Govt takes giant step for IMF conditions

NA approves Rs360 billion ‘mini-budget’, grants absolute autonomy to State Bank

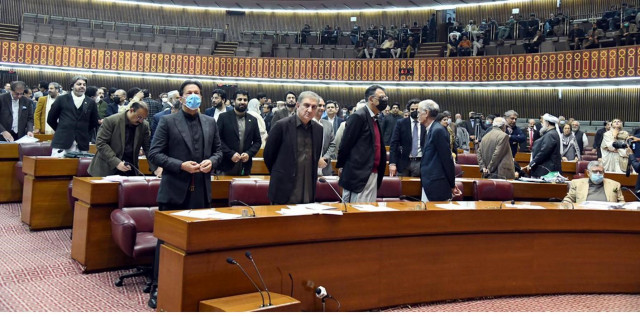

The National Assembly on Thursday approved a controversial Supplementary Finance Bill -- also dubbed as the “mini-budget” -- worth Rs360 billion with a majority vote and bulldozed the State Bank of Pakistan (SBP) Amendment Bill to give absolute autonomy to the central bank -- both moves aimed at meeting two critical conditions set by the International Monetary Fund (IMF).

The government succumbed to pressure exerted by local car assemblers and increased the sales tax rate to 12.5% on the import of electric vehicles -- even higher than the initial 5% rate it had proposed while introducing the “mini-budget”.

It also waived off 15% income tax in favour of a couple of wealthy families of the country.

The government suspended the rules of the National Assembly that require a minimum of two-day debate on any piece of legislation and approved the SBP Amendment Bill in haste -- in just 48 minutes.

However, the government allowed a debate on the mini-budget and approved minor amendments to the Sales Tax Act, the Income Tax, the Customs Act and the Federal Excise Duty.

Prime Minister Imran Khan, who before coming into power had vowed that he would not go to the IMF, remained present in the lower house of parliament till midnight to make sure that his disgruntled party members and allies vote to pass both the bills to meet the IMF conditions.

Read: Govt bulldozes mini-budget, SBP bill through NA amid opposition’s protest

The opposition twice forced the government to count the vote while passing the mini-budget. There were a maximum of 168 members of the treasury present in the House compared with 150 of the opposition, giving an 18 vote edge to PM Imran.

The IMF has set five prior conditions for the revival of the $6 billion stalled programme, including the passage of the mini-budget and giving absolute autonomy to the central bank with the federal government keeping no check on its functioning.

In its desperation to seek the next loan tranche of $1 billion, the government overlooked the objections raised by the PM Office and Finance Minister Shaukat Tarin on the central bank bill, which was passed to the satisfaction of the IMF and the SBP governor.

The IMF’s board meeting was planned for January 12 but was postponed due to a delay in the approval of these bills.

Finance Minister Tarin said the next tentative board meeting date was either January 28 or 31.

LIVE #APPNews : Session of National Assembly #Islamabad Part 2 https://t.co/HQbVwULnIn

— APP 🇵🇰 (@appcsocialmedia) January 13, 2022

PML-N MNA Khurram Dastgir Khan said there was a storm of inflation, as the prices of 51 most essential items affecting the poorest had gone up by 22% just last week.

“The inflation is slaughtering people now,” he added.

Where the government withdrew the Rs335 billion sales tax exemptions that will affect every segment of the society, it has approved income tax exemption for the richest people, who own real estate investment trusts (REITs).

Out of Rs360 billion, Rs335 billion worth of sales tax exemptions have been withdrawn.

Around Rs7 billion income tax measures have been taken in the shape of increasing the income tax rate on telephone calls by 50% and enhancing advance income tax on registration of cars by 100%.

A tax of Rs3 million has also been slapped on foreign-produced dramas.

In addition to that, the government has also increased federal excise duties on the purchase of locally-made and imported cars to raise another roughly Rs20 billion in revenue.

Read More: PM Imran, Khattak engage in 'heated argument' during parliamentary meeting

The government has imposed 17% general sales tax (GST) on infant milk if it was valued over Rs500 for a 200 gram of powder.

It has withdrawn 17% GST which was earlier proposed to slap on bicycles.

The government has also withdrawn 17% GST on red chilies and iodised salt.

However, it has imposed 17% GST on breads, vermicelli, naan, chapatti, sheer mal, bun, and rusk sold by all food shops, bakeries and restaurants that were integrated with the Federal Board of Revenue (FBR) through ‘Point of Sales’ machines.

While giving up to pressure exerted by local car assemblers, the government increased the sales tax rate on imported electric vehicles to 12.5%.

It kept the GST rate on hybrid vehicles of up to 1800 cc cars unchanged at 8.5% and set the rate at 12.75% on hybrid vehicles above 1800 cc.

Similarly, the government has significantly increased the federal excise duty rates on locally produced and imported cars. On imported cars of 1001-1799cc engines, the FED has been doubled from 5% to 10%, on 1800-3000cc engines, the rates have been increased from 25% to 30% and from 3001cc engines and above, they have been jacked up from 30% to 40%.

The government kept the federal excise duty rate on up to 1300 cc cars unchanged at 2.5% but increased the rate on 1301 to 2000 cc to 5% and above 2000 cc to 10%.

The National Assembly also gave the nod to slap 17% sales tax on raw material for pharmaceutical products to generate Rs160 billion.

The premixes of growth stunting have been taxed at 17%.

Tax on prepared foodstuff and sweetmeats supplied by restaurants, bakeries, caterers and sweetmeat shops has been increased from 7.5% to 17%.

Imported edible vegetables have been taxed at 17%. Imported cereals have also been slapped with the 17% tax.

Matchboxes are taxed at 17% rate. Whey excluding those sold in retail packing under a brand name and sausages and similar products of poultry meat or meat offal excluding those sold in retail packing under a brand name or trademark are taxed at 17%.

The tax rate on flavoured milk sold in retail packing under a brand name has been increased from 10% to 17%.

The rates of yoghurt, cheese, butter, cream, desi ghee, whey, milk and cream sold in retail packing under a brand name have also been increased from 10% to 17%.

Machinery and equipment related to dairy products has been taxed at 17% as against the existing 5%.

Mobile phones have been taxed at the standard 17% rate as against the current fixed rate.

Supplies made from retail outlets as are integrated with the FBR’s computerised system that are currently taxed at 10% will now be taxed at 12%.

The tax rate of frozen prepared or preserved sausages has gone up from 8% to 17%.

Seeds, fruit and spores of a kind used for sowing have been taxed to generate Rs4 billion.

The import of newsprint, newspapers, journals, periodicals, books – with the exception of directories – has been taxed at 17% for Rs1.5 billion every year.

The government approved the SBP amendment Bill in haste in just 48 minutes by suspending the assembly rules.

The finance minister had moved the bill at 10.06pm and the NA speaker announced its approval at 10.54pm.

The PML-N and PPP first pleaded the National Assembly speaker to let the debate take place and then in sheer frustration gathered in front of his desk to stop him from bulldozing the parliament’s proceedings.

However, nothing could stop the PTI-led government from handing over absolute autonomy to the central bank, which PPP’s Syed Naveed Qamar said would “compromise national security”.

“I beg you… please do not suspend the rules and allow the house to debate on the most important bill in the country’s history for at least two days”, said PML-N’s Ahsan Iqbal.

Read Also: Maryam calls for 'any possible means' to oust Imran-led govt

However, even this could not move the speaker, who kept on bulldozing one after another amendment suggested by the opposition.

PPP Chairman Bilawal Bhutto Zardari, while referring to another condition set by the IMF, raised the question as to when defence expenditures would be made from one account, would it not be easy for international institutions and powers to scrutinise the country’s nuclear programme spending.

The bill, which will now be taken up by the Senate for approval, has allowed the central bank to target price stability as it primary objective but does not set the explicit inflation target.

#NAsession #NAatwork @betterpakistan @PervezKhattakPK @BBhuttoZardari pic.twitter.com/qt0r68NMks

— National Assembly of Pakistan🇵🇰 (@NAofPakistan) January 13, 2022

The new bill has given the autonomy to the SBP, but neither parliament nor the federal government has the authority to remove the governor for missing the inflation target.

The government has made a few changes in the final draft approved by the National Assembly.

This includes a bar on the governor and deputy governors of the SBP for two years to seek employment in any of the institutions that they have dealt with or negotiated during the term of their office.

Dual nationals cannot become governors and deputy governors of the SBP.

Parliament and its standing committees can call the SBP governor in meetings.

However, the SBP will be completely independent to set the monetary policy, the exchange rate policy and will largely work in isolation from the federal government.

The SBP governor and its officers cannot take instructions from any person of the federal government, including the prime minister.

The governor has been made all-powerful. He will chair the executive committee, head the Monetary Policy Committee and also be the chairman of the SBP Board.

The governor’s term has been increased to five years and his salary will be determined by the SBP board.

The finance minister’s authority to appoint the deputy governor has been withdrawn and the Monetary and Fiscal Policies Coordination Board has been disbanded.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ