The Pakistan Stock Exchange snapped a four-day losing streak on Monday and climbed 229 points on the back of stability in regional markets and uptick in global oil prices.

Local oil sectors were in the limelight following a spike in international crude prices after Hurricane Ida forced some of the US refineries to halt production and obstructed oil supply.

In addition, encouraging corporate financial results, particularly the healthy earnings posted by Hubco, triggered a rally at the local bourse.

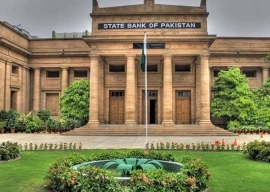

Cherry-picking in select index-heavy sectors lent support to the uptrend. Despite the positive sentiment in the market, the banking sector received a battering where major names closed in the red.

Earlier, trading began with a spike and the KSE-100 index surged close to the 47,500-point mark in early hours. However, a lack of positive triggers sparked profit-booking and erased most of the gains by midday.

The index traded range bound for a few hours but a buying spree, emerging later in the session, propelled the KSE-100 higher and inflated the gains.

At close, the benchmark KSE-100 index recorded an increase of 229.17 points, or 0.49%, to settle at 47,365.70.

A report of Arif Habib Limited stated that the market performed well after closing the roll-over week, where the index added a total of 332 points during the session and closed up by 229 points.

“The ascent in international crude oil prices, due to Hurricane Ida, helped propel the oil and gas chain, particularly the exploration and production stocks,” it said. “Power sector saw Hubco coming to the fore on the back of declaration of a healthy dividend.”

Besides, cement, fertiliser, steel and technology stocks contributed positively to the index. Bank, automobile and textile sectors saw continued profit-booking, the report said.

JS Global analyst Neelum Naz said that the benchmark KSE-100 index closed 229 points higher. Major trading volume was witnessed in Byco (+6.3%), Ghani Global Holdings (-5.5%), WorldCall Telecom (+1.2%), Yousuf Weaving (+12.3%) and Telecard Limited (+7.5%) with total trading volume of 383 million shares.

Hubco (+4.2%) announced its FY21 result with a final dividend payout of Rs5 per share and earnings per share of Rs25.97.

“Going forward, the equity market looks attractive, where a buy-on-dip strategy is advised for the medium term in the cement, steel, textile, oil and gas exploration sectors,” the analyst said.

Overall trading rose slightly to 382.6 million shares compared with Friday’s tally of 382.4 million. The value of shares traded during the day was Rs12.3 billion.

Shares of 605 companies were traded. At the end of the day, 309 stocks closed higher, 200 declined and 96 remained unchanged.

Byco Petroleum was the volume leader with 43 million shares, gaining Rs0.59 to close at Rs10.03. It was followed by Ghani Global Holdings with 29.9 million shares, losing Rs2.35 to close at Rs40.05 and WorldCall Telecom with 26.8 million shares, gaining Rs0.04 to close at Rs3.26.

Foreign institutional investors were net sellers of Rs147.1 million worth of shares during the trading session, according to data compiled by the National Clearing Company of Pakistan.

1730706072-0/Copy-of-Untitled-(2)1730706072-0-270x192.webp)

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ