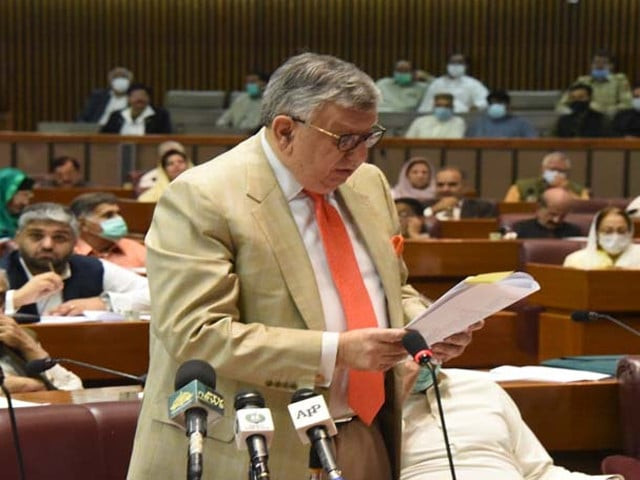

New ordinance for non-filers, under-filers: Shaukat Tarin

Says out of 2.9m tax return filers, 1m have zero taxable income

Out of the total 2.9 million tax return filers, one million filers are those that have zero taxable income, said Federal Minister for Finance and Revenue Shaukat Tarin.

During a meeting with the Karachi Chamber of Commerce and Industry (KCCI) officials on Monday, the finance minister told businessmen to visit Islamabad to discuss their reservations about the new ordinance, besides resolving all issues on the spot by arranging meetings with Prime Minister Imran Khan, ministers and advisers.

“We will instantly give deadlines for all the pending policies as the PM is determined to revive business, industrial and agricultural activities,” he added.

Speaking on the occasion, former KCCI president Zubair Motiwala expressed concern over the newly promulgated ordinance in which enforcement measures had been introduced in the name of broadening the tax base.

He stated that the ordinance had frightened everyone mainly because of the term under-filer, which was hurting everyone’s mind and needed to be removed.

He said that it was highly unfair that instead of appreciating the filers and acting strictly against the non-filers, the ordinance targeted the existing filers too by tagging them as under-filers, which would open more avenues of harassment and corruption. Hence, the term under-filer should be expunged from the ordinance, he added.

Tarin clarified that victimisation was definitely not the purpose of the new ordinance, which was purely for the non-filers and those under-filers who filed zero tax.

“It is a matter of concern that out of the total of 2.9 million filers, one million are those who file tax returns and show zero taxable income.”

Read Kamyab Pakistan size cut to Rs10b a month

The finance minister said, “We intend to take help of artificial intelligence to examine electricity, gas, telephone bills along with banking transaction activities and other details of such filers and classify them as under-filers, who will be asked to submit their taxes through a third party.”

He said that the government was serious about resolving issues in order to ensure sustainable economic growth at the rate of 5%, which was the basic reason for enhancing the PSDP and reducing prices of raw material so that the industry could stand on its feet.

“The good news is that we are growing as all indicators are showing improvements and we are growing faster than expected,” he said, adding, “However, the import bill is going to touch $19 billion this year as compared to $13 billion last year mainly due to rising petroleum prices and other commodities, which we have to absorb.”

He said that the government’s target was to improve the pace of exports from the existing 8% to 18% in the next few years while the narrow industrial base was also being expanded through offering incentives.

“We have to improve exports and FDI by facilitating local investors through the Board of Investment. If our local investors will not be happy, how are we going to attract foreign investors?”

Underscoring the need to take everyone into the tax net, Motiwala said that any income being derived from this country, which crossed the benchmark set by the government, should attract taxes, whether it was agriculture, industry or trading.

“Keeping in view all the expenditures, we really need at least a minimum tax collection of Rs12,000 billion but for that purpose, you will have to look where the funds are being lost instead of looking for them everywhere,” he said.

Published in The Express Tribune, September 21st, 2021.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ