FATF review takes toll on stock market

Trading remains jittery as investors opt for caution

Uncertainty marred trading at the stock market during the outgoing week as investors weighed sentiments on the Financial Action Task Force’s (FATF) plenary meeting, which retained Pakistan in the grey list.

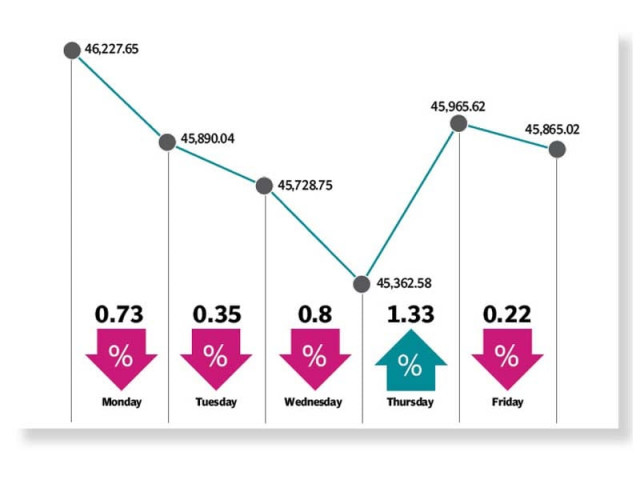

Following the four-day long review, jittery trading was witnessed at the stock market as the KSE-100 index fell 363 points or 0.8% to close at 45,865.02 in the outgoing week.

“The market remained on the back foot for most of the week,” said JS Global analyst Ahmed Lakhani. “A correction was on the cards, given the week coincided with the futures’ rollover.”

FATF’s plenary review of Pakistan’s economy kicked off on the first trading session of the week and eroded investors’ interest in equities which remained visible for most part of the week. The market remained in the grip of selling pressure as participants resorted to trade stocks cautiously.

Denting sentiments further, the State Bank of Pakistan (SBP) announced dismal current account figures for January 2021. In addition, absence of positive triggers kept the index under pressure for the first three sessions.

The market depicted a turnaround on Thursday aided by a significant appreciation in rupee, which strengthened to a three-month high value against the US dollar. A spike in international crude oil prices to near 13-month high lent further support to the uptrend.

The FATF announced its decision after closing hours on Thursday in which Pakistan sustained placement in the grey list as the global financial watchdog set a deadline till June 2021 for the country to comply with the final three conditions. The bittersweet news failed to lift the market upward in the final session as participants had anticipated whitelisting of Pakistan. The development once again led bears to make a comeback on Friday. Hazy political situation in the wake of upcoming Senate elections continued to play on the investors’ minds and the Pakistan Stock Exchange (PSX) witnessed across the board selling.

“We expect the market to remain positive in the upcoming weeks as clouds of FATF-led uncertainty have dispersed and with only three action plans to be addressed, the likelihood of Pakistan exiting the grey list in June 2021 are very bright,” stated a report from Arif Habib Limited.

Average daily traded volume contracted 1% week-on-week to 589 million shares, while average traded value stood unchanged at $159 million on a week-on-week basis.

In terms of sectors, negative contributions came from oil and gas exploration companies (107 points), commercial banks (105 points) and oil and gas marketing companies (78 points). On the other hand, sectors that contributed positively included cement (119 points), technology (53 points) and textile weaving (7 points).

Scrip-wise, negative contributors were Oil and Gas Development Company (92 points), PSO (42 points) and NBP (41 points), while positive contributors included Lucky Cement (160 points), TRG Pakistan (56 points) and Meezan Bank (28 points).

Foreigners turned buyers this week as foreign buying clocked-in at $0.3 million compared to a net sell of $0.6 million last week. Buying was witnessed in cement ($2.6 million) and technology and communication ($2.2 million). On the domestic front, major selling was reported by broker proprietary trading ($10.7 million) and mutual fund ($ 4.9 million).

Among other major news of the week was; Roshan Digital Accounts attracted more than $550 million in five months, government expects $1 billion from dollar-denominated Eurobonds next month and private sector recorded growth in borrowings.

Published in The Express Tribune, February 28th, 2021.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ