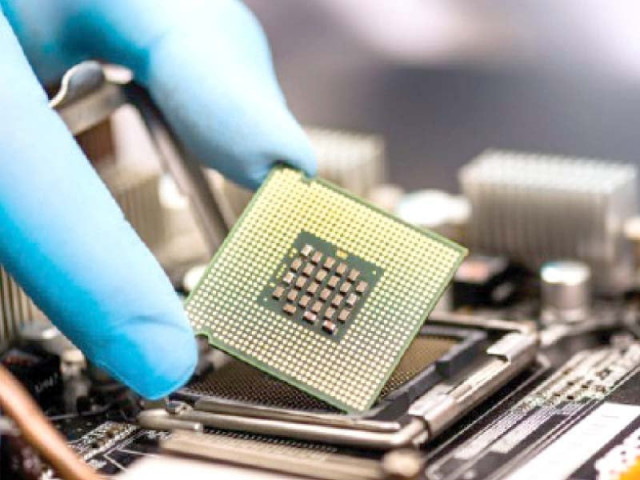

Chip shortage: need for resilience, diversification

More fabricating facilities being planned to enable countries to secure chip supplies

The chip shortage phenomenon is as real as it gets and we see global supply chains faltering when it comes to the production of semiconductors, silicon wafers and integrated circuits, causing billions of dollars in lost earnings to the global automobile industry alone.

Subaru has shut down its plant in Japan while Nissan, Daimler and Volkswagen have reduced their working hours while they await shipment of microcontrollers from Taiwan.

General Motors, in a bid to improvise in the face of the shortfall, has started to remove some non-essentialcfeatures from its SUVs and trucks.

For the first time in the last 50 years, we see used American cars under lease selling at a premium as the cost of new cars, if available, has soared.

In the chip fabrication business, Taiwanese companies TSMC (Taiwan Semiconductor Manufacturing Co) and UMC (United Microelectronics Corporation) enjoy more than 60% market share while Samsung and SMIC (China) account for less than a quarter of the total world production.

As Chinese chips face US tariffs, the world almost relies on one single chipmaker – TSMC.

Now imagine what happens when the world faces both demand and supply shocks at the same time. The manufacturing hub of Taiwan has been facing the worst drought in decades, leading to a halt to the water-intensive chip fabrication process.

So, while the Covid-19 disruption led to the demand for computers, laptops and gaming consoles rising to a record high, the climate change brought the world supply of chips to a record low at the same time, resulting in a chronic shortage of computer chips.

Nobody foresaw that people stuck at home would end up having more disposable income at hand to spend on purchasing better technology such as 4K screens, gaming laptops and PlayStations.

The situation is even worse for the Graphics Processing Unit (GPU) cards whose demand has soared not only due to increased sale of gaming consoles and PCs, but also because of their use in the mining of ethereum, the second-largest cryptocurrency after bitcoin.

Apparently, the automobile industry’s chip woes are just a hint of a systemic problem, and the pandemic has just brought it to the surface more quickly.

A similar demand and supply shock affected the consumer electronics industry in 1997, when an insanedemand spike for a kid’s toy consumed the Taiwanese semiconductor production capacity entirely, resulting in a shortfall of global chip supply for a quarter.

Moreover, there is also a geostrategic element as the chip manufacturing hotspot Taiwan is a focal point of tension between the US and China, which presents a significant supply risk, should Beijing at any point in future tries to block shipments from the island nation to the West.

This chip shortage fiasco in the automotive industry calls for the need of resilience and diversification of the supplier base.

In the immediate future, we see more fabricating facilities being planned to enable countries other than Taiwan and South Korea secure their chip supplies.

Semiconductor giants Intel and TSMC are all set to establish new billion-dollar fabrication plants in the water-scarce state of Arizona, meaning that further investments would be required to store and recycle water.

GlobalFoundries of the US is also aiming to invest $4 billion in a 300mm fabrication plant in Singapore, which will ramp up production by 2023.

However, as the upfront capital and skilled workforce requirement to build new hitech foundries is very high, so apparently the bottlenecks in the supply chain will prevail through the second quarter of 2022 – although the situation could start easing much earlier if demand starts falling.

As the world learns lessons about not concentrating most of the chip manufacturing in a single country, there is another ticking bomb that could go off in the face of the semiconductor industry any second – the supply of rare earth metals.

China is responsible for more than 85% of rare earth production and in case of a supply shock, the world may see the shutdown of key industries involving the production of electric cars, solar panels and even F-35 fighter aircraft.

In the past, whenever Molycorp Inc in the US or the Japanese-backed Australia’s Lynas Corp tried to set up production facilities for rare earth metals, Beijing would typically flood the market with cheap rare earths, making the business case of such a new facility unfeasible.

Later, it would impose import quotas or tariffs to raise the price of rare earths.

As tensions between China and the West will not be easing anytime soon, there is an elevated risk of another shortage that could last for the years to come. This future risk, if left unchecked, could put the electric car industry in a tricky spot.

THE WRITER IS A CAMBRIDGE GRADUATE AND IS WORKING AS A STRATEGY CONSULTANT

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ