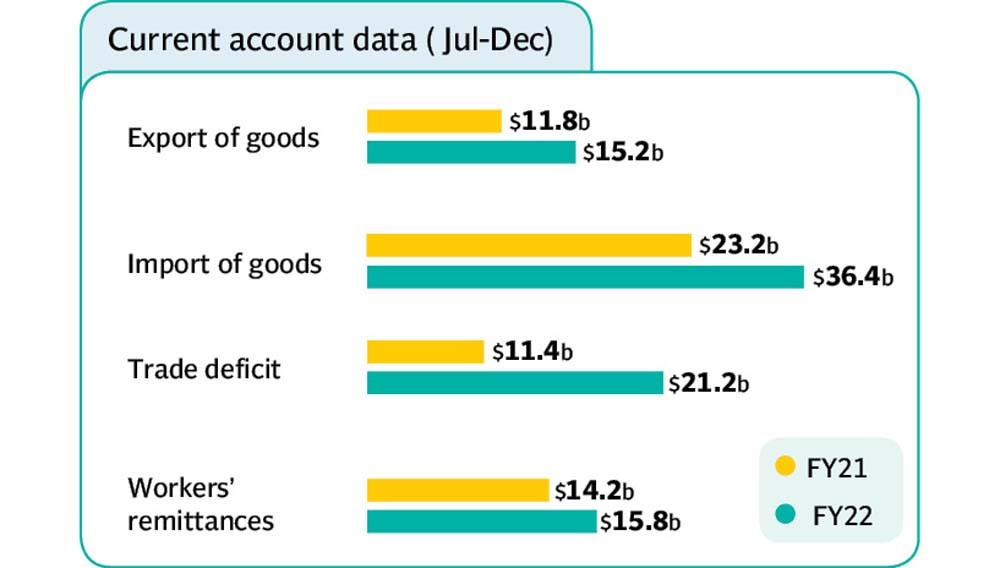

Pakistan’s current account deficit - higher foreign expenditures vs income - widened to $9.1 billion in the first half (July-December) of current fiscal year 2021-22 in the wake of a jump in crude oil prices despite a drop in import volumes.

According to the State Bank of Pakistan (SBP), the country had recorded a current account surplus of $1.25 billion in the corresponding period of previous year.

In a tweet on Saturday, the central bank said that “the deficit was led by significant terms of trade shock amid ongoing economic recovery.”

Arif Habib Limited Head of Research Tahir Abbas told The Express Tribune that in the first half of fiscal year 2021-22, the current account swung to deficit compared to surplus in the same period of previous year.

The reason behind the switch was a significant increase in imports, led by the petroleum group, following a sharp increase in international crude oil prices, he said. The second biggest contributor to imports was the food group as a spike in international commodity prices pushed up the import bill of edible goods, said Abbas.

“Global inflation problem is now reflecting in the current account data and macroeconomic indicators of Pakistan,” he remarked.

Machinery group also had a considerable share in total imports. It came after the State Bank launched the Temporary Economic Refinance Facility (TERF) to encourage businesses to apply for financing and ease the impact of Covid-19 outbreak in the country.

Arif Habib Commodities Managing Director and CEO Ahsan Mehanti termed the high deficit alarming and emphasised that the government should make immediate efforts to rein in imports and prop up exports.

He pointed out that the government was faced with the daunting challenge of controlling the widening current account deficit as it would find it difficult to bridge the gap with necessary funding.

He projected that the current account deficit for full fiscal year 2021-22 would surpass $12 billion.

Echoing similar views, Alpha Beta Core CEO Khurram Schehzad termed the deficit concerning, saying that it was widening due to the persistent uptrend in global oil prices.

“Energy shortages continue to prevail in Pakistan,” he said. “Even residential customers are suffering and gas is hardly available throughout the day in major parts of Karachi.” According to Schehzad, energy needs are rising because of increase in demand on the back of economic growth and surge in population of the country.

“Domestic production is falling, therefore, the country is compelled to import energy and become dependent on the international market.”

He anticipated that oil demand would soar further as the economy was growing. “Oil has the biggest share in imports and its price is expected to stay inflated.”

He, however, forecast that the current account deficit for FY22 would be around $15 billion.

Intermarket Securities Head of Research Saad Ali noted that the current account deficit perched at higher levels because imports had not begun to stabilise.

“High global commodity prices, particularly for oil and petroleum products, are offsetting the slight drop in import volumes,” he pointed out. “In addition to this, machinery imports are up as well but these are expected to normalise in the second half of FY22.” He lamented that exports and remittances had not grown by significant margins.

December numbers

According to the SBP, the current account deficit was broadly unchanged at $1.93 billion in December 2021 from $1.89 billion in November 2021.

Abbas said that the deficit remained stable in December 2021 because export growth offset the increase in imports in percentage terms.

“Foreign shipments from Pakistan rose 30% while the inflow of goods also increased 30%,” he said. “The gap in terms of value was filled by the growth in remittances.”

Arif Habib Limited, in its report, stated that the primary reason behind the higher deficit was 31% year-on-year increase in imports, which reached $7.6 billion in December 2021.

However, total exports and remittances also increased by 25% and 3% respectively, it said.

Published in The Express Tribune, January 23rd, 2022.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ