PSX rebounds amid Covid uncertainty

Drop in inflation rate and positive macro numbers contribute to gains

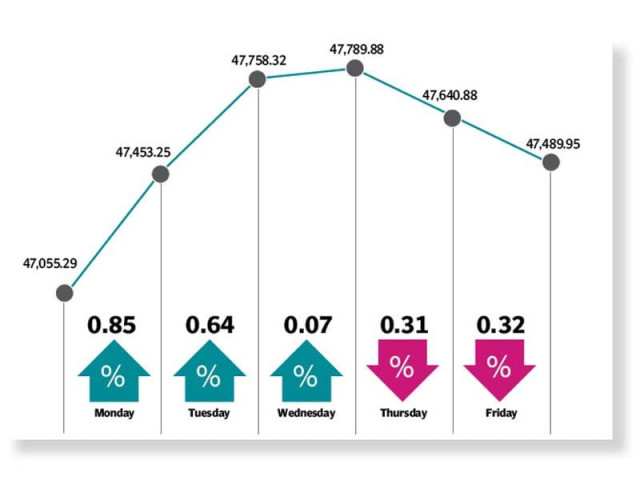

The Pakistan Stock Exchange (PSX) recouped losses from the previous week with the benchmark KSE-100 index gaining 435 points or 0.92% to settle at 47,489.95. Trading remained volatile throughout the week with the index finishing three out of five sessions in the green.

The week started on a positive note as investors cheered the drop in monthly inflation rate. According to data released by the Pakistan Bureau of Statistics, inflation measured by the Consumer Price Index (CPI) spiralled down to 8.4% in July.

Moreover, Pakistani rupee lost ground on Monday and touched almost a 10-month low of Rs163.67, which provided support to technology and textile sectors.

Investors further continued to be encouraged as Adviser to Prime Minister on Commerce and Investment Abdul Razak Dawood took to his official Twitter handle to share the news of a phenomenal growth of 17.3% in exports during the first month of the current fiscal year; July.

Trading during the next two sessions - Tuesday and Wednesday - remained optimistic owing to a host of positive triggers and upbeat economic data.

Record high petrol sales by oil marketing companies in July, which signalled a revival of economic activities in the country, and sales of two major Japanese car companies in the country climbing to fresh peaks last month continued to bolster investor sentiments.

Furthermore, news of approval of $2.8 billion in fresh funds for Pakistan by the International Monetary Fund (IMF) under the global allocation of Special Drawing Rights aided the rise of the bourse on Wednesday.

Read Market watch: Bears continue to rule PSX

Unfortunately, the positivity did not last and the next two sessions succumbed to selling pressure. The surge in cases of Covid delta variant continued to wreak havoc on investor sentiments.

During the outgoing week, global markets and international oil prices remained mixed which kept the local exploration and production sector under limelight.

“We expect the market to continue trading in the green. The low interest rate regime and pro-growth stance of the central bank should keep equities attractive,” stated the Arif Habib Limited report. “Moreover, as mentioned earlier the result season should keep cyclicals in limelight while reduced provisioning, and healthy fee income/capital gains should help fuel banking earnings.”

However, the report added that the fourth wave of Covid-19 is a concern which may keep sentiments jittery.

Average daily traded volume rose 12% week-on-week to 455 million shares while average daily traded value inched down 5% week-on-week to settle at $85 million.

In terms of sectors, positive contributions came from commercial banks (193 points), oil and gas marketing companies (52 points) and chemical (52 points). On the other hand, negative contributors were food and personal care (21 points) and tobacco (7 points).

Scrip-wise, major gainers were Meezan Bank (84 points), MCB (43 points) and HBL (41 points). Meanwhile, Lucky Cement (41 points), Pakistan Services (36 points) and Unity Foods (19 points) were the major losers.

Foreign buying was witnessed this week, settling at $3.1 million compared to a net sell of $5.4 million last week. Buying was witnessed in technology ($1.8 million), cement ($1.3 million) and oil marketing companies ($0.2 million). On the domestic front, major selling was reported by funds ($10.6 million) and insurance ($6.1 million).

Among other major news of the week; Pakistan saved Rs2.1 billion on Qatar Petroleum LNG offer, K-Electric revised investment plan with NEPRA, Tarin directed ministry to import two million tons of wheat, SBP’s foreign reserves remained flattish around $17.8bn mark, cement sales fell 19.41% in July 2021 and ADB approved $500 million for vaccines.

Published in The Express Tribune, August 8th, 2021.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ