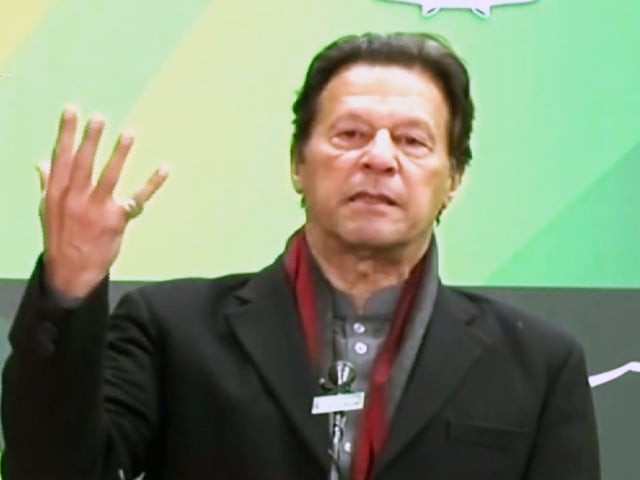

PM urges banks to facilitate salaried class seeking housing loans

Policies of past rulers only aimed at ‘elite segment’ of the society, laments Premier Imran

Prime Minister Imran Khan has lamented that past rulers never made policies for poor segment of the society, while urging the country’s commercial banks to facilitate the salaried class seeking loans to build their houses under the government’s subsidised schemes.

He said this while addressing the launching ceremony of ‘Mera Pakistan Mera Ghar Housing Finance Scheme’ in Islamabad on Friday.

“This elitist mindset has caused tremendous damage to the country and the country’s development had never been inclusive,” he added.

LIVE #APPNews : Prime Minister @ImranKhanPTI addresses #MeraPakistanMeraGhar housing finance ceremony #Islamabad @PakPMO https://t.co/Z6pgtXBelK

— APP 🇵🇰 (@appcsocialmedia) December 24, 2021

PM Imran said the gap between rich and poor had widened in the country over the years due to the inequitable policies aimed at only facilitating a “small segment of the society”.

He also lauded the private banks for disbursing housing loans to the salaried class and urged them to further facilitate them so that masses can build their own houses.

The premier said his government’s housing finance policy will boost the country’s construction sector and economy.

Also read: Bank lending gains momentum

Bank lending for the government’s markup subsidy scheme, commonly known as “Mera Pakistan Mera Ghar”, had gained momentum, said the State Bank of Pakistan in September.

In a statement, the central bank had said that applications with a cumulative worth of Rs154 billion had been received since the launch of the scheme by different banks.

“They have approved housing finance of over Rs59 billion till August 31, 2021,” it said. “Similarly, the pace of disbursement under the Mera Pakistan Mera Ghar has also picked up.”

The central bank pointed out that the disbursement was initially slow because of a number of factors, including the availability of housing units. By August 31, 2021, the disbursement under the scheme had reached Rs11.5 billion, showing an increase of around Rs3.8 billion or 49% in August 2021.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ