Current account gap widens to $1.9b

Deficit increases to 40-month high, driven by soaring imports

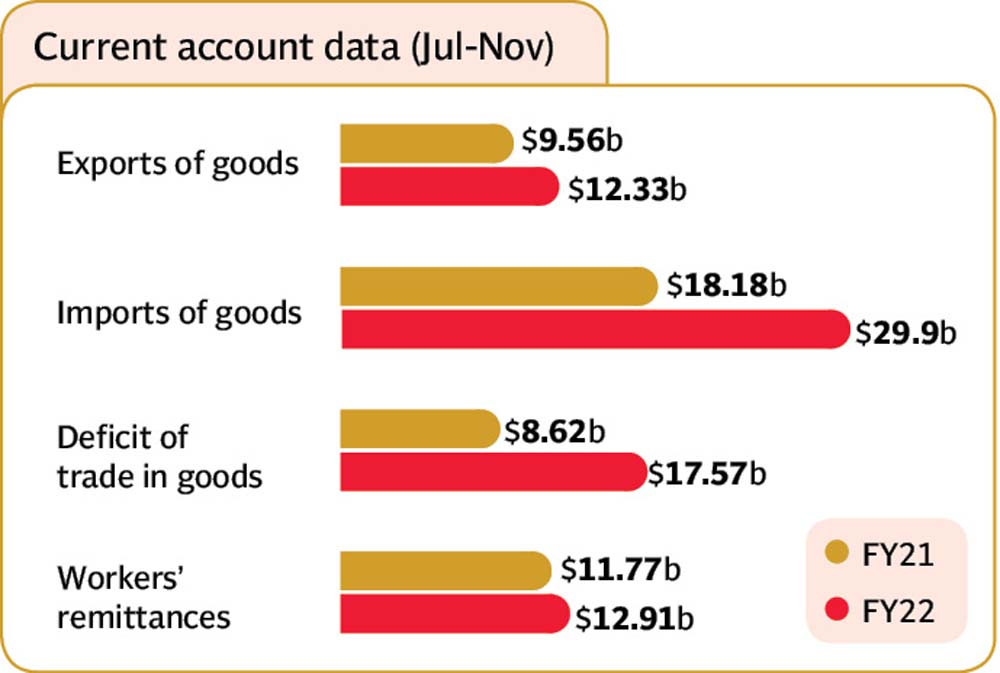

Pakistan’s current account deficit - the gap between the country’s higher foreign expenditure and lower income - widened to a 40-month high at $1.91 billion in November 2021 in the wake of a surge in import payments.

“Current account deficit widened slightly to $1.91 billion in November from $1.76 billion in October, as imports outstripped strong exports and robust remittances,” the State Bank of Pakistan (SBP) said on its official Twitter handle.

“The deficit figure is lower than projections of the (financial) market of $2-2.5 billion,” Pak-Kuwait Investment Company Head of Research Samiullah Tariq said while talking to The Express Tribune.

The market had anticipated a massive deficit after the Pakistan Bureau of Statistics (PBS) reported imports worth $7.92 billion for November 2021.

As usual, the central bank used its own formula for imports and recorded inward shipments of $6.42 billion to calculate the deficit for the month.

The import number, released by the SBP, was $1.5 billion lower than the one reported by the PBS, “which is probably the largest gap seen between the SBP and PBS numbers in any month,” said Ismail Iqbal Securities Head of Research Fahad Rauf in a commentary.

This indicates that payments for some of the purchased goods have not been made in the same month, which is a usual practice.

“This will likely carry forward the burden of these imports into the coming months, hence the current account deficit for December 2021 is likely to be higher than what is being anticipated.”

“To note, the major growth in imports was witnessed in the case of petroleum products and vaccines,” he added.

Other noteworthy imports included food items (palm oil and sugar), plant and machinery for the expansion of industrial base and agricultural inputs (medicinal products and plastic material).

Imports were mainly lifted by high international commodity prices in addition to strong domestic economic recovery, the central bank said.

“Due to the higher recent outturns, the current account deficit is projected at around 4% of GDP (gross domestic product) that is somewhat higher than earlier projections (of 2-3% of GDP for the ongoing fiscal year),” the bank said in its monetary policy statement issued on December 14.

“Monthly current account and trade deficit figures are likely to remain high and they are expected to gradually moderate in the second half (January-June) of FY22 as global prices normalise with the easing of supply disruptions and tightening of monetary policy by major central banks,” the bank said.

In addition, the recent policy actions taken to moderate domestic demand - including policy rate hikes and curbs on consumer finance - and proposed fiscal measures should help steer growth in import volumes during the remaining part of the year, it added.

Tariq said that consumption of various products had slowed down. This suggests that the economy has started cooling down in line with the measures taken by the central bank and the Ministry of Finance recently. The measures were aimed at reducing the current account deficit and controlling inflation.

“Car financing (by banks) and sales of petroleum products, cement and fertiliser (DAP) slowed down in November compared to the previous month of October,” he said.

However, export earnings surged 13% in November compared to October, while imports grew just 5%. In absolute terms, the growth in imports was significantly higher than the expansion in export earnings, he said.

“However, the slowdown in imports in percentage terms signals towards a drop in consumption while the rise in export earnings in percentage terms remains strong mainly due to increase in the benchmark interest rate and rupee depreciation,” he said.

Export earnings are expected to further improve by $200-300 million in December 2021, while imports would slow down by $700-800 million in the month.

“Growth in textile and IT exports would continue to help improve the overall export quantum on a month-on-month basis,” he said.

“The current account deficit is expected to continue to fall gradually from December onwards. It is expected to enter sustainable range of $700-800 million a month from the February 2022,” he said.

Published in The Express Tribune, December 21st, 2021.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ