The Pakistan Stock Exchange (PSX) experienced sombre trading in the outgoing week as lack of positive triggers dimmed investor sentiments and fuelled profit-taking.

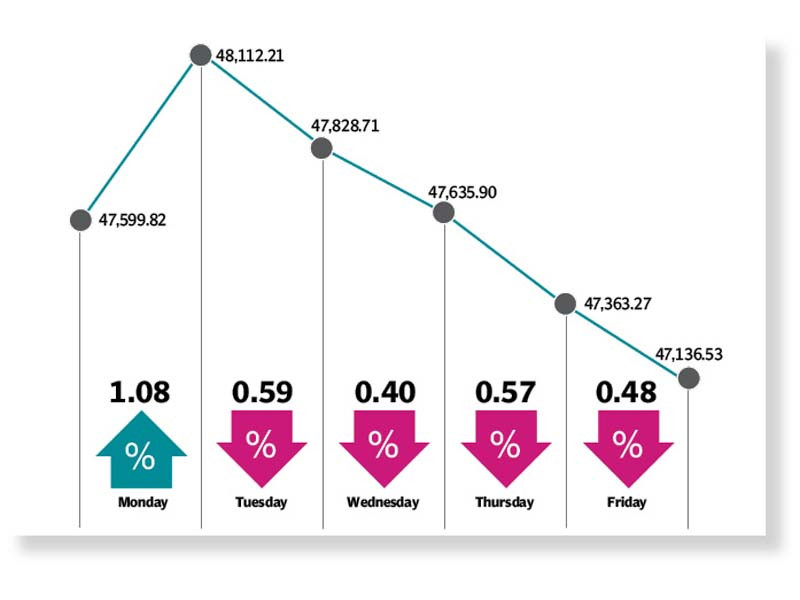

Resultantly, the KSE-100 index dived 463 points or 1% to close the week at 47,136.53 points.

“The index closed on a negative note this week due to Covid concerns, influence of regional politics and lack of positive triggers,” said JS Global analyst Waqas Ghani.

Trading during the past week kicked off on a positive note and the KSE-100 index spiked over 500 points on Monday as the market participants resorted to cherry pick index heavy scrips. Additionally, strong financial results encouraged the investors to pour money in select sectors that aided the rally.

Meanwhile, international oil price also remained on an uptrend and lent support to local oil sectors which experienced modest buying activity.

The market reversed its direction on Tuesday and the decline persisted for the rest of the week. Continuous depreciation in rupee, which fell to an 11-month low of Rs166.28 during the week, dented investor sentiments and raised concerns over the current account balance. Furthermore, a delay in the proposed refinery policy, which is anticipated to boost foreign investment, also dimmed spirits.

A host of disappointing financial results also restrained the market from posting gains.

Read Tarin expresses satisfaction over PSX progress

The receipt of $2.75 billion from the International Monetary Fund by the State Bank of Pakistan under the SDR allocations failed to restore investor interest.

“The week ended with Finance Minister Shaukat Tarin announcing the Roshan Apna Ghar scheme for overseas Pakistanis which would allow them to buy a home in Pakistan and apply for attractive financing through their Roshan Digital Accounts,” said Ghani.

Average daily traded volume increased 44.6% week-on-week to 384.09 million shares while average daily traded value rose 11.6% week-on-week to settle at $78.65 million.

In terms of sectors, negative contributions were led by refinery, oil and gas marketing companies, cement, power and pharmaceuticals. On the flip side, positive contributions were led by exploration and production, commercial banks, food and automobile sectors.

Scrip-wise, positive impact came from Yousaf Weaving Mills Limited, Pakistan Services Limited, Systems Limited, Punjab Oil Mills and Archroma Pakistan Limited. Meanwhile, Jubilee Life Insurance Company Limited, Service Industries, Gadoon Textile Mills and Azgard Nine led negative contribution.

Foreigners remained net sellers as they offloaded stocks worth $4.4 million against $10.82 million last week. Significant selling was witnessed in the cement sector.

Among other major news of the week; foreign investors’ repatriations declined 21% on year-on-year basis, external account improved in July as the SBP reported a current account deficit of $773 million and trade deficit for July 2021 stood at $694 million, an 18% month-on-month decline.

Published in The Express Tribune, August 29th, 2021.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS (1)

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ