Political upheaval keeps gains subdued

Rising cases of coronavirus infections, protests across country take toll on investor sentiment

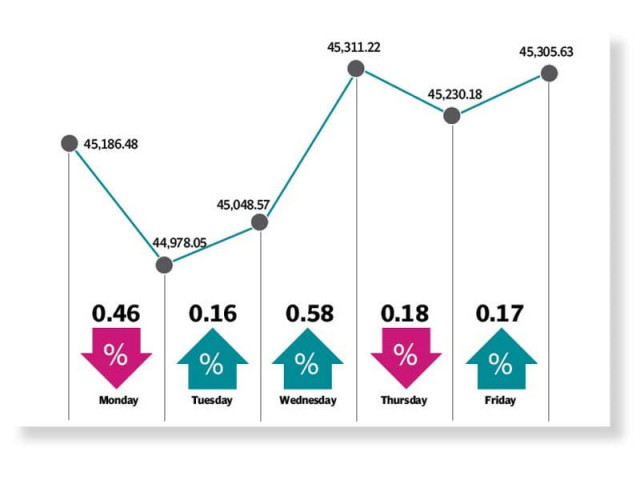

The Pakistan Stock Exchange (PSX) ended on an upbeat note despite sluggish activity during the outgoing week as the index managed to sustain its level at over the 45,000-point mark and ended with a rise of 119 points or 0.26%. The market finished three out of the five sessions in green to settle at 45,305.63 points.

In the wake of rising coronavirus cases and National Command and Operation Centre’s (NCOC) proposal to impose a lockdown in order to contain the spread of Covid-19, the week kicked-off trading on a negative note as the benchmark KSE-100 index shed over 200 points amid panic selling by investors.

Unfortunately, upbeat remittances data announced during the trading session, which showed inflows touching $2.7 billion in March 2021 and remaining above $2 billion for the 10th consecutive month, failed to entice market players.

Tuesday provided a respite from the selling pressure, however, countrywide protests by political activists of Tehreek-e-Labbaik Pakistan in major cities of Pakistan kept economic activity muted, which took a toll on investor sentiments.

Read: KSE-100 crawls up in choppy trading

The uptrend sustained on Wednesday, the first day of Ramazan, on the back of encouraging automobile sales data, which showed a robust growth of 198% in March 2021, and optimistic numbers released by the Pakistan Bureau of Statistics (PBS) for the large-scale manufacturing (LSM) sector, which grew 7.45% in the first eight months (Jul-Feb) of current fiscal year despite the third wave of the Covid-19 pandemic, kept the investment climate buoyant.

Unfortunately, sentiment turned sour again and investors started offloading stocks on Thursday as NCOC announced stricter restrictions across the country as a preventive measure for containing the spread of virus. Moreover, comments by the International Monetary Fund (IMF) country representative on government’s commitment to power tariff hike added to the bearish sentiment.

Fortunately, the tables turned on Friday as market expectations of better financial results in key sectors lent support to the bourse and aided its uptrend. However, news reports of protests by TLP activists and cabinet reshuffle forced investors to trade cautiously and kept index from posting substantial gains.

Prime Minister Imran Khan in yet another cabinet reshuffle on Friday replaced Hammad Azhar from the office of finance minister by Shaukat Fayyaz Ahmed Tarin. Meanwhile, Omar Ayub was appointed as the Minister for Economic Affairs, Azhar has been given the post of Minister for Energy and Khusro Bakhtiar has been selected as Minister for Industries and Production.

“We expect the market to remain bullish in the coming week,” stated a report from Arif Habib Limited. “With the result season commencing next week, we believe oil and cyclical sectors will be under the limelight on the back of healthy earnings expectations.”

Average daily traded volume dropped 10% week-on-week to 368 million shares while average daily traded value declined 18% week-on-week to $100 million.

Read more: Weak investor interest pulls KSE-100 down

In terms of sectors, contributions were led by commercial banks (81 points), technology and communication (78 points), fertiliser (43 points), automobile assemblers (25 points) and oil and gas exploration companies (18 points).

Scrip-wise, positive contributors were TRG Pakistan (60 points), Fauji Fertiliser (60 points), BAHL (22 points), Engro Fertiliser (21 points) and HBL (20 points), while negative contributors included Engro Corporation (47 points), Hubco (27 points), Pakistan State Oil (27 points), Searle (21 points) and DG Khan Cement (20 poits).

Foreign selling continued this week clocking-in at $1 million compared to a net sell of $9.5 million last week. Selling was witnessed in all other sectors ($2.64 million) and commercial banks ($1.31 million). On the domestic front, major buying was reported by individuals ($9.77 million) and other organisations ($ 3.9 million).

Among other major news of the week; the government revised its FY21 and FY22 growth targets to 2.9% and 4.2% in the medium term budget strategy paper, ECC withdrew customs duty applicable to cotton yarn imports, bank deposits posted 18% growth year-on-year during 1QCY21 and SBP reserves increased $2.6 billion to $16.1 billion.

Published in The Express Tribune, April 18th, 2021.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

1724319076-0/Untitled-design-(5)1724319076-0-208x130.webp)

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ