KSE-100 rises despite MSCI reclassification

Cherry-picking of stocks at attractive valuations helped lift market

Uncertainty gripped the Pakistan Stock Exchange (PSX) in the outgoing week as Morgan Stanley Capital International’s (MSCI) pending review of Pakistan influenced market proceedings during early sessions while buying interest provided support later in the week.

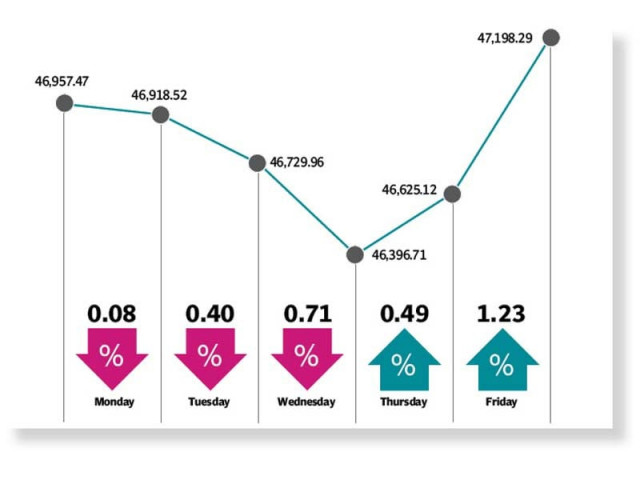

Despite the reclassification of Pakistan and its inclusion in the Frontier Markets Index by the MSCI, the benchmark KSE-100 index posted a rise of 241 points or 0.5%, ending the week at 47,198.29 points.

At the beginning of the week, trading kicked off on a negative note and the market slid over 550 points in the first three sessions, mainly on the back of anticipation of Pakistan’s downgrade by the MSCI, which triggered a sell-off at the bourse.

In addition, investors panicked over the deteriorating macros, particularly the ballooning trade deficit, which widened to $4.1 billion in August 2021.

The rupee lost further ground in the past week and fell to Rs168.02 against the US dollar, which dampened market sentiment.

The KSE-100 index went on a steep decline as soon as the news pertaining to the downgrade of Pakistan from Emerging Markets to Frontier Markets broke. In this scenario, the investors offloaded their stockholdings.

The index bounced back in the final two sessions owing to cherry-picking of stocks by the investors as the shares had dropped to attractive valuations following heavy selling in earlier sessions.

The rebound stemmed from market belief that the funds following the Frontier Markets Index might take fresh positions at the Pakistan Stock Exchange.

The final session saw the index gain close to 600 points because of renewed investor interest in the wake of encouraging remittances data, which depicted inflows of over $2 billion for the 15th straight month in August 2021.

In the week, market players also witnessed the initial public offering (IPO) of Octopus Digital where the issue was oversubscribed by a record 27 times.

“We expect the market to remain range bound in the coming week,” stated a report of Arif Habib Limited. “Keeping in view the concerns over inflation, depreciation of Pakistani rupee against the greenback and the current account deficit, the investors are expected to take a cautious approach.”

During the week under review, average daily traded volumes contracted 7% week-on-week to 429 million shares while average daily traded value rose 5% week-on-week to $87 million.

In terms of sectors, positive contribution came from technology and communication (214 points), miscellaneous (168 points), commercial bank (148 points), pharmaceutical (59 points), and food and personal care products (14 points).

On the flip side, sectors which contributed negatively were cement (155 points), oil and gas exploration (56 points) and fertiliser (34 points).

Stock-wise positive contributors were Pakistan Services (164 points), Meezan Bank (147 points), Systems Limited (115 points), TRG Pakistan (99 points) and Nestle (39 points).

Meanwhile, stock-wise negative contribution came from Lucky Cement (103 points), HBL (57 points) and Engro (51 points).

Foreign selling continued during the week, settling at $18.6 million against net selling of $5.9 million in the previous week.

Selling was witnessed in commercial banks ($10.9 million), cement firms ($6.1 million) and exploration and production companies ($0.9 million).

On the domestic front, major buying was reported by individuals ($12.9 million) and insurance companies ($6.2 million).

Other major news for the week included PIBT planning to invest $70 million in additional cargo handling, Indus Motor sharing plans to invest $100 million in hybrid electric vehicle production, OGDC discovering gas and condensate at Wali 01 well in Khyber-Pakhtunkhwa and Fauji Foods announcing to raise Rs7.8 billion via rights issue.

Published in The Express Tribune, September 12th, 2021.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ