PSX in green after four weeks of losses

KSE-100 rises 344 points as repayment of $1b foreign debt revived investor interest

A V-shaped recovery was witnessed at the Pakistan Stock Exchange in the outgoing week as bulls and bears grappled in a bid to take control of the bourse.

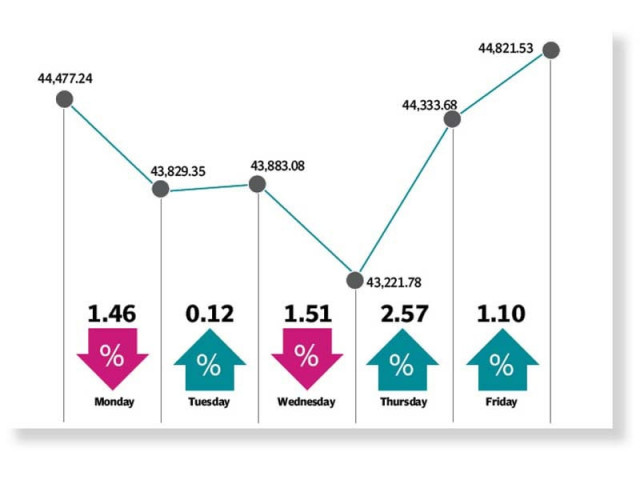

As a result, the market gained 344 points, or 0.8%, and closed at 44,821 in the week ended October 15.

“The equity bourse closed in the green after four weeks of bleeding,” stated a report of Arif Habib Limited.

The week kicked off on a negative note as the benchmark KSE-100 index tumbled nearly 650 points on Monday, weighed down by a deteriorating macroeconomic outlook, which sparked sell-off at the bourse.

Fears of hike in electricity tariff by the government to clear the way for resumption of $6 billion International Monetary Fund (IMF) loan programme dealt a blow to investor spirits and pushed them to offload their stockholdings.

Concerns over rising food and commodity prices combined with stock selling by foreign investors deepened the market’s decline.

The next day proved to be a breather for the market when it staged a partial recovery after the curbs placed by the State Bank of Pakistan on the purchase of US dollar to arrest the decline in local currency revived investor interest and triggered a buying spree.

The market endured a battering in the subsequent session owing to uncertainty about the appointment of a key intelligence agency chief, which dampened investor interest.

During the week, the rupee continued to trade under pressure and extended its slide to an all-time low of Rs171.2 against the US dollar. The depreciation renewed fears of imported inflation and further expansion of the current account deficit, prompting investors to sell stocks in panic.

Investor interest revived in last two sessions of the week, which bolstered the market that recorded a surge of 1,600 points. It came after timely repayment of $1 billion in foreign debt by Pakistan, which encouraged market participants and sparked a rally.

Moreover, the market received support from cherry-picking by investors as the bear-run had reduced stock prices to attractive levels.

“As Pakistan gets closer to resuming the IMF programme and receiving a $1 billion tranche, we expect the market to perform well in tandem,” stated Arif Habib Limited in its report. “However, the recent bouts of selling have once again opened up valuations.”

Average daily traded volume climbed 29% week-on-week to 342 million shares while average daily traded value increased 20% week-on-week to $71 million.

In terms of sectors, positive contribution came from commercial banks (393 points), oil and gas exploration companies (136 points), fertiliser (123 points), cement (98 points) and pharmaceuticals (28 points).

On the flip side, sectors that contributed negatively included technology and communication (-342 points) and food and personal care products (-50 points).

Stock-wise, positive contributors were HBL (153 points), Pakistan Petroleum (87 points), UBL (67 points), Lucky Cement (59 points) and Oil and Gas Development Company (42 points).

Meanwhile, the contribution to the downside came from TRG Pakistan (-260 points), Systems Limited (-70 points) and Pakistan Tobacco Company (-27 points).

Foreign selling continued during the week under review, which came in at $13.3 million compared to net selling of $3.7 million in the previous week.

Major selling was witnessed in the fertiliser sector ($12.1 million), commercial banks ($7.8 million) and cement companies ($3.11 million).

On the domestic front, buying was reported by insurance companies ($12.2 million), followed by mutual funds ($3.4 million).

Among other major news of the week was Pakistan recording $8 billion in remittances in the July-September quarter, gas deficit looming large as Pakistan LNG failed to procure eight LNG cargoes, Ogra pushing RLNG price to a 15-month high, IMF projecting 4% GDP growth for Pakistan in 2022 and a hike of Rs1.39 per unit in the base power tariff.

Published in The Express Tribune, October 17th, 2021.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ