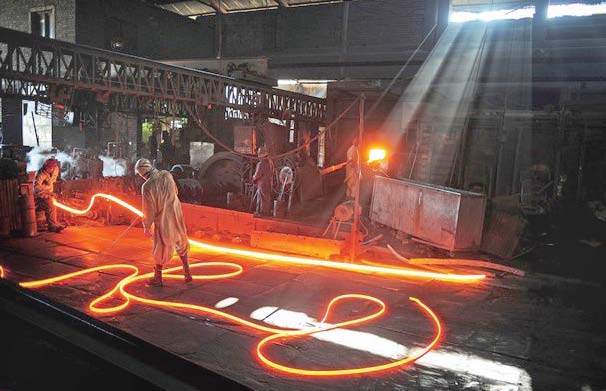

A cabinet body on Tuesday approved to split the Pakistan Steel Mills (PSM) into two companies and decided to sell majority stakes of the new good company amid growing frustration within the government over lack of progress in its privatization.

Headed by Minister for Finance Shaukat Tarin, the Cabinet Committee on Privatization (CCOP) “approved the proposal to issue the scheme of arrangement as requested by Privatization Commission (PC) and approved by the PC board,” announced the Ministry of Finance.

However, the statement is contrary to the fact, as the CCOP made a major change in the PC board approved transaction structure by deciding to retain the ownership of the new good PSM –the Steel Corp Private Limited – officials told The Express Tribune.

The PC board and the Ministry of Industry had proposed that the Steel Corp ownership should rest with the PSM Corporation aimed at keeping a “corporate veil” to avoid international litigation.

However, Shaukat Tarin decided as the CCOP chairman that the federal government should retain the ownership of the Steel Corp too to get a good bid price.

Some committee members objected to the decision to retain the Steel Corp ownership while arguing that it could expose the government to international litigation as had happened in the past.

The federal government had to pay $10 million to a foreign supplier of the defaulter PSM after a ship of the Pakistan National Shipping Corporation was stopped in South Africa to claim money.

Read More: PC defers decision on PSM deal

The CCOP decided that the federal government will retain minimum 26% stakes in the Steel Corp and majority 51% to 74% stakes will be sold to the private bidders, said the officials. The PC board had left the decision of shareholding on the CCOP.

During the meeting, outgoing Adviser to PM on Institutional Reforms and Austerity Dr Ishrat Husain showed his frustration that the government did not do anything to revive the PSM that remains closed for the last over six years, including three years of the PTI rule.

The last PML-N government had closed the PSM –the country’s largest industrial unit –in June 2015 after it failed to privatize the unit and also could not make it profitable.

The CCOP also decided that the liabilities of the PSM would remain with the existing bad company, including Rs71.3 billion owed to the Sui Southern Gas Company Limited (SSGC) and Rs67.2 billion owed to the National Bank of Pakistan as of December 2020.

The CCOP directed the NBP and the SSGC to give no-objection certificates to the splitting of the PSM into two companies when the Scheme of Arrangement is filed with the Securities and Exchange Commission of Pakistan, officials told The Express Tribune.

The PSM and the NBP have also reached an understanding but the SSGC and the Petroleum Division have reservations over the government’s reluctance to clear Rs49 billion late payment surcharges of the SSGC, said the officials.

The Finance Ministry’s terse handout noted that the CCOP examined the substantive arguments for proceeding further with reference to the transaction structure for revival of the PSM.

The finance minister urged the Privatization Commission to expedite the process of soliciting Expression of Interest (EOI) and try to close the transaction, it added.

The meeting decided that a clean balance sheet will be given to the Steel Corp that will have assets of Rs134 billion. There are also liabilities of Rs38 billion of deferred taxes but it in essence becomes an asset in case of a losing making enterprise like PSM.

The revised financial audit statements revealed Rs89.8 billion total "comprehensive income" of the PSM in the last calendar year ending in December 2020.

This was due to the revaluation of the plant, machinery and property. After excluding the impact of the revaluation of the assets, the PSM incurred Rs8.7 billion loss-after-tax.

In the year ending December 2019, the PSM had incurred a loss of Rs8.5 billion. The new subsidiary, Steel Corp Private Limited, will have authorized capital of Rs150 billion and paid up capital of Rs1 billion.

As of December 2020, the PSM's total assets had been reassessed at Rs558.9 billion, including Rs535.5 billion fixed assets. The fixed assets include Rs351 billion worth of land, Rs42.8 billion factory building, Rs99.6 billion plant and machinery.

The liabilities are assessed over Rs307 billion.

These include Rs42 billion trader and payables, Rs73 billion interest accrued and Rs71.5 billion current long-term financing. In addition to that there are Rs59.5 billion long-term financing related liabilities, Rs9.8 billion gratuity scheme, and Rs39 billion deferred tax liabilities.

In May, the PC board approved to carve out the total assets of Rs133 billion and total liability and revaluation reserve of Rs123.5 billion and transfer to the wholly-owned subsidiary.

The Rs88.5 billion worth of plant and machinery had been proposed to be transferred to the subsidiary, Rs41.5 billion worth of building and structure, Rs1.2 billion utility connections and Rs826 million deferred tax assets.

After transferring assets to Steel Corp, PSMC will retain Rs426 billion assets and Rs269.5 billion liabilities.

The financial adviser highlighted nine corporate actions required to be completed and many of those have not yet been completed, the board was informed.

The PSM board has also approved tentative core land of 1,228 acres and its right of use will be awarded without entering into a lease agreement as per the standard terms to the subsidiary until the strategic partner comes in.

The draft land lease deed has been prepared by the advisers and shared with the privatization ministry.

1731329418-0/BeFunky-collage-(39)1731329418-0-165x106.webp)

1731771315-0/images-(3)1731771315-0-270x192.webp)

COMMENTS (2)

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ