SBP projects up to 5% economic growth despite challenges

Warns of elevated import payments, increase in utility tariffs in Annual Report 2020-21

The central bank has projected the economy to grow strongly in the range of four to five per cent in the current fiscal year 2021-22, but warned of challenges including exponentially high global commodity prices, elevated import payments, increase in utility tariffs, higher inflation and expansion in services deficit.

The economic outlook section of the State Bank of Pakistan’s (SBP) Annual Report 2020-21 released on Tuesday, however, did not discuss the likely impact of the latest actions, including aggressive hike in the benchmark interest rate by 1.5 percentage points to 8.75% and the tough economic conditions agreed to reach staff-level agreement with the International Monetary Fund (IMF) to resume the $6 billion loan programme.

"Economic recovery during FY21 is projected to gain further momentum in FY22," the central bank said.

The momentum in growth is evident from the significant increase in machinery and raw material imports, continued expansion in consumer financing, and strong uptrend in domestic sales as seen from high frequency demand indicators during the initial months of FY22.

"Partly capturing these dynamics, the SBP is projecting GDP (gross domestic product) growth in the range of 4-5%."

READ SBP revisits corporate governance regime

The national Consumer Price Index (CPI) inflation is expected to remain within a range of 7-9%. The SBP recommended that better commodity management practices, especially the build-up of reserves for wheat and sugar, would likely contain supply side pressures from seeping into inflation during FY22.

Importantly, headline inflation is expected to retreat more visibly in the second half of the year, with the phasing out of the base impact of hike in power tariffs. "That said, these projections are subject to multiple upside risks, including from a greater-than-anticipated increase in global commodity prices and upward revision in utility tariffs. In addition to triggering a sharp increase in domestic prices, these developments may also give rise to significant second-round impacts on inflation," the annual report stated.

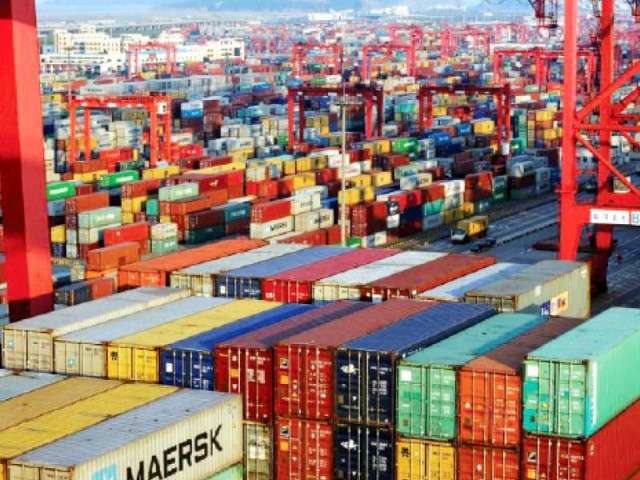

In the external sector, pressures from the import side are emerging, with payments exceeding $6 billion in three of the past four months (June, August and September 2021). The surge in imports is broad-based, partly reflecting the increasing pace of economic activity, a further increase in the global commodity prices, continued imports of agricultural commodities, automobiles, and many consumption related items.

On a positive note, this increase in imports also reflects increase in machinery, much of which is supported by TERF that should help to augment future productive capacity, it said.

"In this scenario, the current account deficit is projected in the range of 2-3% of the GDP during FY22," it said.

Earlier on Friday, the central bank said the current account deficit would exceed the upper limit of its projection of 7-9% in FY22 due to higher import bill.

The annual report said a part of the expansion in the import payments is projected to be financed through a consistent increase in the workers’ remittances and export receipts. Particularly, remittances are expected to remain upbeat amid recovery in the global economy.

The services deficit is projected to expand, in line with some resumption in international air travel. Meanwhile, the outlook for financial flows is likely to remain conducive.

1724319076-0/Untitled-design-(5)1724319076-0-208x130.webp)

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ