Heavy selling at PSX on weak cues

Panic over IMF’s strict conditions forces players to offload stockholdings

The Pakistan Stock Exchange (PSX) experienced heavy selling in the outgoing week as poor economic indicators battered the benchmark KSE-100 index, which recorded the biggest weekly decline since March 27, 2020.

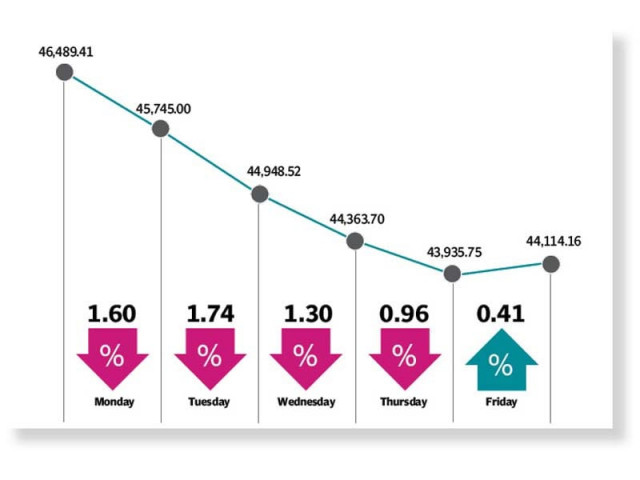

The KSE-100 index plunged 2,375 points, or 5.11%, and closed the week at 44,114 points.

“The bourse continued to witness a ‘massacre’ over growing economic concerns amid International Monetary Fund’s (IMF) issuance of staff concluding statement on the sixth review under the Extended Fund Facility at the start of the week,” said JS Global analyst Amreen Soorani.

On Monday, trading began with a dip as a 150-basis-point hike in the benchmark interest rate by the State Bank of Pakistan (SBP) shattered investor confidence.

The widening of the current account deficit to $5.1 billion in the first four months of current fiscal year painted a sombre picture of the economy, keeping investors on the sidelines.

Although the week kicked off with the announcement of an agreement between the IMF and Pakistan on resuming the $6 billion loan programme, the development failed to encourage market participants, who resorted to offloading their stockholdings.

The stringent conditions laid down by the IMF for the release of next loan tranche, including an increase in power tariff and taxes, triggered panic among market participants and across-the-board sell-off.

The bear-run persisted for the first four sessions of the week during which the market lost more than 2,550 points.

A spike in Pakistan’s foreign loans to $3.8 billion during July-October 2021 dampened the confidence of investors. Moreover, news of country’s total debt and liabilities surpassing Rs50 trillion dealt an additional blow to the market, pulling it down.

Midway during the week, the petroleum dealers announced a strike against the status quo in their margins when fuel was available only at a few filling stations for a day across the country. It signaled a drop in economic activity and accelerated the sell-off at the stock market.

The rupee saw no respite during the week as it continued to fall against the US dollar despite market’s hopes for a sharp recovery following the agreement with the IMF. The weakening local currency forced investors to offload their positions.

Late on Thursday, the government and petroleum dealers reached an agreement and the protest ended, which proved to be a sigh of relief for the investors.

The market took a breather in the final session of the week and staged a partial recovery on the back of a few positive economic developments.

Hopes for the receipt of $3 billion cash assistance from Saudi Arabia fuelled bullish sentiment, driving investors to assume fresh positions.

“We expect the market to show positivity in the upcoming week, attributable to support from Saudi Arabia in terms of safe deposits of $3 billion, which will release the pressure off foreign exchange reserves,” stated a report of Arif Habib Limited.

“A slowdown in international crude oil prices will also ease inflationary pressure.”

Average daily traded volumes rose 8% week-on-week to 264 million shares while average daily traded value dipped 13% week-on-week to $60 million.

In terms of sectors, the contribution to the downside was led by cement (462 points), commercial banks (326 points), technology and communication (290 points), fertiliser (270 points) and oil and gas exploration (252 points).

Stock-wise, major losers were Lucky Cement (205 points), TRG Pakistan (177 points), HBL (114 points), Pakistan Petroleum (98 points) and Engro (95 points).

Foreigners offloaded stocks worth $39.1 million compared to net selling of $25 million in the previous week.

Major selling was witnessed in commercial banks ($15.7 million) and fertiliser firms ($6.3 million).

On the domestic front, buying was reported by individuals ($16 million), followed by companies ($13.3 million).

Published in The Express Tribune, November 28th, 2021.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ