Weekly review: Bulls charge as PSX surges to four-year high

Index rises 1,085 points on back of investor optimism ahead of budget announcement

The stock market witnessed an extraordinary performance in the outgoing week as investor enthusiasm helped the benchmark KSE-100 index shoot past the 48,000-point mark - a feat accomplished after four years. The index had last stepped over this level in June 2017.

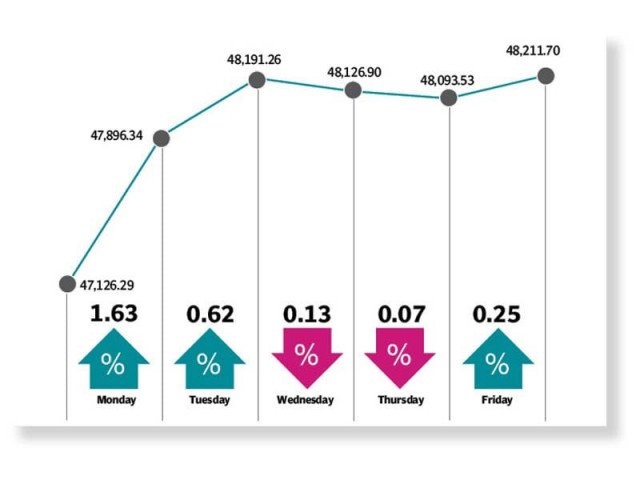

The KSE-100 index managed to sustain its winning streak for the fourth successive week as it advanced 1,085 points or 2.3% to close at 48,211.70.

“Declining Covid-19 cases and upward revision in growth estimates continued to fuel positive sentiments,” said JS Global analyst Amreen Soorani.

The index maintained a healthy momentum on back of encouraging economic data and budget optimism. Additionally, sector-specific developments also spurred buying interest in select stocks, which fuelled the rally. The market finished three out of five sessions in the green.

The Pakistan Stock Exchange (PSX) opened on an upbeat note with investors welcoming the decision by the State Bank of Pakistan (SBP) to leave benchmark interest rate unchanged at 7% for the next two months.

Moreover, the government’s efforts to boost the vaccination drive and a decline in fresh Covid-19 cases helped build confidence and lifted the benchmark KSE-100 index higher as optimism grew.

The bullish rally continued to grip the stock market on Tuesday as the KSE-100 breached the 48,000-point barrier for the first time since June 2017. A slight contraction in the Consumer Price Index to 10.9% in May 2021 coupled with a spike in international oil prices to the highest since March 2021 bolstered investor spirits and encouraged them to make fresh investment.

Unfortunately, the uptrend came to a halt as the index underwent slight correction on Wednesday. Lack of positive triggers that could provide direction to the market and anticipation of upcoming budget announcement scheduled for June 11 forced the investors to resort to cautious trading.

However, in a dramatic turnaround, the last session of the trading week reversed its trend. Anticipation of reduction in taxes on cars in the budget for fiscal year 2021-22 attracted substantial investor interest. Moreover, a spike in international crude oil prices put the spotlight on local oil-related sectors where market participants made fresh investments.

“Going forward, we expect the market to remain positive, with the view of a positive budget for the market in the upcoming week. However, we cannot rule out short-term dips in the market due to Covid-19,” stated an AHL report.

Average daily traded volume surged 9.4% week-on-week to 1.12 million shares while average daily traded value increased 7.9% week-on-week to $192 million.

In terms of sectors, positive contributions came from oil and gas marketing companies (125 points) cement (120 points), oil and gas exploration companies (115 points), power generation and distribution (82 points) and pharmaceuticals (72 points).

Meanwhile, the sectors that contributed negatively included synthetic and rayon (2.89 points), real estate and investment (1.43 points) and vanaspati and allied industries (0.12 points). Scrip-wise, positive contributors were Pakistan State Oil (56 points), Pakistan Petroleum (49 points), Kot Addu Power Company (44 points), Searle (43 points), and DG Khan Cement (43 points).

On the contrary, negative contributors were BAHL (22 points), Millat Tractors (15 points), K-Electric (10 points), HBL (6 points) and Fauji Fertiliser (6 points).

Foreign selling was witnessed this week arriving at $0.2 million against a net buy of $2.1 million last week. Selling was witnessed in exploration and production ($2.7 million) and power generation and distribution ($2.4 million). On the domestic front, major buying was reported by individuals ($11.1 million) and mutual funds ($4.6 million).

Among other major news of the week; petroleum prices remained unchanged, banking sector infection ratio rose to 9.3%, Oil and Gas Development Company discovered gas from Jandran X-04 well, FBR reported record collection of Rs4.17 trillion during 11MFY21 and foreign reserves increased by $271 million week-on-week.

Published in The Express Tribune, June 6th, 2021.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ